National trading volumes in Bitcoin increased by around 77% in March as the starting gun fired on the cryptocurrency’s much anticipated ‘halving’ event.

Bitcoin halvings occur roughly every four years and increase the cost of production of the world’s largest cryptocurrency. At time of writing, the next was expected to take place on 27 April next year.

Australian dollar dominated trading in Bitcoin hit multiple daily highs for the year in March as its price rose 22.5% over the month.

“Anticipation around the next Bitcoin halving is suddenly very real,” said Swyftx Head of Commercial Operations, Tommy Honan. “There are no clear and obvious triggers for Bitcoin’s 80% price rise this year beyond some concern around recent turmoil in US banking, so we’re applying the Occam’s Razor rule that the simplest explanation is the most likely.

“We think the most plausible explanation for Bitcoin’s price movement is anticipation around the halving and that this, in turn, is fuelling local trading activity.”

The five top days of Australian Bitcoin trading so far this year all occurred in March, according to daily national trading data collected by Swyftx on local dollar denominated Bitcoin trades.

The next Bitcoin halving will half the rewards that Bitcoin miners receive. The last Bitcoin halving happened on May 11, 2020.

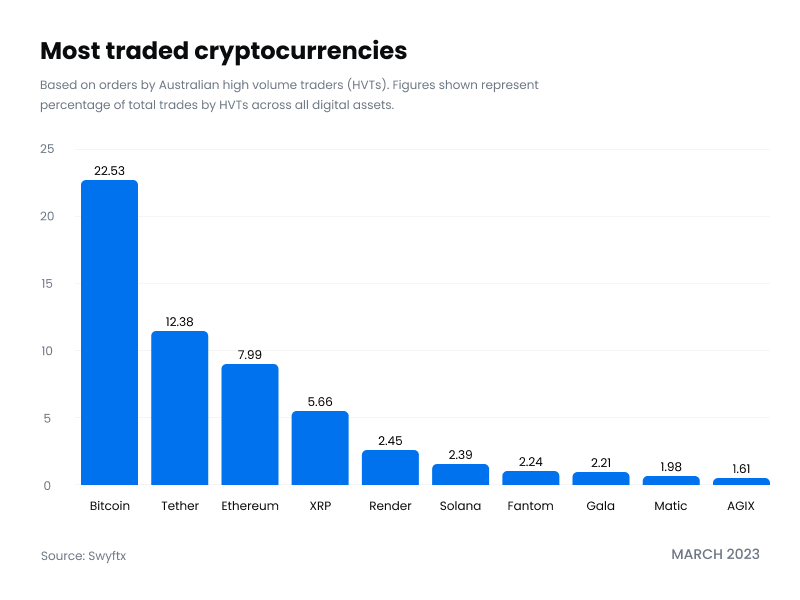

Bitcoin was the most frequently traded digital asset among Swyftx high-volume traders in March. Surpassing Ethereum for the first time in nine months.

“We’re not near all-time high trading territory,” said Honan. “But local Bitcoin trades are clearly trending up with hundreds of millions of Aussie dollar denominated Bitcoin trades in March.”

“We hit the one-year countdown to the halving this month and it seems to be a factor impacting Bitcoin price action and national trading activity,” said Honan. “Bitcoin trading this month remains elevated on January and February levels and we’re seeing a strong trend towards accumulation, with buy orders outnumbering sells by a factor of three.”

March saw a steep increase in large individual trades by Australian high volume traders on Swyftx, with a 17% increase in trades of $20k or more and a 14% increase in trades of more than $100K.

Bitcoin also accounted for 22.53% of total trade volume among Swyftx’s top traders. Up from just 9.45% in February.

Data in this release is based on Swyftx trade data and national trade volumes in BTC/AUD pairs, collected daily from Coingecko to be representative of overall national market trading volumes.

Ted