Cryptocurrency in SMSFs

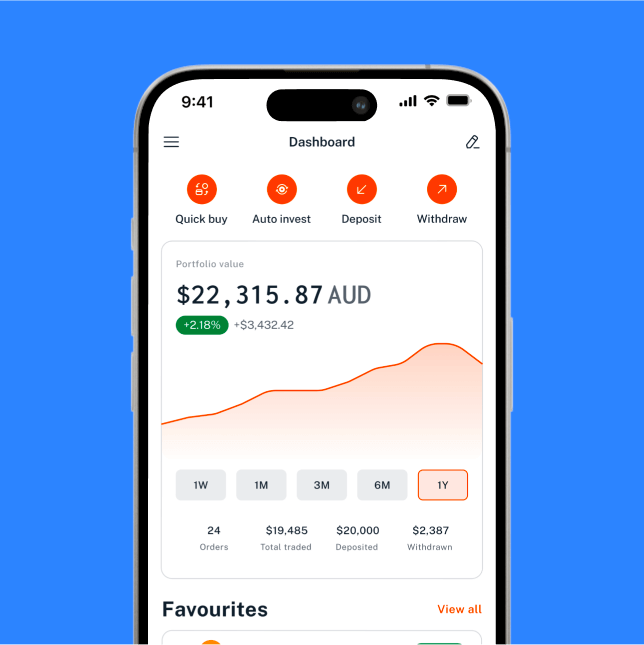

Invest and trade crypto through your Self-Managed Super Fund.

Invest and trade crypto through your Self-Managed Super Fund.

If you already have an SMSF and want to create a Swyftx account, follow the steps in our help article set up an SMSF account.

If you don’t have an established SMSF setup already, we may be able to help! Book a free 30-minute consultation call with one of our dedicated account specialists today.

When it comes to investing in cryptocurrency, Australia provides a very generous tax structure to work within. One of the most popular choices for investors that want to include Bitcoin and other cryptocurrencies within an investment strategy is an SMSF.

Information you may wish to consider prior to investing with a SMSF.

Since fund trustees are responsible for all fund decisions and compliance, risks are weighted heavier on the trustees. The risks of cryptocurrency SMSFs include low or negative returns, and assumption of full responsibility even when life changes (e.g. losing your house or job).

If you lose money through theft or fraud, you won’t have access to any special compensation schemes or to the Superannuation Complaints Tribunal. The trustees should also consider continuity of the SMSF in the event of death, relationship breakdown or incapacity.

The sole purpose test is one of the legislative requirements for any SMSF. The sole purpose test requires that Cryptocurrency SMSF funds can only be maintained for the sole purpose of providing fund members with retirement or death benefits. For example, if you have a piece of art in your fund, the art piece cannot be displayed at an SMSF member’s house.

A common consideration about cryptocurrency self-managed super funds is the high number of ongoing costs that may be required for fund maintenance. According to MoneySmart, some of the costs for maintaining a cryptocurrency SMSF include:

Many SMSF providers offer a fixed fee service that covers the required compliance costs.

Yes. You can roll over your super balance from a pre-existing superfund into your cryptocurrency Self-Managed Super Fund (SMSF).

In Australia, a Self-Managed Super Fund must adhere to super and tax laws, the most critical being the Superannuation Industry (Supervision) Act. The Australian Tax Office (ATO) is the regulator for SMSFs and the SMSF trustees are responsible for ensuring that their Crypto SMSF is compliant. For more information and to find out if your Crypto SMSF is compliant, visit the Australian Government’s official Superfund website.

At Swyftx, protecting our customer’s assets is our top priority. We have implemented a robust security framework to ensure that our customers can trade and store their cryptocurrency in a safe environment. We use the highest standard of industry storage protocols. Learn more about Swyftx’s security protocols and procedures. Additionally, once users have successfully purchased an asset, they can easily withdraw that asset to an external wallet.

No, under no circumstance can you deposit SMSF funds into your personal Swyftx account. There are legal implications and tax consequences that can arise from intertwining SMSF assets with personal assets.

You can find relevant information on what you’re required to submit for an SMSF crypto account with Swyftx in our Support article Set up a self-managed super fund (SMSF) account. Alternatively, you can book a consult with one of our account specialists via the form below to get you started.

After you fill out a form with a cryptocurrency SMSF service provider, the SMSF trustees will have to wait for approval from the ATO.

Once the ATO approves the SMSF, there are additional steps that trustees will have to take such as opening an account on a secure portal, opening a bank account for the SMSF, rolling over your super balance into your new SMSF, setting up a new crypto trading account for the SMSF and setting up data feeds.

The trust deed is also a crucial part of the SMSF process. The trust deed is a document that contains the rules through which an SMSF is governed. The fund’s trust deed also includes obligations, terms, and conditions of the trust.