- > XRP network spill sends token crashing

- > Judgement day: The next wave of altcoin ETFs await their fate

- > Ondo announces native Layer 1 to revolutionise RWAs

- > Uniswap unleashes Ethereum scaling solution

XRP network spill sends token crashing

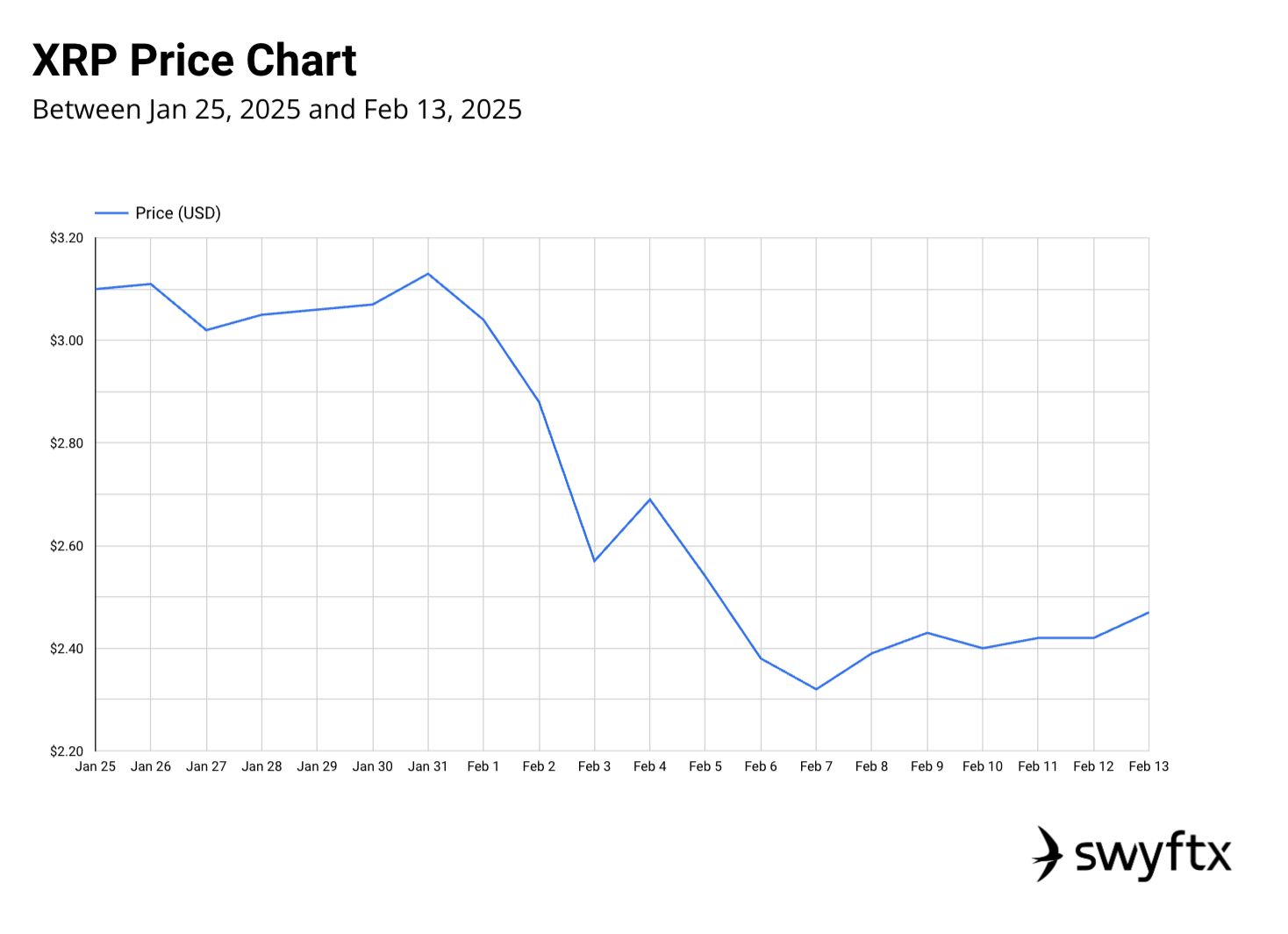

An outage on the XRP Ledger compounded broader market struggles, causing a weekly drop of over 25%.

The momentum XRP built to kick off 2025 has, for now, come to a grinding halt.

After surging 400% between November and January, the popular global payments coin nearly dropped below $2 USD — a 48-hour collapse of nearly 30%.

This capitulation was largely a result of the market concern around Trump’s tariffs. However, XRP’s recovery was cut short when the native network, XRP Ledger, experienced a major outage just 24 hours later.

For about an hour, transactions on the network froze, leaving DeFi users in limbo. The exact cause of the problem wasn’t identified, with Ripple’s Chief Technology Officer explaining validations ‘weren’t being published’ despite consensus working as intended.

Following the downtime, XRP Ledger seemed to recover ‘spontaneously’, either through the help of a single validator…or of its own accord.

Again, the circumstances are pretty ambiguous.

Thankfully, once the network was up and running again, no transactions were lost and everything has been fine and dandy ever since.

Ripple Labs is awaiting an SEC decision on the approval of a potential spot XRP ETF.

Judgement day: The next wave of altcoin ETFs await their fate

The Securities and Exchange Commission (SEC) has acknowledged filings for spot Solana ETFs, as experts predict a strong likelihood of new crypto funds hitting the market.

It’s happening again.

The crypto market is in a bit of a holding pattern for now, with the community waiting (im)patiently to see what comes next.

Much of the hype around Donald Trump’s presidency centred on widespread Bitcoin Strategic Reserves. And while these are well and truly in play, they may take a while to get off the ground floor.

But a key market movement could be just around the corner, as an SEC decision on the upcoming series of spot crypto ETFs looms.

While there have been some filings for…unique spot crypto funds (like Bonk and Trump Coin), more realistic ETF documentation is being reviewed for Litecoin, Solana, XRP and Dogecoin.

The SEC officially acknowledged the filings earlier this week, indicating serious consideration is already underway.

And according to key Bloomberg analysts James Seyffrat and Eric Balchunas, the outlook is pretty positive.

In particular, Balchunas believes a Litecoin ETF has a 9 in 10 chance of securing SEC approval, while he suggests Solana’s odds of acceptance are 70%.

If Solana is successful, investment managers VanEck predict the price of SOL could rocket as high as $520 USD before the close of 2026.

Ondo announces native Layer 1 to revolutionise RWAs

Ondo Chain is a planned blockchain network designed to bridge the gap between TradFi and DeFi through tokenisation.

Ondo Finance has unveiled the next stage of its tokenisation project — a native Layer 1 blockchain.

The new network, to be called the ‘Ondo Chain’ will serve as a purpose-built protocol for building, hosting and trading tokenised assets.

Ondo Finance burst onto the scene with its tokenised Treasury Bills, forming partnerships with major institutional players like BlackRock and Franklin Templeton.

The goal of the L1 chain is to combine the transparency of public ledgers with the guardrails necessary to offer institutional assets.

Speaking at last week’s Ondo Summit, the company’s Chief Strategy Officer expanded more on the team’s vision.

‘We really set out to build something that could combine the best of both traditional finance…with all the benefits of DeFi….However, as we set out on this mission, we realised that the necessary…infrastructure to bring these two together really was not present.’

The chain will help fulfill Ondo’s ambitious plan — to tokenise all stocks, bonds and ETFs, in combination with their new onboarding platform Ondo Global Markets.

The details of both the new L1 and Ondo Global Markets are a little murky, but the intention is clear as day. Revolutionise real-world assets.

Uniswap unleashes Ethereum scaling solution

The Unichain mainnet is officially live, allowing developers to begin building and releasing dApps on the protocol.

The surge of Ethereum L2s is showing no signs of slowing down with the unveiling of Uniswap’s scaling solution, Unichain.

After four months and 95 million transactions via the project’s testnet, the appetite for the product is clearly there — and now, DeFi users and dApp developers can finally sink their teeth into the Unichain mainnet.

The network utilises Stage 1 rollups, which bundles transactions off the main network and submits them as a single transaction. This can significantly reduce congestion and its associated symptoms, like slow confirmations and high gas fees (aka, using Ethereum’s L1 in 2025).

Specifically, Unichain boasts one-second block times and interoperability with other Superchain L2s (such as Base, Mantle and others leveraging OP Stack infrastructure).

In less than a week of launching, Unichain’s mainnet hosts nearly 100 protocols and dApp developers, including (naturally) Uniswap, Circle, Coinbase, Lido and more.

Meanwhile, network users can launch their own Unichain-native tokens, explore existing applications or provide liquidity via Uniswap.

The growing popularity of a new Layer 2 network raises concerns for Ethereum, which has struggled with stagnant prices and user growth. Amid a hot leadership debate, the efficiency of scaling solutions has re-directed revenue away from Ethereum, and Unichain’s launch could be another dagger into the project’s long-term success.

Ben Knight