- > XRP overtakes USDT to become the third-largest cryptocurrency by market cap

- > Old-school projects back in the spotlight as altcoin season gains momentum

- > Spot crypto ETFs celebrate record-breaking November with unprecedented inflows

- > Regulatory whirlwind as court overturns Tornado Cash sanctions

XRP overtakes USDT to become the third-largest cryptocurrency by market cap

The popular cryptocurrency project hit a seven-year high following speculation the SEC may drop its lawsuit.

The way XRP is going, NASA might need to consider the crypto for a role on its next mission.

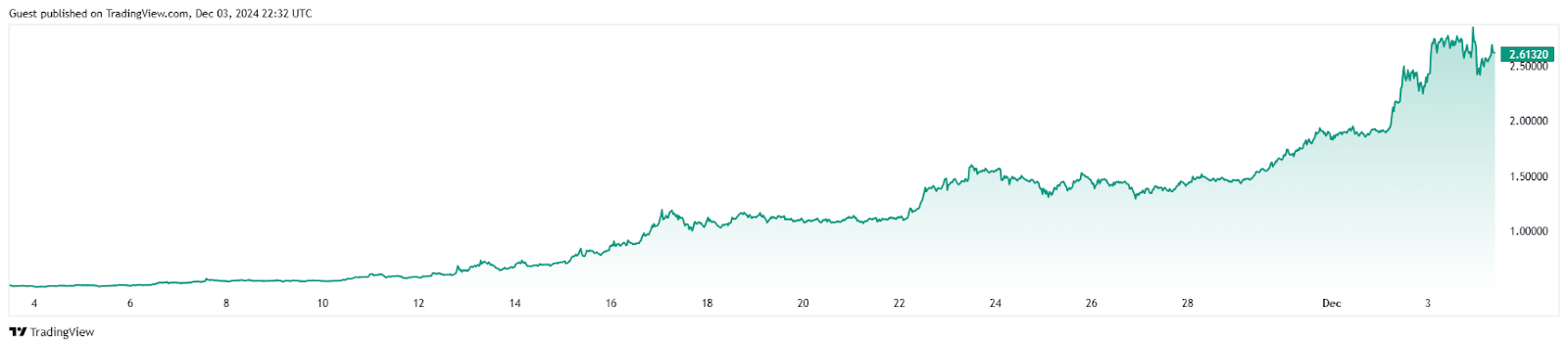

XRP has been flying up the market cap rankings like a man possessed, overtaking big names like BNB and Solana throughout the past month.

But perhaps the biggest coup came this week. On the back of 90% weekly gains, XRP usurped Tether (USDT) – something that seemed almost impossible earlier in the year.

While altcoins went on a run for the ages in 2021, XRP never scored an invite – with the project’s all-time high coming way back in 2018.

The main reason for this was the Securities and Exchange Commission’s lawsuit against the cryptocurrency, which began in 2020. With the future of XRP unclear, investors steered clear.

But now, clarity is returning to the industry. The election of Donald Trump has the cryptopshere gearing up for a more forgiving administration – in particular, the expected move away with the SEC’s “regulation by enforcement” approach.

The first step was the expected removal of Gary Gensler as Chair of the SEC. However, Gensler decided to resign on his own terms, announcing that he will step down on Trump’s inauguration date, 20 January 2025.Many in the industry believe this leadership shake-up will see the SEC drop the lawsuit against XRP once and for all.

Without the shadow of legal action hanging over its head, XRP can finally stretch its muscles, with institutions rushing back into the cryptocurrency.

Old-school projects back in the spotlight as altcoin season gains momentum

Prominent cryptocurrencies like Cardano, Algorand and Stellar Lumens have enjoyed their best month in years.

For most of this year, we’ve been most vocal on the subject of the altcoin season.

“Where is the altcoin season? When are we going to get the altcoin season? Why aren’t we getting the altcoin season now?” And so on.

Well, we think we can finally announce, once and for all – altcoin season is here.

It’s been a Stellar (sorry) month for popular, older-era coins like XLM (+471%), ALGO (+369%) and ADA (+265%), surging on the optimism of Trump’s election victory.

These pre-2020 projects are experiencing a resurgence as retail investors slowly re-enter the crypto market. These older coins are benefiting from their established name recognition, making them attractive options for both new and returning investors.

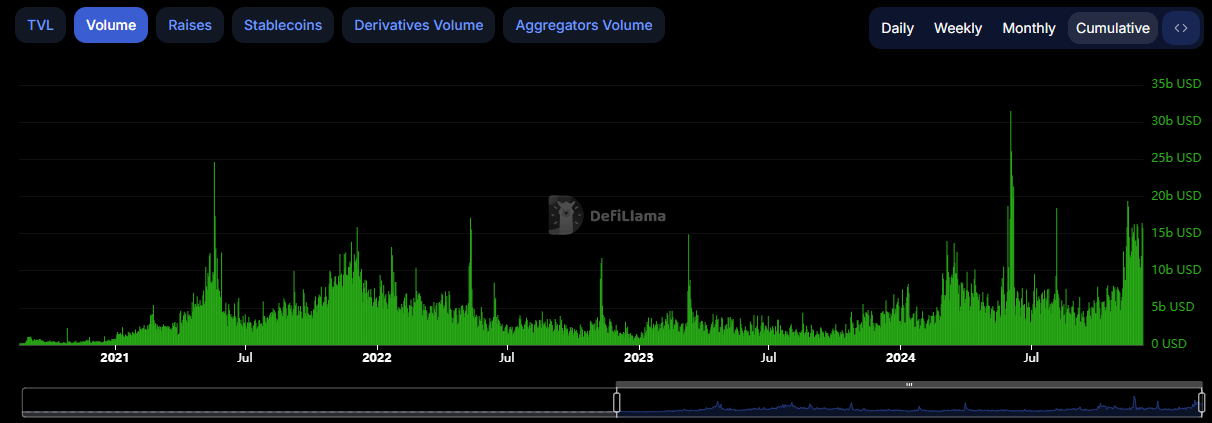

Network activity has been another key factor in the altcoin rush, with DeFi ecosystems experiencing consistently high transaction volumes.

Institutional interest in altcoins has also spiked, with the community bullish that Trump’s administration will be more receptive to spot crypto funds for non-BTC/ETH projects.

Cardano has been another big winner of late, with the coin skyrocketing on news of technological developments. A significant upgrade for the network came in late November, with the protocol successfully deploying its first zero-knowledge (zk) smart contract.

ZK verification is a big deal for blockchains, as it allows transactions to be confirmed without revealing any underlying data. This not only improves a network’s privacy, but the tech can also help bolster scalability and interoperability.

The news bled through to the community, with Cardano’s TVL hitting an all-time high.

Spot crypto ETFs celebrate record-breaking November with unprecedented inflows

BlackRock’s spot Bitcoin ETF, IBIT, dominated trading volume, while Ether funds outpaced BTC for the first time.

To put it lightly, November has been a pretty kind month to the crypto market.

Bitcoin hit a new all-time high, the overall market cap reached US $3T and several altcoins posted 100%+ gains for fun.

The growing optimism was reflected in the spot ETF market, which went into an immediate frenzy once Donald Trump was confirmed as the new US President.

On the first day of trading following the Republican victory, spot Bitcoin ETFs saw a staggering inflow of USD $1.38b.

Unsurprisingly, more than US $1b went straight into the pockets of BlackRock’s Bitcoin fund, IBIT.

All up, November saw spot Bitcoin ETF inflows of US $6.3b – the highest month on record. The next best came in February (US $6b), when a slew of TradFi investors entered the digital asset market for the first time.

The November demand for Bitcoin saw ETF managers buy over 70K BTC throughout the month.

Not to be outdone, Ethereum also broke records following Trump’s victory. Total Ether assets under management (AUM) grew to an all-time high above US $10b as investor appetite returned to Bitcoin’s commander-in-chief.

The news only got better when, in late November, spot Ether funds had their best trading day in history, with net inflows of US $332m.

On this day, for the first time ever, Wall Street investors sided with Ether over Bitcoin.

Regulatory whirlwind as court overturns Tornado Cash sanctions

The landmark ruling deemed that self-executing code doesn’t qualify as property, limiting the reach of departments like the US Treasury’s OFAC.

The regulatory landscape has officially changed.

Most in the community anticipated a Trump election victory would see some clarity return to the industry following four years of “regulation by enforcement” under Gary Gensler.

And, after a landmark decision from a U.S. court, it seems legal firms must adapt to this shift more quickly than anticipated.

Tornado Cash, a decentralised privacy network, was sanctioned in 2022 by the US Treasury Department over accusations of money laundering.

Specifically, Tornado Cash allows users to conceal the identity behind transactions, which the US Treasury Department Office of Foreign Assets Control (OFAC) claimed was leveraged by North Korean hacking syndicate Lazarus.

However, New Orleans Judge Don Willett deemed that OFAC overstepped its bounds when going after Tornado Cash’s smart contracts. According to the Court, OFAC’s jurisdiction only applies to property – something that doesn’t apply to self-executing code like smart contracts.

Coinbase, who played the role of financial backer for Tornado Cash, was buoyant upon the Judge’s decision.

Despite Tornado Cash’s code receiving its freedom, the same cannot be said for the project executives. In 2023, founders Roman Storm and Roman Semenov were indicted on charges of conspiracy to commit money laundering and may face jail time if found guilty.

Ben Knight