The crypto market has taken several large blows in the past 24 hours. The price of Bitcoin has traded at below $28,000 USD for the first time since December 2020.

This crash which, reportedly, brings the price below key support has resulted in cryptocurrencies plummeting across the board.

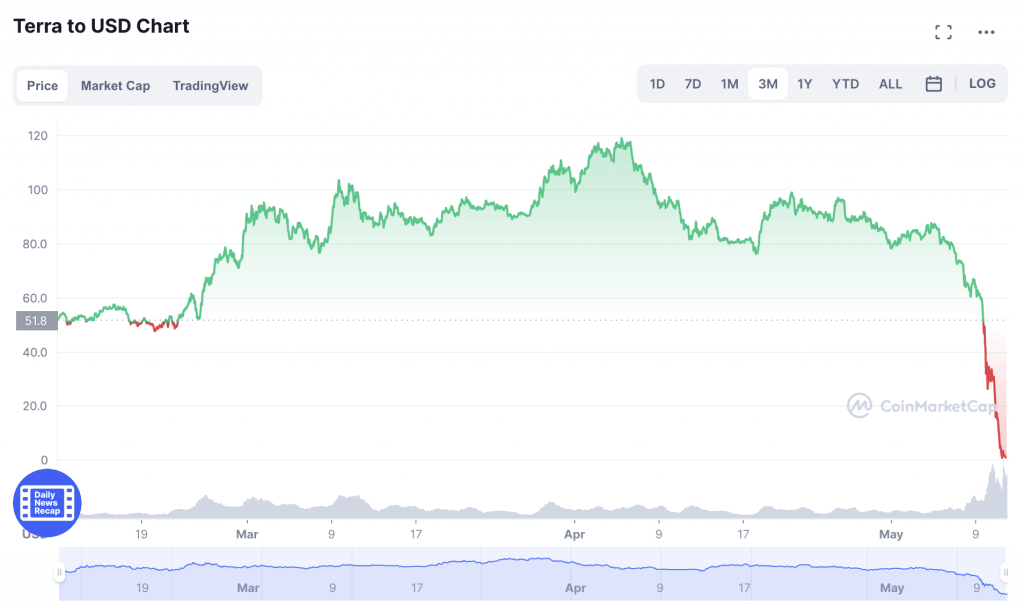

Perhaps one of the worst-hit has been Terra (LUNA), which has crashed almost 98% in the past 24 hours. This is due, in large part to the Terra network’s TerraUSD (UST) stablecoin losing its peg to 1 US dollar.

The key feature of stablecoins is that, at least in theory, they aren’t affected by the price volatility that other cryptocurrencies experience frequently.

However, during this most recent crypto crash, the value of 1 UST dropped as low as $0.30 USD, according to CoinMarketCap. This is a massive 70% decline from where it is supposed to be pegged. This has resulted in the loss of confidence in the whole Terra ecosystem.

Timeline of Events

10/05/2022 – Terra USD (UST) loses its $1 USD peg, falling below $0.70 USD in 4 hours.

10/05/2022 – UST loses its US dollar peg causes Terra (LUNA) price to dramatically fall as investors begin to sell off their assets. In just 24 hours, LUNA had dropped over 50% and continued to rapidly fall.

11/05/2022 – Terra’s founder, Do Kwon, addresses the Terra community on Twitter. Do Kwon acknowledges the extremely tough time everyone is going through and tries to reassure people that a price stabilisation mechanism is in place to rebuild UST.

13/05/2022 – Exchanges begin to halt trading on LUNA and UST. LUNA price now below $0.01, as the price continues to dive.

13/05/2022 – Terra announced via Twitter that the blockchain has officially halted. Terra’s validators stopped generating new blocks.

14/05/2022 – Do Kwon announced via Twitter that it was game over for the Terra ecosystem. He Tweeted “I still believe that decentralised economies deserve decentralised money – but it is clear that $UST in its current form will not be that money,”.

14/05/2022 – The price of LUNA jumped 200% amid the submission of a “revival plan” that could see ownership within the Terra network redistributed to UST and LUNA holders through 1 billion new tokens. The prices of LUNA and UST remains highly volatile, and there is still a lot of uncertainty surrounding the future of both digital currencies.

17/05/2022 – Do Kwon proposes a new revival plan that entails the current Terra blockchain undergoing a hard fork, creating a new chain without algorithmic stablecoins. The new chain will be called “Terra” (LUNA) and the old chain will be known as “Terra Classic” (LUNC).

18/05/2022 – Voting begins, All Terra holders are given the opportunity to vote on the proposed revival plan for the Terra blockchain.

20/05/2022 – The voting threshold is passed with 66.03% in favour of the revival plan. A final snapshot of the Terra Classic network will be taken on the 27th of May.

28/05/2022 – The first block of LUNA 2.0 is mined at 4 pm AEST, marking the official launch of the new Terra blockchain. New LUNA 2.0 tokens begin being airdropped to eligible Luna Classic holders.

New LUNA tokens will be airdropped to Luna Classic stakers, Luna Classic holders, residual UST holders, and essential app developers of Terra Classic.

How UST works

There are a few different types of stablecoins, each of which carries their own unique risks. For instance, the most well-known stablecoins, Tether (USDT) and USD Coin (USDC) are both, allegedly, backed by fiat currency. This means that for every $1 token they issue, they claim to have $1 in reserve to back it.

UST, on the other hand, is an algorithmic stablecoin, which relies on computer code and market forces to maintain the price instead.

Put simply, users are encouraged via dedicated smart contracts to mint or burn (explained below) UST or LUNA (the Terra network’s native token), which decreases or increases the price of UST such that it remains at around $1USD. In stable market conditions, this seemed to work for a time, however, algorithmic stablecoins like UST have never been truly tested in turbulent conditions as they are now.

Terra Founder, Do Kwon, addressed the Terra community on Twitter to explain the situation.

What is minting and burning?

Minting is the process of creating new coins to put in circulation. Coins like Bitcoin rely on computational power to mint new coins. Stablecoins, however, use a variety of different processes for minting. Some, like USDT and USDC mint new coins once they have the fiat currency to back it. For algorithmic stablecoins like UST, the process is automated.

Burning is the process of permanently removing coins from circulation. This is generally achieved by transferring coins to a “burn address”. This is a wallet from which coins can never be recovered.

Theoretically, both of these mechanisms help regulate the circulation and make sure that corrections are made if the price deviates from the dollar peg. If the price is too high, the algorithm mints more tokens to lower the price. If the price is too low, the algorithm burns tokens to reduce circulation and raise the price.

How did UST lose its peg?

It is being reported that the root cause of UST losing its peg is due to the decline is UST deposits on Anchor protocol. Anchor protocol acts as a money market for stablecoins. It just so happens, that UST is highly reliant on Anchor, which has been a source of criticism leading up to this event. Over the weekend UST deposits into Anchor dropped from $14 billion USD to $11.2 billion USD.

How is Terra trying to fix the situation

Over the weekend, when UST first lost its peg, the Luna Foundation, an organisation dedicated to maintaining the UST dollar peg, tweeted that they would take out two $750 million loans in order to protect the UST peg. However, the price of UST continued to drop. As confidence in UST eroded further, more investors tried to sell, causing a “run”.

The Luna Foundation then said it would defend UST’s price by selling its $3 billion Bitcoin reserves, it is unclear if this will be enough.

Related: What are stablecoins and how do they work?

What does this mean for LUNA and UST investors?

For the price of LUNA and UST to recover, confidence in both tokens will have to be restored and an assurance given that this will never happen again. The Luna Foundation will be doing everything in its power to achieve that. And if confidence is restored, investors may eventually return to the fold. However, there is a chance that irreversible damage has been done to the Terra ecosystem. Only time will tell.

The silver lining

The crypto market is no stranger to events like this. There have been several massive crashes in the history of cryptocurrency (just look at the crashes of 2014/15 and 2018 for example). And also several rock-solid cryptocurrencies that have just collapsed out of nowhere. Zcash and Dash are a few that come to mind.

But if we zoom out a bit on the whole market, we can see that after each big crash an even bigger resurgence has occurred. Over the past decade, cryptocurrency has proven time and again that it is here to stay. This situation is no different.

Ted