- > “Yeah, I think so,” Trump hints at Bitcoin strategic reserve as BTC hits new all-time high

- > SUI surge: Layer 1 blockchain posts all-time high

- > AMP becomes first Australian super fund to publicly disclose Bitcoin holdings

- > Chainlink and Hedera team up to push real-world assets to the next level

- > Ripple Labs’ much-anticipated stablecoin, RLUSD, goes live

“Yeah, I think so,” Trump hints at Bitcoin strategic reserve as BTC hits new all-time high

The USA isn’t alone in considering a Bitcoin reserve, as Japanese and Russian politicians also contemplate its potential.

The noise surrounding a US strategic Bitcoin reserve has hit fever pitch.

The proposal, initially aired by Republican Senator Cynthia Lummis, gained legs ever since Trump affirmed his interest in the idea at a Nashville event in July.

But things were taken to the next level earlier this week, when the President-elect said four simple words when asked about the prospect of a Bitcoin reserve:

“Yeah, I think so”.

Earlier, Trump also said:

“We’re gonna do something great with crypto because we don’t want China or anybody else – not just China but others are embracing it – and we want to be the head.”

As it turns out, his urgency is warranted, with the US far from the only nation looking into creating a national reserve of Bitcoin.

Japan has seemingly joined the race, with a politician (coincidentally named Satoshi…) calling for the country to launch their own reserve.

Putin and Russia may also consider something similar, following their forex reserves being frozen by several nations.

“For example, Bitcoin. Who can prohibit it? No one.”

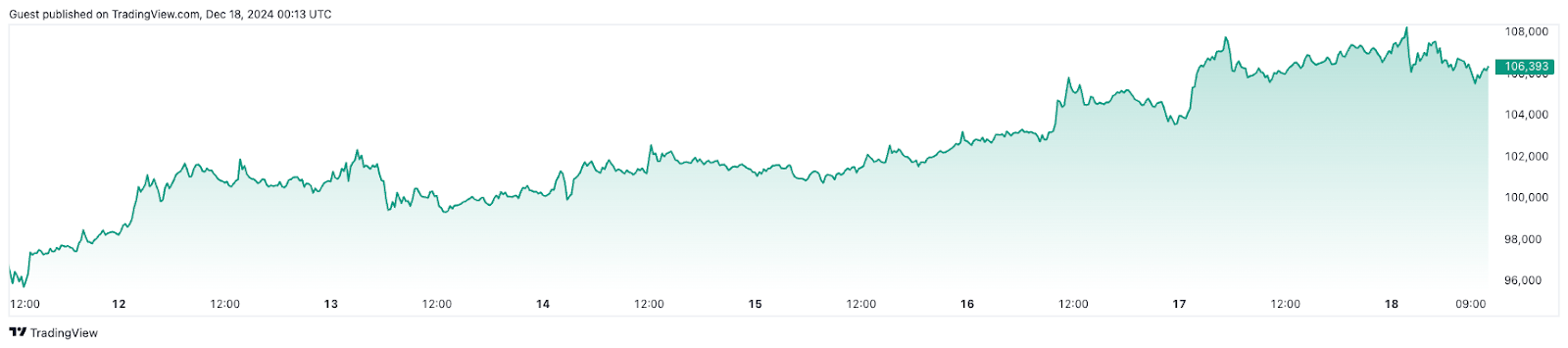

While nothing has been officially actioned yet, all the hubbub around Bitcoin reserves sent the coin to a new all-time high.

BTC snuck past the US $108k mark for all of two seconds, before stabilising around the US $106k range.

And to absolutely nobody’s surprise, Michael Saylor and MicroStrategy purchased another two lots of BTC over the past fortnight, bringing their holdings to a whopping 439k Bitcoins.

SUI surge: Layer 1 blockchain posts all-time high

SUI’s stellar 2024 reached a new peak following a major increase in on-chain activity paired with a partnership alongside Chinese blockchain company Ant Digital.

Every bull market, there’s a handful of projects that capture the narrative.

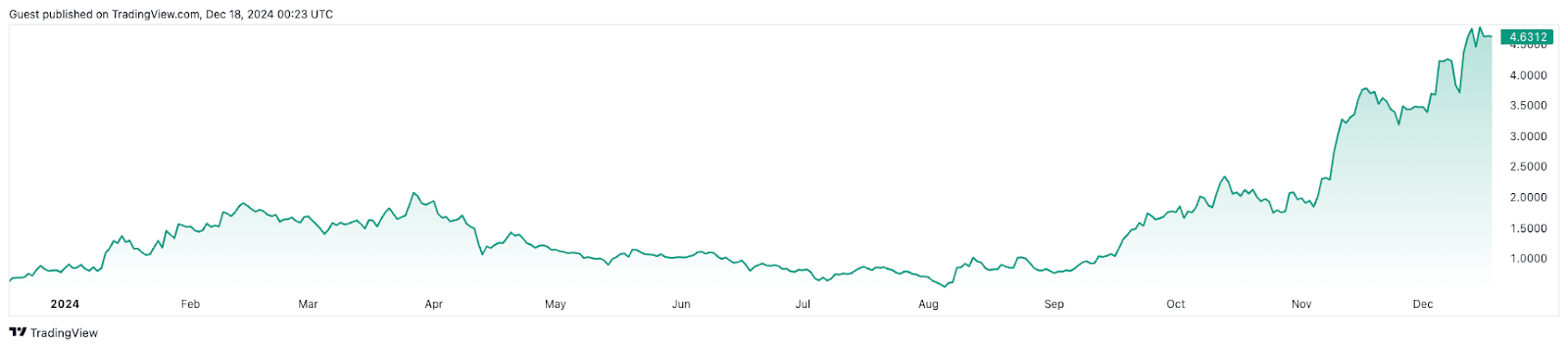

This time around, SUI has been one of the leading stories. It has enjoyed a 2025 to remember, posting gains of over 650% in the past 12 months on the climb to a new all-time high.

The L1 project couldn’t quite make it to US $5, falling just short at US $4.93 on December 16th – but nobody will be complaining.

There are several factors behind SUI’s Sweet Surge, with rising adoption rates and network activity major catalysts.

- The ecosystem’s total value locked (TVL) has grown by more than 50x since October 2023, currently sitting at over US $1.8b.

- Daily active addresses have tripled to just shy of a million over the past 12 months.

- The network recorded over US $500 million in trading volume on December 12th — a significant jump compared to SUI’s highest 24-hour trading volume in 2023, which just exceeded US $50 million.

This momentum was manifested in a partnership with Chinese blockchain and tech giants Ant Digital, with the duo teaming up to “bring ESG-backed RWA assets onchain.”

The collaboration will focus on major Chinese companies working within the solar sector, as both the blockchain and corporate worlds strive to create a more sustainable environment for all.

AMP becomes first Australian super fund to publicly disclose Bitcoin holdings

The AU $27m purchase comprises just 0.05% of AMP’s total portfolio – but represents a whole lot more for the crypto community.

Bitcoin and crypto is becoming “too big to ignore”.

Hey, these aren’t our words – they’re the words of the billion-dollar Australian super fund, AMP.

The superannuation firm, which manages an impressive AU $57b in assets, let the world know they added $27m worth of BTC to their holdings earlier this week.

But what makes the move even more interesting is that – while it was disclosed in December – AMP actually purchased the Bitcoin in May.

The coin was trading at about US $60k around then so… suffice to say AMP would be pretty happy with their investment right now.

But you know who’s probably happier?

The Australian crypto community.

While the Government Down Under has been working with regulators to improve legislation for digital assets going forward, several banks and institutions have adopted a relatively conservative outlook toward the crypto sector.

A major super fund entering the scene – even with a relatively subdued investment – shows a clear shift toward acceptance among Aussies.

As AMP’s Head of Portfolio Management, Stuart Eliot, told InvestorDaily:

“[Our investment is] a small and risk-controlled position…While our super members have benefited from the exposure, we fully appreciate the risk and volatility characteristics of this emerging asset class and will continue to carefully manage our holding.”

Admittedly, AMP aren’t exactly jumping out of their seats at the prospect of holding crypto.

But the more important thing is that they’re holding crypto at all.

Chainlink and Hedera team up to push real-world assets to the next level

Chainlink’s suite of tools are set to be leveraged by Hedera to improve transparency and accuracy across the network’s RWA and DeFi projects.

Chainlink is knocking on the door of the top ten cryptocurrencies by market cap after a hot start to December.

The interoperability and tokenisation project is up nearly 100% over the past four weeks, hitting its highest price since 2021.

The snowball might continue on its merry way after L1 blockchain Hedera launched several Chainlink integrations onto its network. The primary goal of the collab is to provide developers “access to tamper-proof feeds needed to support the development of highly secure DeFi and tokenized RWA applications.”

Chainlink’s Data Feeds allow devs on Hedera’s ecosystem to leverage decentralized and secure off-chain data when building smart contracts. This is vital for basically any DeFi or RWA project you can think of, as it ensures accurate and transparent pricing for assets.

Meanwhile, Chainlink’s Proof of Reserves will provide an extra layer of reliability for tokenisation projects, as it can confirm in real-time that assets backing an RWA on Hedera… well… actually exist.

There were many that had plenty to say about the partnership, but we think that Chainlink summed it up the best in this tweet:

Ripple Labs’ much-anticipated stablecoin, RLUSD, goes live

The tokenised USD asset debuted on both Ethereum and XRP Ledger, prompting a 5% 24h push on XRP’s price.

The tokenisation wave has officially washed over Ripple Labs with the launch of the XRP Ledger’s native stablecoin, RLUSD.

The much-anticipated release came as XRP continues to enjoy its time in the sun, with the token up nearly 140% over the past month of trading.

Opening day, the 17th of December, saw XRP peak at over US $2.71, though the coin eventually settled around $2.60 – a 24h increase of 5%.

The stablecoin was initially made available via several exchanges, including Uphold, MoonPay and CoinMENA, with more set to come.

RLUSD has generated buzz thanks to its approval from the New York Department of Financial Services (NYDFS), joining Gemini USD (GUSD) among a handful of others.

Ripple’s CEO, Brad Garlinghouse, spoke to the potential of RLUSD amid an increasingly competitive stablecoin environment.

“As the U.S. moves toward clearer regulations, we expect to see greater adoption of stablecoins like RLUSD, which offer real utility and are backed by years of trust and expertise in the industry.”

The plan for RLUSD is to tackle institutional-level cross-border payments leveraging both the XRP Ledger as well as Ethereum’s network.

According to Ripple, the stablecoin will be “fully backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents – designed to ensure its stability, reliability and liquidity.”

The token won’t be available in Europe for now, as it is yet to meet stringent MiCA requirements – but plans to amend this will likely come in the new year.

Despite the market’s initial optimism, some in the community are concerned that RLUSD could make XRP a little redundant, as they have fairly similar functions.

With RLUSD in its early stages, how the two coins will synergise within the XRP Ledger ecosystem is a little unclear. Most likely, XRP will continue to be used by institutions for international transactions intended for currencies other than USD.

Additionally XRP’s token will remain the native cryptocurrency of the XRP Ledger, the network that powers RLUSD.

Ben Knight