- > Longest US Government Shutdown in History Comes to an End

- > XRP and Ripple eye off Wall Street

- > Bitcoin stumbles below $100k USD

Longest US Government Shutdown in History Comes to an End

The longest government shutdown in US history is finally coming to a close.

The House of Representatives voted to reopen the US administration following nearly six weeks in limbo.

The government had been without funding since the 1st of October – due to a dispute over healthcare funding. However, after a period of toing and fro-ing, the Democrats and Republicans finally reached a deal that will see Federal operations resume.

The uncertainty caused turbulence among the US and in the broader financial markets, as important macroeconomic data has been unavailable to investors, regulators and economists.

Notably, the US Government’s lack of funding is estimated to have caused a several-billion-dollar loss of production across the nation. Even if indicators like US money supply and unemployment were trending in the right direction for the crypto market, the shutdown left a significant fiscal hole in the nation’s liquidity.

In a year already marred by uncertainty and retail malaise, the government grinding to a halt added another layer of complexity and concern to investors.

But with some clarity potentially returning to the market – even something as simple as getting up-to-date inflation and unemployment data from the US – sentiment could start to turn.

If the next round of macroeconomic data is positive, it could be a trigger some traders are watching before re-upping exposure to BTC.

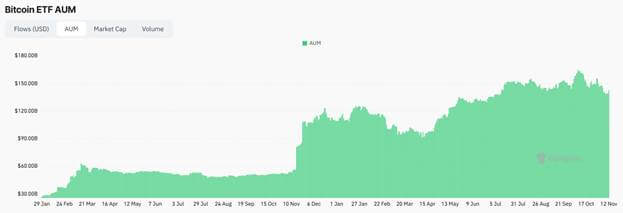

Total net assets under management in spot BTC ETFs peaked October 7th. Since then, holdings have been bleeding.

The US Government reopening is just one piece of the puzzle. And it may actually reveal an economic situation different from what analysts have been predicting.

But at the very least, we’ll soon have a better idea of where the crypto market stands.

XRP and Ripple eye off Wall Street

Though interest in spot crypto ETFs has been somewhat muted over the past month, the products have been seen as a key driver of price growth when sentiment is positive.

Both Bitcoin’s and Ethereum’s recent all-time highs came alongside significant inflows into their respective spot ETFs.

And now, XRP, a top-five crypto by market cap, is looking to dive into Wall Street with its very own spot ETF.

Launched on Thursday, Canary Capital’s XRP ETF is available on the Nasdaq stock exchange. It will be the first product in the US providing spot exposure to XRP’s price.

Other XRP ETFs exist, however, these derive value from bundling derivatives products, rather than actually managing a 1:1 ratio of XRP (like BlackRock’s popular BTC ETF, IBIT, for example).

Typically, futures-based crypto ETFs haven’t drawn as much interest as their spot counterparts.

For example, XRP futures ETFs raked in $800 million USD within their first three months of trading, representing one of the strongest performances for such a product in history.

And yet, Canary Capital CEO, Steven McClurg, predicts that spot XRP ETFs could see inflows as high as $5 billion USD in less than a month of being live.

In its first day of trading, Canary’s XRP ETF generated $58 million USD in volume, the biggest debut for an ETF so far in 2025.

Meanwhile, Ripple, the company behind the XRP project, has continued its acquisition strategy, most recently snapping up crypto wallet provider Palisade. The goal of this M&A push is to ‘bring crypto-enabled solutions to…[the] traditional financial world’.

Their earlier purchase of brokerage firm Hidden Road allowed Ripple to unveil ‘Prime’, a product connecting institutional brokers with digital asset liquidity.

Bitcoin stumbles below $100k USD

As clarity begins to emerge from the United States, some in the community were hopeful the crypto market would respond positively.

However, in the first few days following the government’s re-opening, a sea of red has enveloped the market.

Bitcoin fell below $100k USD for the second time in November, dropping to its lowest value in approximately six months. Several other projects followed suit, with L1s like Ethereum and Solana seeing 24-hour losses of 7% at their lowest points.

Spot ETF outflows have been a major catalyst for the market struggles. Open derivatives positions were liquidated to the tune of +$1 billion AUD.

But why did these occur in the first place?

Simply put, the market isn’t particularly bullish on the macroeconomic environment in the United States.

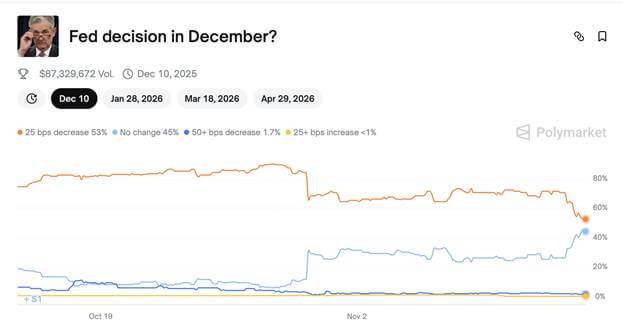

A glance at the Polymarket odds for a December rate cut reveals that investors are approaching inflation with trepidation.

For most of October, market sentiment suggested that a December rate cut was coming. This implies it was likely priced into the value of Bitcoin and other cryptocurrencies.

Therefore, if more and more market participants now believe the Fed will hold rates in December, the valuation of assets will naturally shift.

The market uncertainty is far from isolated to the crypto sphere. On Friday alone, the Nasdaq 100 fell more than 2%, while the S&P 500 dropped 1.6%.

Broadly speaking, it appears inflation concerns are still plaguing the US. Without any data to support (or reject) this sentiment, the market is still largely trading blind. The White House has also said that key economic trends for October might not be revealed whatsoever, leaving a one-month hole for investors to navigate before some much-needed clarity in December.

But still, even among the chaos, Bitcoin’s holiday below $100k USD lasted no longer than 12 hours. BTC soon reclaimed the psychological six-figure milestone, a move that occurred even within sentiment we can quantify as ‘Extreme Fear’.

It’s hard to know what to make of the crypto market at the minute. Is this the tail end of a 12-month bull run, kick-started (and peaking) when the ‘Crypto President’ was elected as Head of the United States?

Or is this simply an accumulation phase before another move?

Most crystal balls are a bit opaque for the time being. It might be another month before we can really see a clear picture of what’s to come.

For now, let’s see if BTC can hold its position above $100k USD, or if journeys below this mark become more of the norm.

Ben Knight