- > Payment giants Venmo and PayPal add simple name crypto transfers to platform

- > Australian ETF market blossoms: Monochrome to launch spot Ether fund

- > Ripple USD stablecoin RLUSD may be just weeks away

- > Solana records all-time high in daily active wallet addresses

Payment giants Venmo and PayPal add simple name crypto transfers to platform

Users can now send crypto via domain names such as “eth.xyz” to finalise transactions, rather than complex wallet addresses.

One of the most daunting aspects of managing cryptocurrency can be sending digital assets between wallets. Consider that the average wallet address is about 20 random characters that even people with a photographic memory would struggle to remember – get just one of those figures wrong and your crypto is kaputt.

That’s why trillion-dollar payment gateways PayPal and Venmo have introduced Ethereum Name Service to their crypto platforms (ENS). The everyday Fintech solutions are striving to turn crypto transactions into a simple, thoughtless exercise – just like sending fiat currency via their gateways. And that’s exactly what ENS allows.

The integration essentially allows users to send crypto via domain names, rather than traditional wallet addresses. By plugging in the recipient’s ENS name – for example, Swyftx.xyz – PayPal and Venmo can automatically detect the underlying wallet address, eliminating the need to enter a complex alphanumeric phrase.

Removing the anxiety of sending crypto, especially when using high-traffic platforms like PayPal or Venmo, could be a huge coup in the quest for widespread adoption.

The underlying token of Ethereum Name Service, ENS, spiked upon the announcement – gaining as much as 4% in under 24 hours. However, with the broader Ethereum ecosystem struggling, the price rise was eventually wiped out as the market consolidates following a mixed start to September.

Australian ETF market blossoms: Monochrome to launch spot Ether fund

The fund will allow both cash and in-kind redemption for Aussie investors and will be managed by Vasco Trustees Limited.

Institutions flocking to the crypto scene has been the big story of 2024. Spot Bitcoin ETFs in the United States are enjoying a stellar start to their career on the markets, raking in billions of inflows – and it hasn’t taken long for Australian investors to prick their ears.

Monochrome Asset Management announced on September 5th that they were entering the spot Ether ETF game Down Under, seeking approval for their newest fund IETH. The Aussie investment managers have been big players in the TradFi/crypto crossover, releasing the first Australian fund to hold BTC directly.

The company is now taking its talents to the Ethereum market, intending to push IETH live later this month – pending regulatory approval. The application now sits with the relevant Aussie authorities and awaits their decision.

IETH, if approved, will be available on Australia’s second-largest stock exchange, Cboe Australia. The fund is set to support both cash and in-kind redemption, meaning investors can swap their shares for actual ETH (or fiat) if they want to exit or alter their positions.

Aussie investors have steadily accumulated spot Bitcoin ETFs since they came back in vogue earlier this year, and Monochrome’s new product is set to stoke the fires even more.

Ripple USD stablecoin RLUSD may be just weeks away

CEO Brad Garlinghouse announced the team is gearing up for a potential September/October release of the much-anticipated stablecoin.

Stablecoins have become the backbone of DeFi over the past few years. They provide all the benefits of crypto – high-yield, low transaction fees, fast settlement times, 24/7 markets – but without the volatility. The biggest danger for stablecoin users is a de-pegging event, where the token falls in value compared to its underlying asset (typically USD). To mitigate this, having a broad market of trusted options is an important step toward maturing the industry.

This is where Ripple Labs comes into the picture.

Ripple, owner of the XRP token and XRP Ledger, has one of crypto’s most expansive infrastructures, leveraging international banks to achieve its goal of cheap, worldwide transactions. The team believes its pre-existing work alongside trusted institutions makes it the perfect candidate for a trustworthy USD-based stablecoin – which is called Ripple USD (RLUSD).

Upon announcing their entry into the tokenised asset scene earlier this year, many in the community speculated that RLUSD would take until at least 2025 before it went live. However, according to Ripple Labs CEO Brad Garlinghouse, the launch could be closer than we think.

“We will certainly launch soon. Weeks, not months…We felt like there was an opportunity for a credible player already working with lots of financial institutions to lean into that market.”

RLUSD will join USDC (Circle) and Tether (USDT) as the prime USD-based stablecoins. The move comes as part of a larger operation from the Ripple Labs team, who aim to build their native blockchain (XRP Ledger) into a massive ecosystem with a wide set of use cases.

Solana records all-time high in daily active wallet addresses

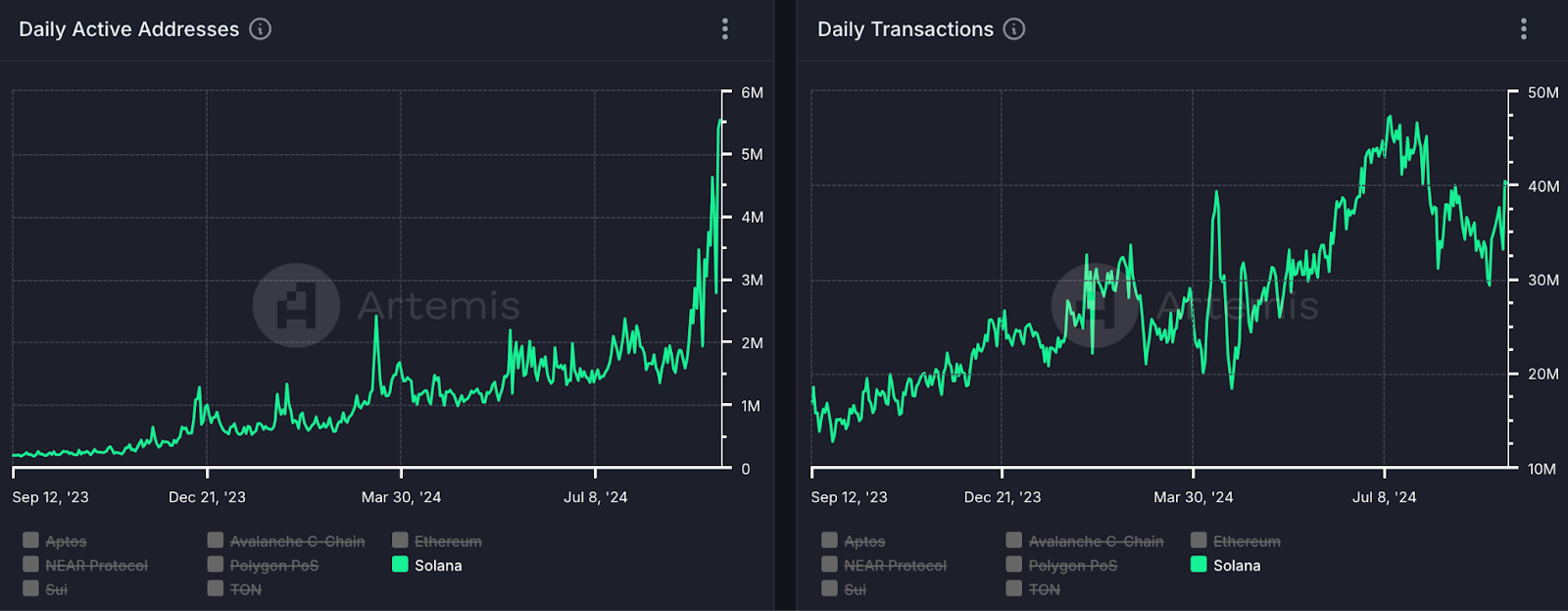

The network experienced over 40 million daily transactions on September the 9th from approximately 5.4 million wallets.

September 9th demonstrated the strength of the Solana ecosystem to the rest of the crypto community. It has been a fairly slow news month for DeFi kingpin, with significant attention moving to Tron and its meme coin exchange SunPump. As investors flocked to Solana’s competitor, and the SOL token’s price remained stagnant, it’d be easy to assume the network would experience a bit of a lull.

But on September 9th, Solana laughed in the face of those assumptions, flexing its muscles to record an all-time high in daily active addresses (DAA).

For lack of a better term, the blockchain has gone bananas over the past few days, experiencing 5.4m active wallets and more than 41m unique transactions through just 24 hours.

These figures blew competitors like Ethereum and BNB out of the water to the tune of 500%.

Solana Trading Activity (Source: Artemis xyz)

The rising user activity within the Solana ecosystem caps off a stellar year for the blockchain, with “flippenings” (where Solana records more daily activity than Ethereum) becoming the norm, rather than a blue moon event.

SOL itself hasn’t had a great run at it over the past month, however, this is more of a reflection of the broader macroeconomic landscape than a lack of investor confidence. Once the crypto market comes back into full swing, it might not take long for Solana to recapture the imagination of investors given its strong fundamentals.

Ben Knight