New SEC Head Paul Atkins Says Crypto is ‘Top Priority’

The reign of Gary Gensler is over.

The ex-Chair of the Securities and Exchange Commission was, to put it diplomatically, a controversial figure among the digital assets community.

Gensler’s SEC adopted a regulation by enforcement approach to crypto, which saw major players like XRP, Coinbase and OpenSea plunged into lengthy legal battles.

But with a new SEC comes a new dawn for the blockchain world. Earlier this week, Paul Atkins was officially sworn in as the head of the financial agency, causing positivity to bubble among the community.

Atkins is renowned among the industry as a ‘pro-crypto’ figure. Since 2019, he has worked alongside Securitize – a tokenisation platform – in an advisory role, while also sitting as co-chair for a blockchain adoption venture.

Any fears that Atkins’ support for crypto would dissipate upon his election as SEC Chair was quickly abated at his swearing in ceremony.

In his very first speech, the new leader of the Securities and Exchange Commission made it abundantly clear where his priorities lie:

Since Trump’s election, it’s been a bit of a wait for crypto regulation to take centre stage, with the US administration largely focussing on global tariffs.

However, with the introduction of Atkins as SEC Chair, alongside several stablecoin bills moving through Congress, the wait is finally over.

Now we get to see how far regulatory clarity can propel the industry.

Real-world asset project Mantra suffers catastrophic collapse

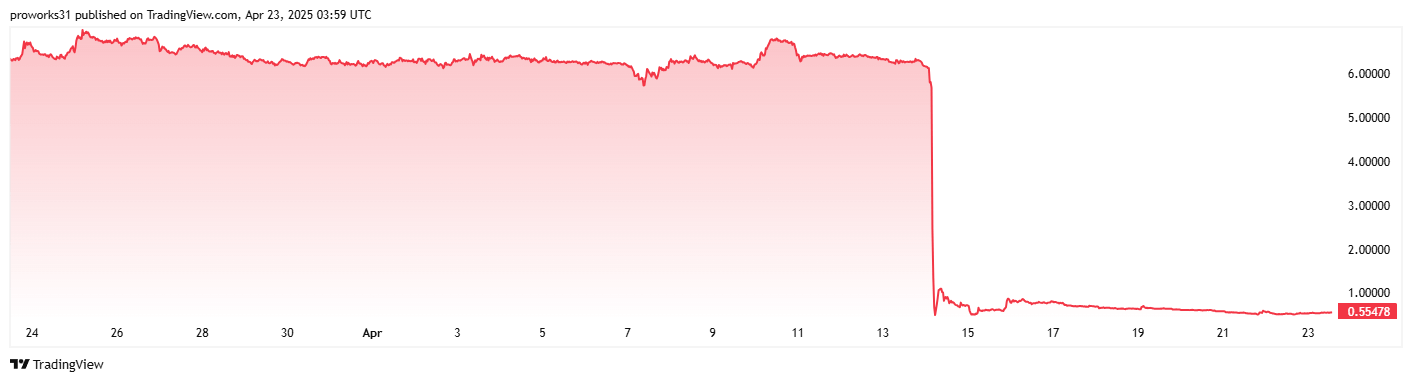

The token price of OM fell 90% within a single hour, as the team scrambles to assure its community that no insider trading took place and the project is still legitimate.

The cryptocurrency market is renowned for some pretty hefty swings. Tokens rising plus or minus 10% within a day is a relatively commonplace event for investors who’ve been around the traps.

But earlier this month the community witnessed one of the most dramatic collapses of an established cryptocurrency in recent history.

Mantra, the real-world asset tokenisation project, had cemented itself as a top 50 cryptocurrency toward the end of 2024. Yet, in a matter of hours, $6 billion USD worth of market cap was wiped from the market when the native token, OM, plummeted 90%.

The cryptocurrency’s price, quite literally, fell off a cliff.

The calamitious April 13th event was reminiscent of similar token collapses from 2022, when the infamous failure of TerraUSD drained billions from the crypto scene.

Now, over a week later, the destruction caused by Mantra’s implosion is still a Holmesian mystery.

The first, and natural, reaction across the community was fear and anger. Accusations ran wild across social media of rug pulls and insider trading. In fact, just weeks earlier, a crypto sleuth uncovered a wallet address linked to Mantra’s team that supposedly held upwards of 90% of OM’s circulating supply.

However, Mantra’s CEO was quick to get on the front foot, dismissing the prevailing theory of a rug pull. Rather, the team claimed the incident was related to ‘reckless liquidations’ that took place on a single centralised exchange (which remains nameless). Fundamentally, OM was secure and the disaster had nothing to do with the Mantra project in general.

Of course, the cries for trust fell on mostly deaf ears.

According to some Bitget’s CEO, Gracy Chen, the token collapse was a perfect storm of ‘opaque governance’ and ‘wealth concentration’.

‘When it’s a token that’s too concentrated, the wealth concentration and the very opaque governance, together with sudden exchange inflows and outflows. That, combined with the forced liquidation during very low liquidity hours in our industry, created the big drop off.’

While the true catalyst behind Mantra’s billion-dollar crash remains uncertain, trust in the project has plummeted. To salvage its reputation as a legitimate crypto venture, co-founder Jean-Patrick Mullin has pledged to burn all team-held tokens – which he hopes will dispel accusations of an insider cash-grab.

However, for now, it looks like the damage has already been done, with OM’s price settling more than 90% below where it started the month.

Mantra’s seismic collapse came at a time of market strength, with most major coins climbing since the incident – so a contagion like we saw in 2022 has thankfully been avoided. Still, it serves as a sobering reminder that token popularity does not necessarily equate to strength behind the scenes.

Canada to introduce fully-featured spot Solana ETFs

The new financial products will ‘engage in staking activities to earn rewards’, giving Canadian ETFs a point of difference compared to US offerings.

All the attention has been on the US SEC, with the community wondering which (if any) crypto projects will join Bitcoin and Ethereum as spot ETFs on prominent stock exchanges.

But as the agency ponders potential ETF approval for several assets, Canada has been working away in the background and, once again, beaten their southern neighbours to the punch.

After being one of the first nations to introduce spot Bitcoin and Ether ETFs, Canada has officially launched its newest crypto-based product – funds tracking the spot price of Solana.

Canadian regulators greenlit four asset managers – Purpose Investments, 31Q Digital Asset Managent, CI Global Asset Managemtn and Evolve Funds Group – to offer spot Solana ETFs to Canadian investors.

Perhaps the biggest news to come from the announcement isn’t the spot funds itself. Rather, it’s the features they come alongside with.

Some in the community has suggested that Ether ETFs won’t become super popular until they include staking. This is because holding and generating passive income via ETH not only offers compounding returns – it also serves to secure the Ethereum network.

However, Canada is one step ahead in this regard, with the new SOL products including staking. Not only does this help maintain the integrity of Solana’s protocol, it may also serve to lower ETF fees.

Ben Knight