- > Ethereum shakes off the rust

- > Has altcoin season finally arrived?

- > GENIUS Act ticked off as United States jumps into crypto regulation

- > Pakistan enters burgeoning world of digital asset regulation

Ethereum shakes off the rust

2024-5 has been a tough time for Ethereum. Competition is catching up to the DeFi ecosystem, as ETH struggles with price stagnation, on-chain congestion and leadership direction.

The result was dwindling faith, frustration among the community and ultimately, a personnel shake-up within the Ethereum Foundation. However, after the past few weeks, it appears the DeFi kingpin may be moving past its malaise.

Purely from a price standpoint, Ether has enjoyed a stellar month. At its peak, the cryptocurrency was up nearly 70% over the past four weeks, pushing it toward the $4,000 USD ceiling that has proven a stubborn resistance point over the years.

It’s all well and good to see the price of Ethereum jump and to announce it’s ‘back on track’. But what’s really behind this sudden change of fortune?

It’s a tale as old as time…or as old as spot crypto ETFs.

Just as we saw Bitcoin explode to a new all-time high earlier this month on the back of major institutional inflows, Ethereum is now following suit.

Investment from large, high-net-worth corporations has been a key driver in Ether’s momentum, with record-breaking inflows landing throughout July. The lowest net flow over the past ten trading days was $192 million USD.

To put that into context, before July, the average daily flow for Ether ETFs was $31 million USD.

In fact, the 16th of July alone – where Ether ETFs saw a record $726 million of inflows – accumulated higher net volume than the entire month of May ($564.18 million USD).

Another element to Ethereum’s rise stems from a new Treasury strategy we’re seeing gain momentum among corporations – adding ETH to their books.

While buying inordinate amounts of Bitcoin has been MicroStrategy’s masterplan for quite some time, snapping up Ethereum is a newer trend with a distinct advantage. Because companies can stake Ethereum, they potentially earn both compounding interest and capital gains on their asset holdings.

To read more about ETH Treasury movements, check out this edition of Swyftx Squawk from earlier in the month.

And adding fuel to the fire was the approval of the United States’ GENIUS Act, providing clear regulations around stablecoins – an asset class closely associated with Ethereum. (More on this later).

The Ethereum jigsaw is starting to take shape. With institutions eyeing off $4,000 USD, the question looms large: Can ETH sustain its momentum and solidify its role as the backbone of DeFi? Or will the rising tide of younger competitors erode its dominance?

As the market watches closely, Ethereum’s next move could redefine the narrative.

Has altcoin season finally arrived?

This past week’s morning routine has been the same.

Roll over, pick up the phone, head over to Coinmarketcap and check if the altcoin season indicator is finally signalling ‘Yes’.

For now, the CMC indicator says we’re not quite there yet – but it’s the closest it’s been to a green light since Trump’s election, when the discourse surrounding his meme coin went haywire.

While, for alt season believers, it may not quite be time to hang the banners and order the championship rings, the past week has seen plenty worth celebrating.

Meme coins have been leading the charge, with several tokenised cultural icons posting gains over 20%.

The ever-flatulent Fartcoin caught wind of the altcoin surge and blew away expectations with a 7-day increase of 40%. Floki (+53%), Dogecoin (+35%) and Pudgy Penguins (+38%) all followed suit – leading to the total crypto market cap briefly ticking past the $4 trillion USD milestone.

Meanwhile, Bitcoin dominance has dropped to its lowest level (approx. 60%) since February 2025, despite BTC hovering around its all-time high of $120k USD.

The cocktail for success has been stirred by the introduction of LetsBonk.fun, a decentralised platform for buying, selling and creating unique meme coins. The Solana-based dApp generated $10 million USD in fees between the 14th and 20th of July and has captured 64% of the total Solana memecoin launchpad market share.

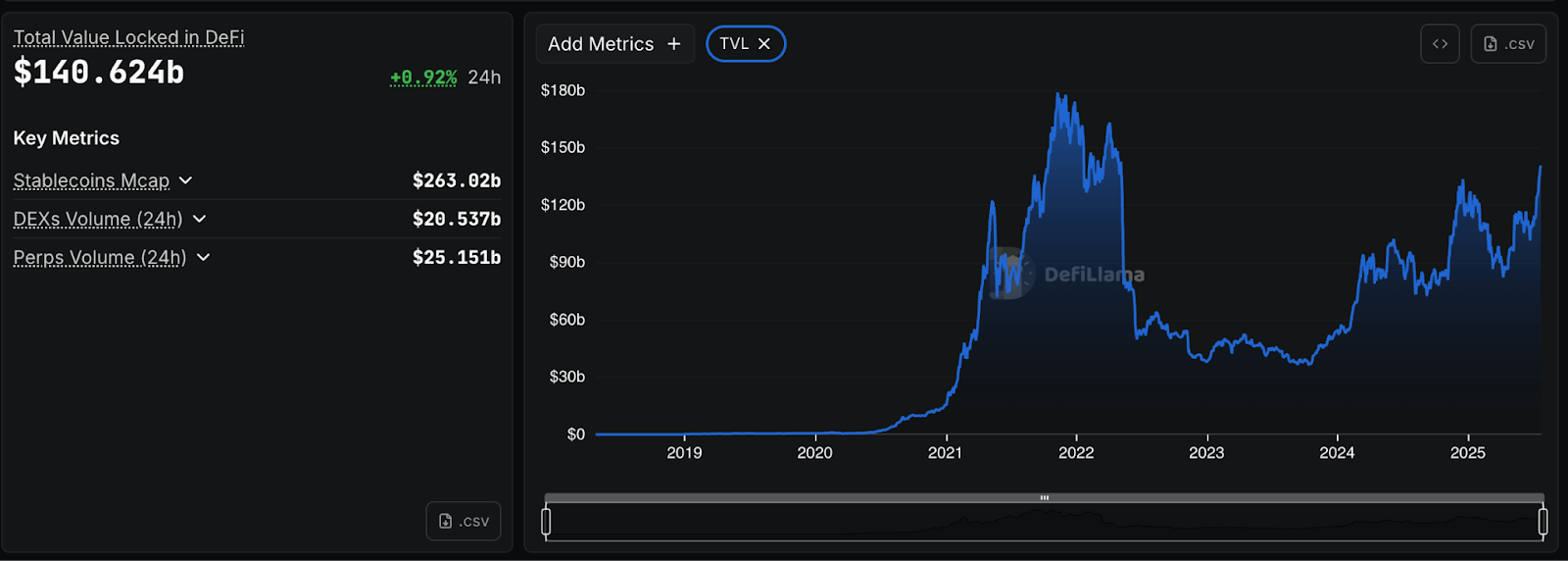

On-chain transactions are starting to heat up, too. DEX volume, according to DeFiLlama, is at its highest point since January this year.

And perhaps even more significantly, Total Value Locked across all chains – a key metric for measuring ecosystem activity – is the most it’s been since the collapse of Terra in 2022.

So, while CoinMarketCap’s altcoin season indicator is still playing it cool, it’s easy to see why the community is getting excited.

GENIUS Act ticked off as United States jumps into crypto regulation

Bureaucracy isn’t often known for its speed and efficiency – something that has frustrated some in the crypto community following Trump’s election promise of introducing digital asset regulation.

But, after months of waiting, the first step toward regulatory clarity in the United States has been taken.

On the 18th of July, President Donald Trump signed into law the much-anticipated GENIUS Act. The day before, the Act passed through the US House without much resistance, securing bipartisan support in a 308-122 final vote.

The comprehensive framework for stablecoin legislation defines key terms, clarifies responsibilities across federal and state agencies and establishes clear operational rules for issuers and banks to follow.

The GENIUS Act requires stablecoin issuers to hold full cash (or cash equivalent) reserves while releasing monthly, independent reports from auditors.

Many in the community expect the legislation will boost confidence among banks, fintech firms and developers, encouraging them to explore issuing their own stablecoins – a move that could significantly enhance liquidity and accelerate adoption across the US financial system

Despite the regulatory progress flooding the markets with positivity, not everyone in the industry is pleased with the outcome. Prominent Bitcoin maximalist, Justin Bechler, believes the GENIUS Act is simply a proxy for the US Government to maintain control over a once decentralised asset class.

The intersection of government regulation and cryptocurrency has always been one likely to end in a heated debate. While events such as the FTX contagion and the TerraUSD collapse have meant regulation is likely necessary for widespread adoption, it also somewhat flies in the face of cryptocurrency’s foundational philosophies.

So, what will come of the GENIUS Act? For now, institutions, investors and innovators are still navigating the uncharted terrain of regulated crypto. Striking the right balance between legal clarity and decentralised ideals won’t be easy – it’s a fine line to walk, and the path ahead is narrow. But if the industry wants to move forward, the time to start laying the pavement is now.

Pakistan enters burgeoning world of digital asset regulation

Regulatory clarity in the Web3 space is starting to accelerate – this time in the South Asian nation of Pakistan.

Pakistan has traditionally been a major player in the crypto industry, with some estimates suggesting some 40 million residents are engaged in the scene, accounting for upward of $300 billion USD in trade volume.

Despite its historically unregulated environment, the Pakistani government has pivoted sharply in the past few months. First, they introduced a Strategic Bitcoin Reserve, followed by the appointment of Binance co-founder Changpeng Zhao as a crypto advisor.

Now, the murmurings have warped into full-blown shouting, with the Pakistan Cabinet officially greenlighting the Pakistan Virtual Assets Regulatory Authority (PVARA) in the past fortnight.

The body will have several responsibilities, including enforcing AML/CTF rules, implementing cybersecurity measures and fostering Web3 innovation in a safe and ethical manner.

The team will also allocate a pre-defined amount of surplus energy dedicated to mining Bitcoin and building reserves.

Compounding the news was the July 9 announcement from Pakistan’s central bank (aka the State Bank of Pakistan, or SBP). Speaking at the Reuters NEXT Asia Summit in Singapore, the SBP Governor declared the nation is ‘building up our capacity on the central bank digital currency’, promising a pilot project coming soon.

The move is part of Pakistan’s broader push to overhaul its financial system. Increasingly, the country is turning to Web3 technologies to drive innovation, attract investment and expand access to digital finance.

Ben Knight