- > Trump’s first week in Office: What we’ve learned

- > DeepSeek sends markets tumbling amid fears of Chinese AI revolution

- > Sweeping changes to crypto ETFs as new SEC takes shape

- > Ethereum leadership drama reaches fever pitch as Buterin addresses concerns

Trump’s first week in Office: What we’ve learned

Another News on the Block, another article about Trump — but hey, can you blame us?

The new US President captured the attention of the crypto community by promising to revolutionise the industry, and his first week in power was as eventful as we all anticipated.

Things got off to a controversial start just before his presidency, when Trump released his very own memecoin aptly called, TRUMP.

Within just a few hours, the project sky-rocketed 1,100% and, at its peak, had a market cap of over $10 billion USD. Making matters even more opaque was the fact companies affiliated with the Trump Organization controlled 80% of the token’s supply.

This naturally sent Trump Organization’s theoretical net worth through the roof, pushing it to over $50 billion USD. However, these remained paper gains, and the hysteria was short-lived as TRUMP’s price fell over 50%.

The short-term success of Trump’s venture led to a barrage of copycats, including from wife Melania and Malik Obama (Barack Obama’s half-brother).

Many in the crypto community were split on the release of Trump’s meme project. On one hand, an incoming US President openly endorsing crypto in such a fashion was unprecedented, giving a level of attention to the industry never seen before.

On the flipside, it presents a clear conflict of interest, while others believe it was a straight-up criminal act — a pump-and-dump scheme for Trump insiders.

Unfortunately, the memecoin launch has grappled attention away from Trump’s other crypto-related actions.

The US President has signed several executive orders since his inauguration, including creating a crypto-centric taskforce within the Government to advise and develop regulatory clarity for digital asset markets.

Another order proposed the ‘potential creation and maintenance of a national digital asset stockpile’ — the first steps toward a widely-anticipated Strategic Reserve.

Meanwhile, the new-look Securities and Exchange Commission got off to a hot start, abolishing the controversial SAB 121. This change-up gives banks a clear path to entering the digital asset sector if they please.

Trump’s first week has been chaotic, and we still don’t know just how much the new US regime will benefit the industry. Nevertheless, we’ve caught a glimpse into the potential of Trump’s crypto revolution — now let’s see how far it can go.

DeepSeek sends markets tumbling amid fears of Chinese AI revolution

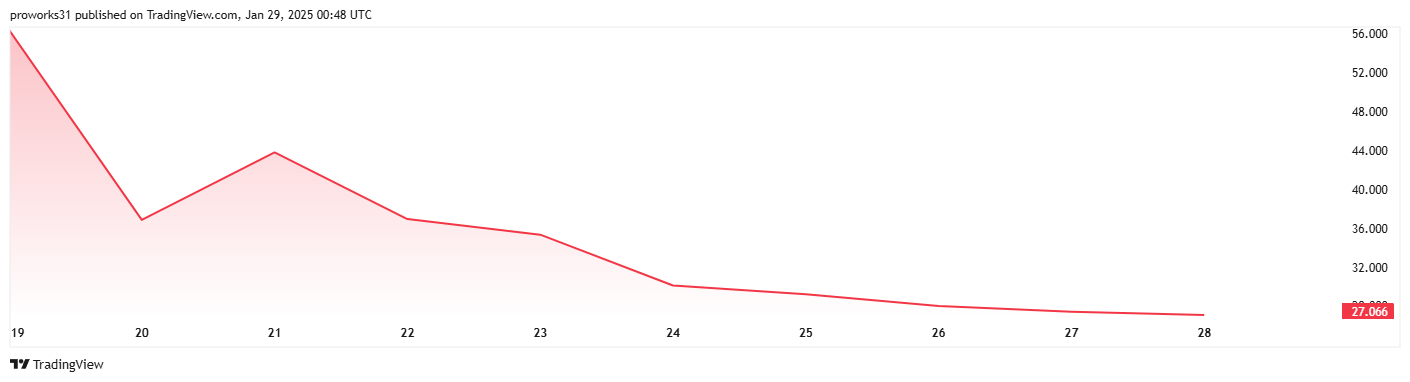

US tech and the crypto market have taken a hit this week following the release of China’s latest artificial intelligence chatbot — DeepSeek.

It was pandemonium on Wall St, with 2024’s hottest stock NVIDIA Corp (NVID) copping a beating to the tune of 17%, shedding almost $1 trillion AUD in market capitalisation.

The Nasdaq 100, a fund littered with top-tier tech and AI companies like Meta and Amazon also felt the pinch, falling over 3%.

US technology equities have become increasingly correlated with the crypto market, and the Web3 space couldn’t escape the mayhem.

Bitcoin plummeted to under $100k USD upon DeepSeek’s release, while AI projects such as FET (-9.4%) and Virtuals Protocol (-8.4%) experienced heavy same-day losses.

So, how did a Chinese machine-learning model cause a wave of panic across the Western financial markets?

The answer is simple: efficiency.

Much of the world’s largest tech (largely found in the US) have significant resources dedicated to AI – think Google’s Gemini, Amazon’s Alexa, Microsoft’s Copilot and so on.

However, these models are quite expensive to run, for both the operator and the consumer.

The DeepSeek R1 model divides tasks among ‘submodels’, and using it can be up to 30 times cheaper than some of its Western counterparts. According to the devs, the chatbot was trained using just $6 million USD (in contrast, GPT-4 cost around $63 million USD).

So, with many modern crypto initiatives revolving around AI — plus the innate link to US tech — DeepSeek sent most prominent digital currencies into the red.

Of course, the immediate reaction may have been a bit premature.

DeepSeek demonstrated impressive potential that could disrupt how the world’s biggest companies see and build AI infrastructure… but it’s not without flaws.

Data integrity and censorship is a huge issue with artificial intelligence. And while DeepSeek presents some new ideas about efficient machine-learning models, it does little to solve one of AI’s biggest problems.

The US government has raised concerns around data collection and privacy, which they’ve quickly leveraged to quell the chatbot’s momentum.

And wait, there’s more: not everyone is convinced the project is as cheap as claimed.

So, was this a case of Wall Street jumping the gun? Or were investors justified in their DeepSeek-led panic?

Only time will tell.

Sweeping changes to crypto ETFs as new SEC takes shape

The days of Gary Gensler are over, and so too is the SEC’s ‘regulation by enforcement’ stance.

The previous administration’s policy of forcing crypto to comply with pre-existing financial regulations caused a lot of industry angst. Some even believed that it was purely a vendetta against an evolving financial landscape.

But things are different now.

Mark Uyeda, who has a reputation of being amicable to crypto, is the acting Chair of the Securities and Exchange Commission (SEC).

One of the team’s first moves was to scrap SAB 121, which essentially strongarmed banks out of holding digital assets.

Now, fund managers are testing the waters to see just how ‘crypto-friendly’ the new administration is.

Like a teenager breaking curfew, it seems investment funds are making deliberately ridiculous ETF filings to discover where the line is.

Perhaps the most outrageous filing of the past week came from TuttleCapital, who unleashed documentation for ten different spot ETFs, including one representing Bonk, TRUMP and Melania.

Despite the arguably unrealistic memecoin filings, the spot ETF space is heating up for real.

Cboe BZX Exchange is looking to add in-kind redemptions to the 21Shares Bitcoin and Ether ETFs, something much rarer under Gensler’s leadership.

Fund managers have ramped up filings for prominent crypto projects like Solana, Chainlink, Cardano, XRP and Polkadot, which should see approval or rejection in the coming months.

And if, somehow, the memecoin ETFs make it through the SEC, well, you’ll be able to buy them on US exchanges come April.

Ethereum leadership drama reaches fever pitch as Buterin addresses concerns

Ethereum has had a tough time of late.

The revolutionary Layer 1 project has suffered from stagnating price growth, with competitors such as Solana, XRP and Sui capturing significant on-chain market share.

Particularly, concerns around the non-profit Ethereum Foundation’s management of the project have arisen, with a chorus of social media commentators calling for a leadership shake-up.

Resentment was already bubbling away in the background following 2024 revelations that a team member accepted a paid position at the Eigen Foundation. Additionally, the community was displeased with the transparency and centralisation of the Foundation’s Treasury management.

However, things reached an ugly melting point last week, causing Ethereum co-founder Vitalik Buterin to step in.

Buterin’s response didn’t exactly inspire confidence in those hoping for a decentralised approach to solving Ethereum’s stagnation and leadership issues.

However, the community figure accepted that change was necessary to address some of the project’s issues.

He also noted the negative economic impact L2s were having on Ethereum’s mainnet growth. But rather than defeat the purpose of decentralisation and shut down the competition, Buterin believes the path forward is to improve interoperability and create a tight-knit, innovative community.

Ben Knight