For a while now, Bitcoin and the cryptocurrency market have been compared to the rise of the internet, and the subsequent dot com crash of the early 2000s. Here, we will investigate this comparison, looking at both the volatility of crypto and the internet companies of the late 90s, with a focus on global adoption of new assets, speculative trading, innovative technology and large, far-reaching crashes.

While it’s true that the crypto industry has faced a variety of downturns, it’s important to remember that Bitcoin and co have weathered several crashes, with most reputable projects managing to recover. Furthermore, many of the related declines in crypto we have seen can be attributed to global factors outside the market’s control.

Crypto and the Rise of the Internet

Since crypto first started breaking into the public’s eye, it’s been compared to the rise of the internet, circa 1997. While there are certainly a range of similarities, it’s the contrast between these two varieties of assets that makes all the difference.

It’s clear that cryptocurrency and its underlying technology, blockchain, and the internet are both protocols for connectivity. However, while the internet exchanges information digitally, cryptocurrency was originally invented for exchanging value digitally.

Easily the most significant similarity between crypto and the internet is just how decentralised they are. The barest of regulations gives way to enormous levels of freedom, and it is perhaps this freedom that may sometimes rattle the confidence of investors and users in the face of such innovations.

Adoption of crypto vs adoption of the internet in 1997

Still, in 2022, during relatively early stages of global adoption, Bitcoin was being used by less than 2% of the world’s population. This is roughly equivalent to the number of people using the internet in 1997, as the uptake was very slow from its introduction in 1983: Forecasts were often pessimistic, dismissive, and, ultimately, incorrect.

The current growth of Bitcoin is very similar to the internet of the late 90s, and it is increasing its market presence every year.

By the year 2000, the global internet adoption rate grew to 5%. In 2025, Bitcoin’s adoption rate had grown to just under 5% too – eerily within the same three-year timeframe as the internet.

Fast-forward to now, and the internet has become so ubiquitous that today’s non-adopters represent the same small, niche minority that its early adopters did back in the ’90s.

The chart below compares the growth of the internet from 1992-2006 to actual crypto adoption from 2016-2022 and then projected adoption from 2022-2030.

Of course, history does not repeat itself; rather, it often rhymes. With numerous factors at play, the adoption of Bitcoin and other cryptocurrencies cannot be accounted for perfectly, but more and more people and institutions are taking ownership of digital assets and adopting blockchain technology. As with anything new, there are ups and downs, but the mass adoption of crypto is approaching us in much the same way as the internet did in the late 1990s.

The introduction of regulation (starting with stablecoins in the US), traditional financial instruments providing exposure to BTC, and treasury strategies incorporating crypto, have all helped accelerate adoption.

That being said, this rise in adoption did contribute to the dot-com crash of the early 2000s, as over-inflated publicly listed companies tanked under a drastic loss of consumer confidence.

Crypto crashes vs the Dot Com crash of 2000

As with the similarities between cryptocurrencies and the internet, so there are between the most recent crypto crash and the dot-com crash.

The rise of the internet was associated with both new technology and new business opportunity that promised to revolutionise the way we retain information and purchase goods and services.

Investors saw the potential for huge gains in publicly listed internet companies. In fact, people were investing in anything that was associated with this new technology. This led to dozens of companies changing their name to be more ‘web-oriented.’ What resulted was an enormous bubble in the prices of these stocks leading to a market crash in the early 2000s.

At present, some experts are comparing what happened in the early 2000s to the recent cryptocurrency bull run and subsequent crash.

Like the overvalued, essentially worthless companies of the dot-com era, thousands of blockchain-based tokens with little-to-no value became quite popular in 2021 and other alt seasons. These tokens would ride the success of the broader crypto market, leveraging the popularity of coins with actual intrinsic value. Following major crashes, however, a lot of these low market cap altcoins became basically worthless.

Many experts predict that prolonged bear markets – which are a necessary part of the economic cycle – help shake out the bad players and leave projects with strong fundamentals.

Good companies prevailed

During the crash of the early 2000s, companies such as Worldcom, NorthPoint Communications, and Global Crossing failed. The NASDAQ lost close to 78% of its value, and Amazon lost 90%. However, those companies were solid enough to weather the decline. Amazon, as well as eBay and PayPal – other major players that were initially hurt during the dot-com crash – grew to become powerhouses of the tech industry.

It’s likely we have seen the same thing happen to the crypto markets. Major downturns, like in 2022, saw the failure of several cryptocurrencies and associated projects. FTX and Terra are perhaps the two biggest examples of this. However, while these two did not survive, their failures largely stemmed from bad actors, poor management and straight-up fraud. It was in fact, this very collapse, that caused a renewed effort to mitigate the risk of crypto ventures and demonstrate the durability of legitimate projects.

What does this tell us? Yes, the crypto market can be extremely volatile, however, it’s important to zoom out from short-term pain and understand the bigger picture.

Is crypto a bubble?

On this rather bleak note, the question must be addressed: As with the dot-com companies of the late 90s, is crypto a bubble?

There have been rumblings for quite some time that the rising price of cryptocurrencies represents no more than a bubble. However, the idea that Bitcoin is based purely on the speculation of a fickle, inexperienced market is simply not true.

Bitcoin and cryptocurrency are genuine inventions, and frequently outperform other asset classes. A great deal of evidence points to the creation, in the introduction of crypto, of a real economy slowly establishing itself as a global asset. How long it will take for cryptocurrencies to be finally and fully accepted is – but global adoption is rapidly growing.

One only has to look at the US Government’s push for a Federal Strategic Reserve comprising BTC as a growth asset, or the record-breaking success of BlackRock’s spot Bitcoin ETFs, to see how public perception is shifting.

Bitcoin seems to be heading ever upwards, albeit through cycles of bull and bear markets.

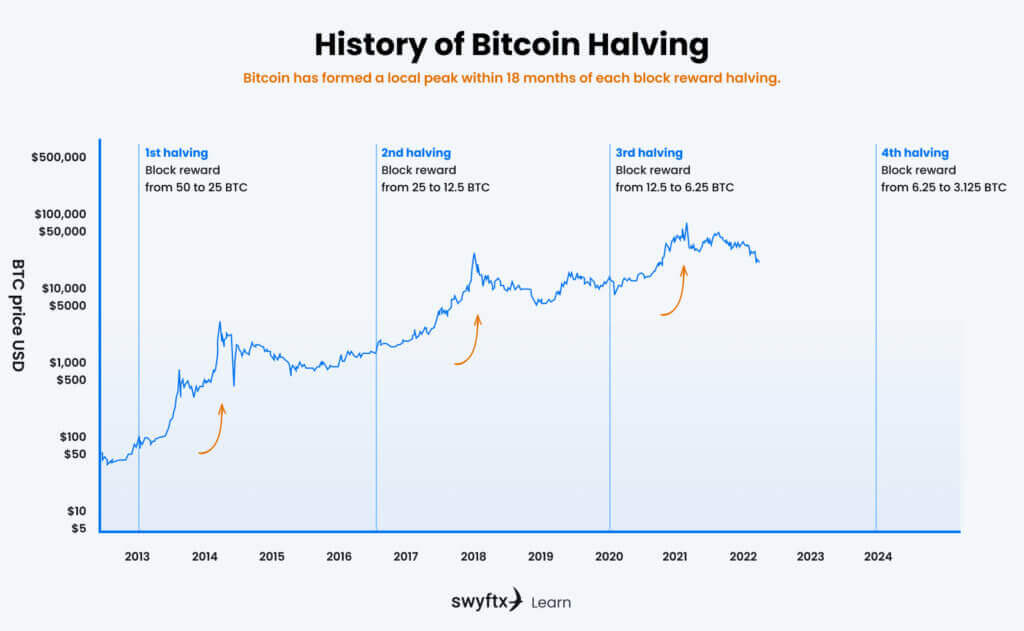

Historical data reveals that the bitcoin halving, which occurs every four year, has a significant impact on the price of bitcoin. Every occurrence of a Bitcoin halving has been followed by a large surge in price. A halving refers to an event where the rewards provided to Bitcoin miners is cut in half. Take a look below:

Investors like Michael Saylor and Elon Musk have noticed patterns in Bitcoin and bet on the understanding that the market is upwards and cyclical. In other words, strong coins like Bitcoin have every chance of being every bit as reliable, in the long run, as the stronger online companies of the early 2000s.

And just like the dot-com bubble, it will be the weaker projects that struggle to maintain relevance over time.

The crypto market may be volatile, but it has also proven itself to be versatile, durable, and here to stay. What began as an unknown digital innovation has evolved into a multi-trillion dollar industry with an array of different utilities – not just payments. To find out more about Bitcoin and cryptocurrency market cycles, click here.

Ted