While cryptocurrency is new(ish) in the grand scheme of “money” in exchange for goods and services, the tax department is not. If you are wondering if your Bitcoin or Ethereum is subject to tax obligations, the short answer is yes.

We delve into the different types of tax cryptocurrency investors and traders are subject to, and when each applies to an individual’s circumstances. If you’re newer to cryptocurrency, we recommend reading our Beginner’s Guide for Cryptocurrency Investing beforehand.

Cryptocurrency in Australia

A recent study, conducted between December 2021 and February 2022, by market research firm Roy Morgan revealed that more than one million Australians own cryptocurrency.

While cryptocurrency first entered circulation in 2009, it wasn’t until December 2014 that the ATO published guidance on how cryptocurrency fits into existing tax law – mainly relating to their view of Bitcoin being a ‘Capital Gains Tax (CGT) asset’ rather than ‘foreign currency’ for investors.

The ATO has since published general guidance on cryptocurrencies and NFTs tax treatment in Australia.

March first of 2020 saw the Taxation Office announcing its plans to target and audit cryptocurrency traders, sending up to 350,000 letters to individuals reminding them of their tax obligations. Since then, the ATO’s crypto focus has remained, with similar letters during 2021 and for 2022, the ATO focus has been ramped up ahead of the 2022 tax year, where the ATO released a statement calling out ‘record-keeping’ and ‘capital gains from crypto assets’ as two of four key priority areas this tax time. In 2023, the ATO again noted it had capital gains from assets such as crypto high on its hit list.

By now, crypto investors should be well aware that crypto is taxable. In 2023, we saw the ATO release new web guidance specifically addressing more complex transactions related to DeFi, including staking, wrapping, liquidity pools, interest, lending and borrowing. This guidance indicated that the ATO was taking the stance that smart contract interactions likely trigger CGT events, meaning that many common onchain interactions are taxable and must be reported to the ATO.

There was also another key change related to airdrops, which were previously taxable as ordinary income when received. Airdrops that are not an ‘initial allocation airdrop’, will not be subject to income tax when received (but may later be taxable as capital gains when you later sell – more on this below!)

How the ATO Classifies Crypto

First and foremost, the Australian Tax Office (ATO) does not view cryptocurrency as foreign currency, or any fiat currency. Instead, for most investors it is viewed as ‘property,’ a CGT asset for tax purposes.

The definition from the official ATO website says: “The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. Cryptocurrency generally operates independently of a central bank, central authority or government.”

To calculate a capital gain or loss made from cryptocurrency, you need to know and keep records of the cryptocurrency market value in Australian Dollars at the time of disposal.

How the ATO tracks crypto trades

If you have not exchanged your cryptocurrency for fiat currency you may think the Australian Taxation Office (ATO) is unaware of your crypto finances. This is not the case.

The ATO started collecting records from Australian cryptocurrency designated service providers, or DSPs, in May 2019 to ensure individuals were tax compliant. These DSPs include anything from cryptocurrency exchanges, payment facilitators, brokerage services, and more. They also have a data matching programme with Australian exchanges.

The type of information collected can include your name, address, ABN, date of birth, and contact details, amongst other personal information.

The ATO is also able to access transaction and account details, such as the status of accounts, linked bank accounts and associated wallets, types of cryptocurrency, amounts in fiat and crypto and more. The ATO has obtained data for the period from 2014–15 to 2019–20 financial years and ongoing. Last year, the ATO ramped up their crypto focus, releasing a statement calling out ‘record-keeping’ and ‘capital gains from crypto assets’ as two of four key priority areas this tax time.

The majority of gains and losses in relation to cryptocurrency are subject to tax, so your best bet is to familiarise yourself with it and prepare to factor it into your tax return, or work with an accountant who understands the ATO cryptocurrency guidance.

Cryptocurrency record keeping

Whilst it’s important to ensure you have prepared your tax return accurately, it is also crucial that you keep proper records of all your transactions to support your tax return disclosures. The ATO states:

According to the ATO, you need to keep the following records in relation to your cryptocurrency transactions:

- receipts when you buy, transfer or dispose of crypto assets

- a record of the date of each transaction

- a record of what the transaction is for and who the other party is (this can just be their crypto asset address)

- exchange records

- a record of the value of the crypto asset in Australian dollars at the time of each transaction

- records of agent, accountant and legal costs

- digital wallet records and keys

- a record of software costs that relate to managing your tax affairs.

- the date of the transactions

- the value of the cryptocurrency in Australian dollars at the time of the transaction (which can be taken from a reputable online exchange)

- what the transaction was for and who the other party was (even if it’s just their cryptocurrency address).

The ATO also explains that you may use third-party software to help with record-keeping obligations. Crypto Tax Calculator (CTC) is an Australian-made crypto tax software solution for all types of crypto users, from casual dabblers to full-time traders. CTC integrates directly with your Swyftx account and automatically generates crypto tax reports that your accountant will love or that can be used to file directly with the ATO via myTax. Use the code SWYFTX30 to get 30% off your next Crypto Tax report for new users only. Offer ends 31 October 2024.

Are you an investor, or a trader?

If your dealings with cryptocurrency predominantly involve using it as a personal investment, and the majority of your earnings are coming from long-term gains, you will likely fall under the Investor category. In this instance, gains and losses on cryptocurrency are subject to Capital Gains Tax, or CGT.

Traders are typically carrying on a business or profit-making activity involving cryptocurrency that derives Ordinary Income. To be classified as a trader, you must assess your facts and circumstances and consider how the Australian Taxation Office will view the activity.

Investor

Despite the name, and the fact you may regularly ‘trade’ cryptocurrencies, most Australians will fall under the Investor category. If your dealings with cryptocurrency predominantly involve using it as a personal investment, and the majority of your earnings are coming from long-term gains, you will likely fall under this Investor category.

In this instance, gains and losses on cryptocurrency are subject to Capital Gains Tax, or CGT.

Trader

Traders are businesses, including sole traders, that operate a business that involves cryptocurrency. To be classified as a trader, you must assess your facts and circumstances and consider how the Australian Taxation Office will view the activity. At minimum you should be:

- Carrying on your activity for commercial reasons and in a commercially viable way

- Undertaking activities in a business-like manner – e.g. preparing business plans, acquiring capital assets or inventory in line with the business plan

- Preparing accounting records and marketing your business name

These are only some of the factors that go into determining what is considered a business activity. There can be a number of other important factors, such as your professional education, hours spent on the activity, sophistication and scale of the activity, use of automation, and many others. We encourage you to seek professional advice to determine if you may fall into this category.

Tax treatment is not a matter of choice but is based on an objective assessment of the relevant facts and circumstances. The current ATO guidance does not address all crypto trading scenarios that may occur – as such, taxpayers are left to use their best judgement until the ATO releases more detailed guidance. Disputes on the nature of income in mixed portfolios are common, so it is important to clearly separate and document each activity. If you’re unsure of your self-assessment of the situation, it is best to check with a qualified accountant who specialises in cryptocurrency.

Capital Gains Tax (CGT)

As previously mentioned, the ATO classifies digital currency as a CGT asset, similar to a share in a company. It is therefore required to assess and keep records of your capital gains each time you trade, sell, spend or gift your crypto assets or have any other type of disposal event. There are several types of capital gains events, and we’ll discuss these in the section below.

Capital gains

To calculate whether you have a capital gain you need to start by knowing your cost basis. Put simply, your cost basis is whatever it costs you to acquire your cryptocurrency plus any related fees – like purchase or sale fees.

If you own a CGT asset and you make a profit after you sell, trade or gift that asset, then you’ll need to pay tax on the capital gain you’ve made.

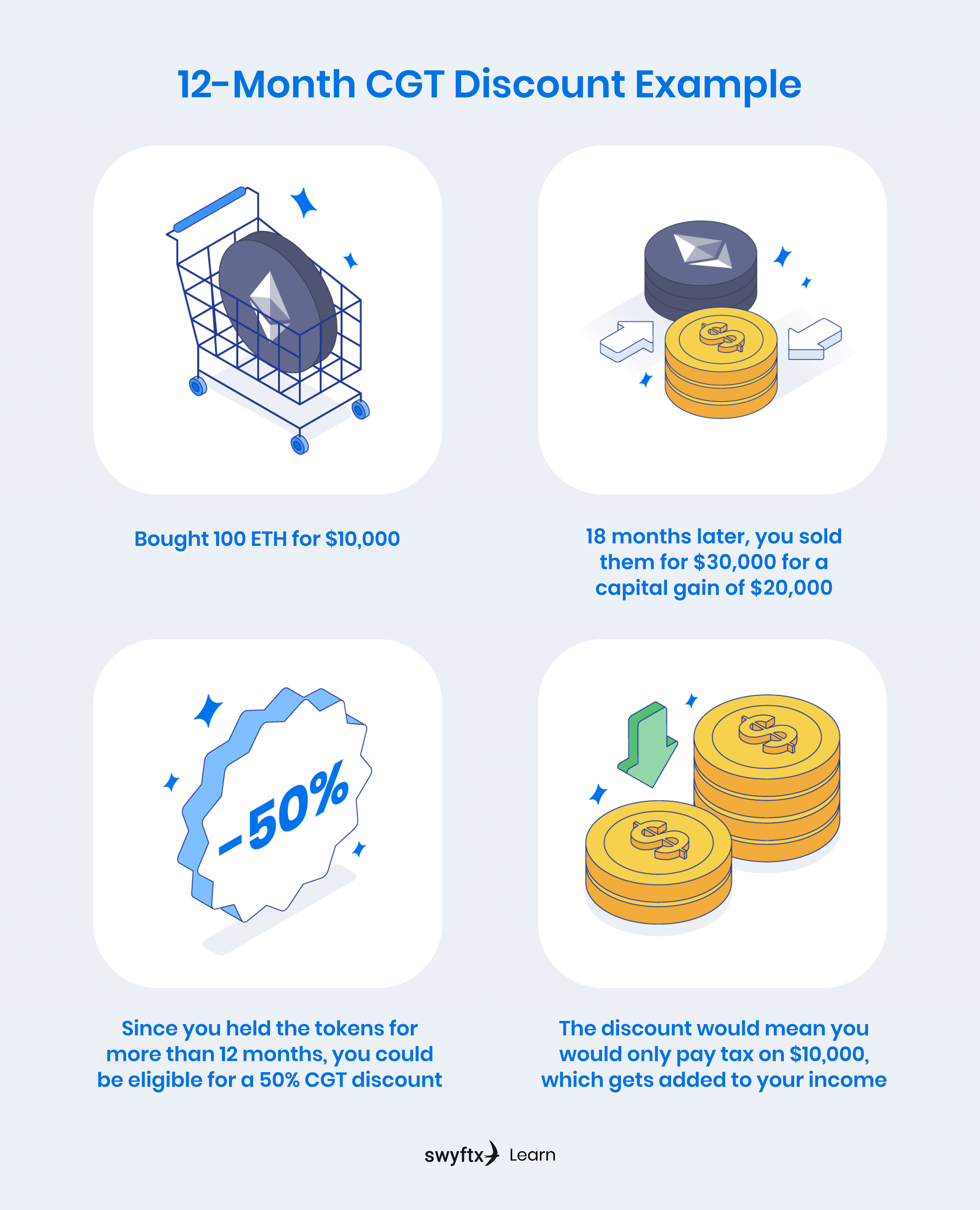

12-month CGT discount

If you hold a CGT asset for longer than 12-months, you may be eligible to apply the 50% CGT discount (this is also referred to as long-term gains). This is a 50% discount for individual taxpayers and 1/3% (i.e. 33.33333%) for compliant crypto SMSF accounts.

Capital losses

If you sell your cryptocurrency asset for less than when you originally bought it, this is referred to as a capital loss. For instance, if you buy Ethereum at $1,000 and then sold it 6 months later for $500, your capital loss is $500. Fortunately, capital losses can be used to offset capital gains. However, investors should be mindful that if you sell and purchase the same asset within a short space of time purely to realise a capital loss, wash sale rules may apply and the ATO may deny the loss.

The capital gains tax rate

Should you trade or sell, gift or spend cryptocurrency in your capacity as an individual investor, then the percentage you will owe in capital gains tax will be calculated at the same rate as your income tax. If you hold a crypto asset for 12 months or longer, you’ll be eligible for a 50% CGT discount.

How much you owe in income tax will depend on your total income throughout the year, as per the following table.

Australian Tax Office income tax rates 2023-2024

| Income | Tax Rate |

| $0 – $18,200 | 0% |

| $18,201 – $45,000 | 19% of excess over $18,200 |

| $45,001 – $120,000 | $5,092 + 32.5% of excess over $45,000 |

| $120,001 – $180,000 | $29,467 + 37% of excess over $120,000 |

| $180,001+ | $51,667 + 45% of excess over $180,000 |

When does capital gains tax apply, and how do I calculate it?

Now you’re aware of the cryptocurrency tax treatment in Australia and your obligations, let’s take a deeper look at the one that affects most Aussies: Capital Gains Tax, or CGT.

CGT occurs when you dispose of cryptocurrency. According to the ATO, this could be by the following common events:

- Trading or exchanging, most typically in the form of disposal of one cryptocurrency for another

- Converting cryptocurrency to fiat currency, such as the Australian dollar

- Using cryptocurrency to purchase goods or services or

- Selling or gifting cryptocurrency

- Depending on the situation, depositing into a DeFi protocol

How do we define personal use assets

In rare cases, you may be eligible to exempt capital gains tax if you hold cryptocurrency as a personal use asset. If you purchase (over a short period of time) no more than $10,000 of cryptocurrency to directly buy something else with crypto for personal use or consumption, you may be eligible.

Beware though, the personal use asset exemption cannot be used where you treat the asset as an investment - The time of disposal of the crypto is the key to working out if it’s a personal use asset. The longer the crypto is held, the more unlikely it is to be considered a personal use asset, even if you ultimately use it to purchase items for personal consumption.

Capital Gains Tax on investments

Cryptocurrency is an increasingly popular part of investment portfolios. Capital Gains Tax comes into play when you dispose of your cryptocurrency through one of the methods above.

However, while it sits in your investment portfolio, regardless of changes in market value, you do not make a capital gain or loss until you dispose of it and are thus not liable to pay capital gain tax on unrealised gains.

Tax on exchanging one cryptocurrency for another

Digital wallets can contain different types of cryptocurrencies, and while they all fall under a broad category, each type is actually regarded as its own CGT asset.

Thus, when you trade one cryptocurrency for another, you are effectively disposing of one, and acquiring another. Because cryptocurrency is regarded as property, the value of the cryptocurrency is based on the market value of the currency on the day it was acquired or traded.

To calculate the Capital Gains Tax, you would look at the market value of the cryptocurrency you acquire at the time of the transaction.

It is important to note if you have multiple digital wallets in which you store your cryptocurrency, transferring from one to another is tax-free. However, where you pay for transfer fees in cryptocurrency, these transactions will constitute disposals and may be taxable.

Tax on gifting crypto

Gifting crypto, even if you do not receive payment for it, is still considered a disposal. As such, it is subject to capital gains tax. If you are on the receiving end, you do not have to pay tax when you receive the cryptocurrency, however, if you dispose of it, that is when capital gains tax will be applied. If you are donating to a deductible gift recipient, you can claim the donated amount in dollars as a deduction on your tax return.

Spending crypto with gift or debit cards

The Australian Taxation Office (ATO) has recently issued updated guidelines regarding the use of cryptocurrencies for purchasing or loading gift or debit cards. According to these guidelines, such transactions are treated as sales of cryptocurrency, and as a result, any profits made are subject to Capital Gains Tax.”

Tax on Gambling and crypto winnings

The Australian Taxation Office (ATO) has issued new guidance stating that cryptocurrency received from lotteries, game shows, and similar sources is not classified as ordinary income. However, it’s important to maintain records of the fair market value of any such cryptocurrency winnings. This information is crucial for establishing your cost base in case you decide to sell, exchange, spend, or gift your crypto in the future. Be aware that any profit made from these disposals will be subject to Capital Gains Tax.

Tax on DeFi activities

In late 2023, the ATO provided guidance on the tax treatment of some DeFi activities. The ATO’s stance is that many DeFi activities, including lending, borrowing, providing liquidity, and wrapping tokens, do, in fact, trigger a CGT event.

The reasoning behind the tax implications for DeFi ‘lending’ and ‘borrowing’ arrangements is based on their opinion that these activities do not resemble traditional loans or interest-bearing activities. This is because these transactions often involve a change in beneficial ownership of crypto assets, either through exchanging one crypto asset for another or for a right to receive assets in the future.

For liquidity providers and participants in liquidity pools, depositing assets into a pool and withdrawing assets are considered CGT events. The ATO also clarifies that rewards or yields received from DeFi platforms are generally treated as assessable income, similar to interest. Additionally, the creation or redemption of wrapped tokens is viewed as an exchange of crypto assets, triggering a CGT event. In their web guidance, the ATO has stressed the importance of analysing the terms and conditions of DeFi protocols and their actual operation to determine the correct tax treatment of transactions.

Alternative crypto trading methods

Various other crypto trading methods such as margin, futures, contracts, or options also exist, however, there is minimal or no guidance currently from the ATO on the tax treatment of these products for cryptocurrency. As such, it is best to talk to a reputable tax accountant specialising in cryptocurrency for further advice.

Calculating your capital gains or losses

It’s essential to know the value of your cryptocurrency in Australian dollars to work out your capital gain or loss by assessing this information through a reputable online exchange.

If you’ve purchased or sold crypto directly with Australian dollars the sale and purchase prices are fairly straightforward, make sure you take into account brokerage fees included in each transaction. If purchases or sales were made in an alternative cryptocurrency though these must be accounted for at the Australian market value at the time of transaction.

Your gain or loss is simply the amount you sold your cryptocurrency for (as it equates in Australian dollars) minus what you purchased it for.

For taxation purposes, this is even easier with a service like Swyftx. Full transaction reports based in Australian dollars can be generated and downloaded as needed to cover any time period you like.

When does income tax apply, and how do I calculate it?

We’ve demonstrated above that ordinary income derived by traders, or businesses that operate in cryptocurrency as their primary source of income.

Essentially, if you’re receiving cryptocurrency as payment for goods or services, or by mining it, this counts as ordinary income that is taxable.

Market value is applied on the day the cryptocurrency is received to determine the income amount

If you’re declaring cryptocurrency as ordinary income, you may also have related deductions. Business expenses you purchase with cryptocurrency throughout the financial year, including the cost of acquiring cryptocurrency itself, can be deducted from your annual tax return in the same way as if they were paid for with fiat currency.

What if I’m not a cryptocurrency mining or trading business, but we accept cryptocurrency? – Income

If you’re one of a growing number of Australian businesses that accept cryptocurrency in exchange for goods and services, this needs to be accounted for as part of your ordinary income and accounted for in its value in Australian dollars.

A reputable cryptocurrency exchange will be able to help you determine the value in Australian dollars.

Similarly, when you incur business expenses and pay for these in cryptocurrency, you are entitled to deductions based on the value of the acquired items, as stipulated by the Australian Taxation Office.

Getting paid in cryptocurrency – Income

It is not uncommon, especially among businesses that operate by trading or exchanging cryptocurrency, to pay their employees, at least partially, in crypto. If, as an employee, a portion of your paycheck comes in the form of cryptocurrency, like fiat currency, this is constituted as a portion of your income.

As such, it is subject to Income Tax. In some cases, being paid in cryptocurrency can constitute a fringe benefit. Employers will need to comply with PAYG and superannuation rules in the same way as if they had paid in fiat currency.

Tax loss-harvesting

Tax loss-harvesting is the concept of recognising capital losses on CGT assets which can be used to offset against current or future capital gains. You’ll be able to deduct your net capital losses from your net capital gain for the year. Your net capital gain is the total amount of capital gains you’ve made throughout the financial year, while your net capital loss is the total amount of capital losses you’ve made throughout the financial year.

However, watch out for the ‘wash sale’ rule which may apply to those who sell and repurchase the same capital asset in a short space of time – purely to realise a capital loss. This practice is viewed unfavourably by the ATO and they can deny your capital loss under these circumstances.

How to file crypto taxes

MyTax

You can easily lodge your tax return through MyTax, which is available through your MyGov account. You can personalise your tax return and declare capital gains or losses by selecting the ‘Capital gains tax (CGT) related items’ option (as seen below).

Crypto Tax Calculator allows you to generate a myTax form that outlines the exact entries required to correctly file your crypto taxes directly with the ATO. Automatically import transactions from your exchange and wallet accounts, review your transactions and generate your tax reports for easy filing.

Completing a printable form

An alternative to lodging your tax return through MyTax is to declare your CGT on a printable form and return the form to the ATO by mail. There are two separate forms that you’ll need to submit: an income form and a CGT form. If you have made a capital gain, you will need to declare this next to the ‘Current year capital gains’ label. You will also need to enter any capital losses next to the ‘NET capital losses carried forward to later income years’ label.

Total assessable income

One major misconception is that capital gains tax is paid separately to your income tax. However, your net capital gain (after applying any capital losses and the CGT discount) is simply added to your taxable income (wage, interest, dividends etc) for the year in which you sold or disposed of the asset.

Example:

Tony earns a salary of $65,000 per year. Tony buys BTC for when the price of Bitcoin is $10,000 and 8 months later sells it for $25,000 which nets him a profit of $15,000. This $15,000 gain will get added to his total assessable income within a financial year. So, Tony’s personal tax return items will look like:

- Wages – $65,000

- Capital Gains – $15,000

- Total Income – $80,000

Tony will then pay tax on the Gains achieved based on his total assessable income. At the current marginal tax rates for Australian tax residents, Tony’s tax for the year will be calculated as follows:

- 0% income tax for the first $18,200 of his income (tax-free threefold)

- 19% income tax on the second bracket from $18,201 to $45,000 which equals to $5,092

- 32.5% income tax for the portion of income from 45,001 to $80,000 which equals to $11,375

Total income tax: $16,467

2% Medicare levy tax (2% x $80,000) equals to $1,600

Tax on staking

Earning staking rewards

Any rewards received from staking cryptocurrency will not trigger a Capital Gains event. Instead, any tokens rewarded to users for staking their cryptocurrency are treated as ordinary income by the ATO. As the staking rewards are not cash, you must determine the market value of the rewarded tokens when they are received. The income from staking rewards will be added to your other sources of income and will be taxed in accordance with your individual income bracket. The income from staking rewards should be declared as ‘other income’ on your tax return.

Selling staking rewards CGT

The tax treatment of staking rewards is consistently treated as ordinary income regardless of which protocol or service is utilised. Once received, the rewarded token will be treated like any other CGT asset, and you may have a capital gains event when it is sold.

How proceeds from airdrops are taxed

An airdrop is when holders of a coin or token are distributed additional coins to their wallet address, usually for free. Airdrops often occur when a network increases its coin supply and allocates new coins to current holders. This is often used as a marketing tactic to increase awareness of a cryptocurrency project.

The ATO changed their guidance on airdrops. Previously, the tax treatment was similar to staking and taxable as ordinary income at the time it was received. In updated guidance, the ATO has introduced a new term called ‘initial allocation airdrops’. Initial allocation Airdrops are: “A crypto project may make an initial airdrop of tokens that is the very first distribution of its tokens. These tokens are the initial allocation, if there has been no trading in the project’s tokens prior to the airdrop.”

These will not be taxed as ordinary income when received but may later be taxed as a capital gain when sold, with the cost base of the airdropped assets being $0.

Airdrops which do not meet the definition of being an initial allocation airdrop will be taxed as ordinary income at market value when received.

Receiving an airdrop

Like staking, the ATO views airdrops which are not an initial allocation airdrop as a source of ordinary income, and therefore they are taxed according to your individual income bracket, and at the fair market value of the tokens on the date they were received. In this way, airdrops are like bonuses.

According to the ATO, the value of an airdropped token is ordinary income of the recipient at the time it is derived, and this applies to both participant and involuntary airdrops. To calculate how much Income Tax you owe, apply your income tax rate to the fair market value of your airdropped crypto on the day you receive it.

Selling or trading airdropped coins – CGT

Should you spend, sell, swap, or gift any coins or tokens you received in an airdrop, this is treated as a capital gains event, with the cost basis being $0 if the airdrop is an initial allocation airdrop. If the airdrop is not an initial allocation airdrop, the cost base is the value of the tokens when they were initially airdropped.

NFT tax Australia

NFTs are unique digital collectibles that are an application of blockchain technology. They may be purchased from various websites and platforms and are stored in digital wallets, much like cryptocurrency.

The ATO has released some guidance on Non-Fungible Tokens (NFTs) which follows a similar pattern to the tax treatment of cryptocurrencies.

Creating and selling NFTs

NFTs may be created and sold just as any other product, qualify as business income and are subject to income tax. Further, farming NFTs for a staking reward is likely to be considered income in the same way other staking rewards would be.

Selling, trading and gifting NFTs

For investors, a disposal of an NFT will be treated under the Capital Gains Tax (CGT) regime.

If you purchase an NFT and dispose of it later, you will trigger a CGT event. If you sell the NFT for a higher price than you bought it, you will need to pay tax on the capital gain. If you hold the NFT for longer than 12 months, then you will be eligible for a 50% Capital Gains discount. Because NFTs are non-fungible, you must ensure that you always match the disposal with the original acquisition of the same asset.

Decentralised Finance (DeFi) and Wrapping Crypto

The Australian Taxation Office (ATO) has finally provided detailed guidance on the taxation of decentralised finance (DeFi) activities for Australian investors, highlighting several key areas:

- DeFi Transactions: The ATO’s guidance covers a range of DeFi activities, including lending, borrowing, and participating in liquidity pools. These actions are considered crypto-to-crypto transactions, and any resulting gains are subject to Capital Gains Tax (CGT). This means when you engage in such DeFi transactions, you need to be aware of potential CGT implications.

- Wrapped Tokens: A notable aspect of the ATO’s guidance is the treatment of wrapped tokens. Converting your cryptocurrency into a wrapped token is recognized as a CGT event. The value for tax purposes is based on the market value of the wrapped token at the time of the transaction. This clarification is crucial, especially given the debate around the economic disposal of assets when wrapping, as the underlying asset remains essentially the same.

- DeFi Rewards: The guidance also addresses the tax treatment of earnings from DeFi platforms. If you receive new tokens as rewards, these are taxed in a manner akin to interest income. The assessable income in such cases is the market value of the tokens when they are received. This is an important consideration for investors participating in DeFi platforms and earning rewards through their activities.

Overall, while the ATO’s stance provides clarity, it also raises questions, particularly regarding wrapped tokens, where the underlying asset remains the same but is subject to CGT upon wrapping and unwrapping, often done for practical reasons like facilitating transactions on different blockchains.

Crypto taxes for businesses and traders

When running a business mining, trading, or exchanging crypto, you may be able to claim tax deductions for expenses incurred in the carrying out of your business, provided they are directly related to earning assessable income—and that you are indeed running a legitimate business, according to the ATO.

Trading crypto

A trader differs from an investor in that they seek to earn an income from cryptocurrency, rather than to casually supplement their income, and operate from a business setup. Investors will pay capital gains tax on crypto, whereas traders will pay income tax.

If you operate a cryptocurrency trading, forging, or mining business, and regularly buy and sell for short-term gains, or if you run a crypto exchange, the ATO may tax you as a trader. When determining your tax status, the ATO will take into account whether or not you use trading systems, how many transactions you make, whether you have a business plan, and whether you keep records in a business-like manner. Under these circumstances, your profits will be taxed as income. If you believe you are operating a business, it may be worth seeking professional advice from an accountant.

Buying and selling crypto as a business

Should you hold cryptocurrency for sale or exchange in the course of your business, the trading stock rules apply; not the rules for capital gains tax. Gains from the sale of cryptocurrency held as trading stock in a business constitute ordinary income—the cost of acquiring cryptocurrency held as trading stock is deductible.

Further, any cryptocurrency you own at the end of the financial year is your trading stock, and you must declare its value as a part of your taxable income. That said, you are free to declare this stock at either its market, cost, or replacement value, giving you some flexibility with regard to planning your taxes.

My business accepts crypto

Businesses must book sales in AUD, and log a corresponding entry for the acquisition of any cryptocurrency, whenever recording a customer payment made via crypto. Any cryptocurrency accepted in this way is considered as trading stock.

When the currency is traded or sold, the sale must be recorded as a sale in AUD—as either a profit or a loss. Any disposal of crypto acquired by business sales will be likely to fall under GST, and will involve further requirements.

There exists a variety of cryptocurrency payment processors, allowing businesses to capture crypto payments and convert them into AUD instantly. Businesses are provided with wallets, payment monitoring, and conversion rates. Under this mechanism, businesses at no point actually capture cryptocurrency, and so may avoid any additional tax obligations beyond ordinary acceptance requirements.

Who can help you with your Australian crypto tax?

As cryptocurrency becomes more widely used for investment and payments, more accountants offer taxation services around it. We encourage you to consider seeking advice from an accountant.

To assist with this process, Swyftx partners with Crypto Tax Calculator, an Australian-made crypto tax solution that offers a seamless way to calculate and file your crypto taxes. CTC enables you to automatically import all of your crypto transactions and provides you with personalised tips based on your transactions, helping you generate an accurate report and avoid overpaying on tax to reduce the amount of tax you need to pay. By syncing your Swyftx account with CTC, your transactions will automatically import into CTC, allowing you to calculate your taxes and stay one step ahead of the ATO this tax season

Use code SWYFTX30 to get 30% off your next Crypto Tax report.* Offer ends 31 October 2024.

How do I get my info from Swyftx

If you’re a Swyftx user, you can generate and download a transaction statement on both the Swyftx desktop and mobile applications. for a step-by-step guide on how to do this, check out the following articles:

If you’re having trouble with generating your transaction statement or have any more questions on how cryptocurrency is taxed in Australia, you can reach out to our online live support.

With cryptocurrency taxation guidance not yet a decade old, it’s understandable you would have questions about how to approach cryptocurrency and your tax return. This article has broken down the most common situations but when in doubt, it’s best to check with a registered tax accountant who deals with cryptocurrency.

*Eligible for first time orders only.

Ted