- > Bybit breached for $1.4 billion USD in what might be crypto’s largest hack on record

- > Bitcoin falls below $90k USD as hundreds of billions wiped from market

- > Ethereum leadership shake-up as Foundation aims to tackle inefficiencies amid stagnating growth

- > Survey reveals cryptocurrency may have a say in the upcoming Australian election

Bybit breached for $1.4 billion USD in what might be crypto’s largest hack on record

It’s being called the single-largest digital heist in cryptocurrency history.

One of the world’s largest digital asset exchanges, Bybit, was compromised earlier this week, with the hackers stealing a whopping $1.4 billion USD worth of Ethereum from associated wallets.

As the crypto market comes to terms with the breach, the community is left asking — how did an attack of such immense proportions happen?

According to preliminary investigations from security firms Sygnia Labs and Verichains, it appears that a ‘benign code’ was supplanted by North Korean hackers known as Lazarus Group. Simply, it targeted Bybit’s Ethereum wallets to make the malicious transaction appear to be a routine transfer, draining more than a billion worth of ETH into the attacker’s clutches.

In a bombshell finding, Sygnia Labs concluded that the ‘root cause of the attack’ was due to an issue with custody solution ‘Safe {Wallet’s} infrastructure’. This was later confirmed by Safe.eth’s official Twitter account.

While the community may find some comfort in the fact Bybit was likely not at fault, the hack mounted extra pressure on an already struggling crypto market.

However, there is still some good news to come out of the momentous event.

According to many industry figureheads Bybit has handled the calamitous situation with transparency and quick thinking.

Within an hour of the hack going public, Bybit CEO Ben Zhou launched a 100-minute live stream walking customers through the details of the compromise, including the platform’s next steps. Leaning on industry partners, Bybit promptly secured a bridge loan and replenished all of the lost funds.

Despite the massive losses, no customer funds were affected and Bybit didn’t face a single second of downtime.

‘Bybit is solvent even if this hack loss is not recovered, all of clients assets are 1 to 1 backed, we can cover this loss’.

In times past, a breach of this size could’ve ripped the market into a state of despair, as we saw with FTX’s 2022 collapse and the resulting contagion.

But as the industry matures, bad actors in the scene are slowly being replaced by strong communicators able to effectively manage a crisis.

Bitcoin falls below $90k USD as hundreds of billions wiped from market

The crypto market has endured a week to forget.

After weeks of consolidation, the tension building between bulls and bears finally reached breaking point.

When Bitcoin bleeds, altcoins tend to gush – and the events of this week have been no exception.

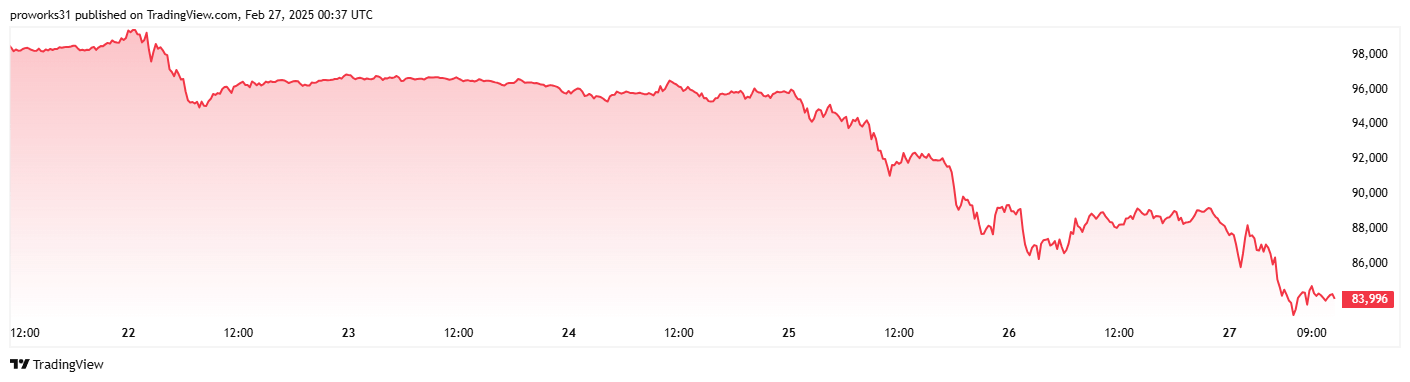

Over the past seven days, BTC has fallen nearly 13% to sit at $84k USD, its lowest value since before Donald Trump was elected.

Prominent altcoins were hammered even harder by sellers, with XRP (-19.8%), Solana (-19.31%), Dogecoin (-20.5%) and Chainlink (-16%) feeling the heat.

All up, the total crypto market capitalisation plummeted from $3.2 trillion to $2.83 trillion USD.

So, what’s going on?

For now, it seems negative macroeconomic sentiment has been a primary driver of the market collapse. According to a report from The Conference Board, Consumer Confidence in the United States suffered its biggest single-month decline in nearly four years.

Stagflation — where the cost of living rises but wages remain the same — is one of the biggest current concerns in the US. As the nation grapples with sticky inflation, the Feds appear less likely to introduce several rate cuts in 2025, as many had hoped.

Meanwhile, President Donald Trump’s continued threats of global tariffs have served to increase concerns that inflation may be here to stay.

The economic despondency has made its way into the digital currency markets, stifling the community’s euphoria over a pro-crypto US president.

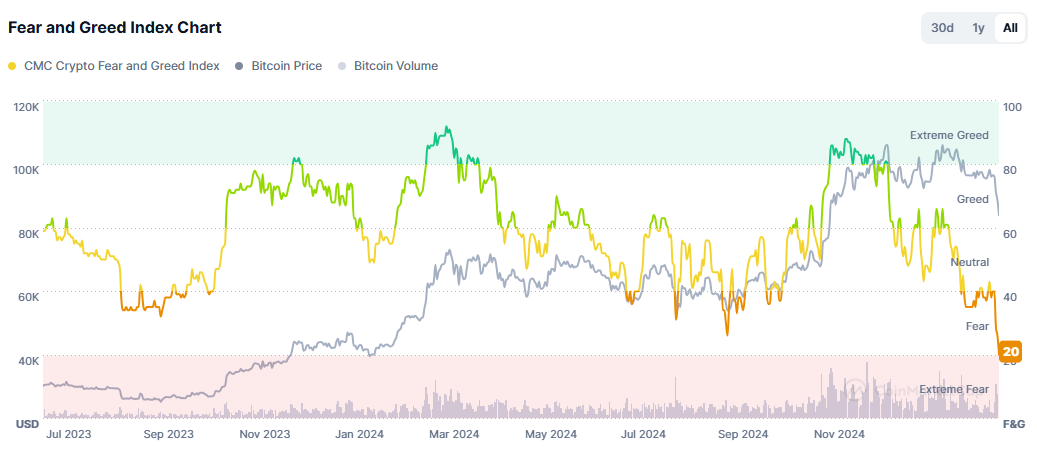

The Fear & Greed Index, a popular measurement of market sentiment, has fallen to 20, indicating ‘Extreme Fear’. This is its lowest point in over 12 months.

Pair macroeconomic issues with concerns over the massive Bybit hack and the outcry against memecoins, and you have the perfect storm for market volatility.

Crypto is no stranger to wild swings in price and certain assets like Litecoin (+8% in 24 hours) are already showing signs of recovery.

However, it may take significant macroeconomic or industry news to pull global markets out of the funk in the short term.

Ethereum leadership shake-up as Foundation aims to tackle inefficiencies amid stagnating growth

The Ethereum Foundation’s long-standing Executive Director, Aya Miyaguchi, has announced she is stepping aside from her role.

The leadership reshuffle has been on the cards for quite a while, with leader and Ethereum co-founder Vitalik Buterin hinting that more change is likely to come.

The move intends to put fresh eyes on what many claim is a stagnating crypto project, with Ethereum’s on-chain activity falling behind L2s and other ecosystem competitors.

In particular, the Ethereum Foundation (EF) itself has been at the centre of the community’s ire, with revelations that key members accepted donations from projects built on EVM.

Pressure began mounting on Aya Miyaguchi, who oversaw major events such as Ethereum’s transition to Proof-of-Stake and several technological upgrades.

However, many in the community placed the project’s struggles at the Executive Director’s door which may have played some part in the leadership changes.

Vitalik Buterin was quick to quash these suggestions, claiming that the transition of Miyaguchi from ED to President had been in the works for over a year.

Ultimately, the move is part of the Ethereum Foundation’s broader plan to ‘improve technical expertise within EF leadership’, ‘improve two-way communications’ and ‘improve execution ability and speed’.

Survey reveals cryptocurrency may have a say in the upcoming Australian election

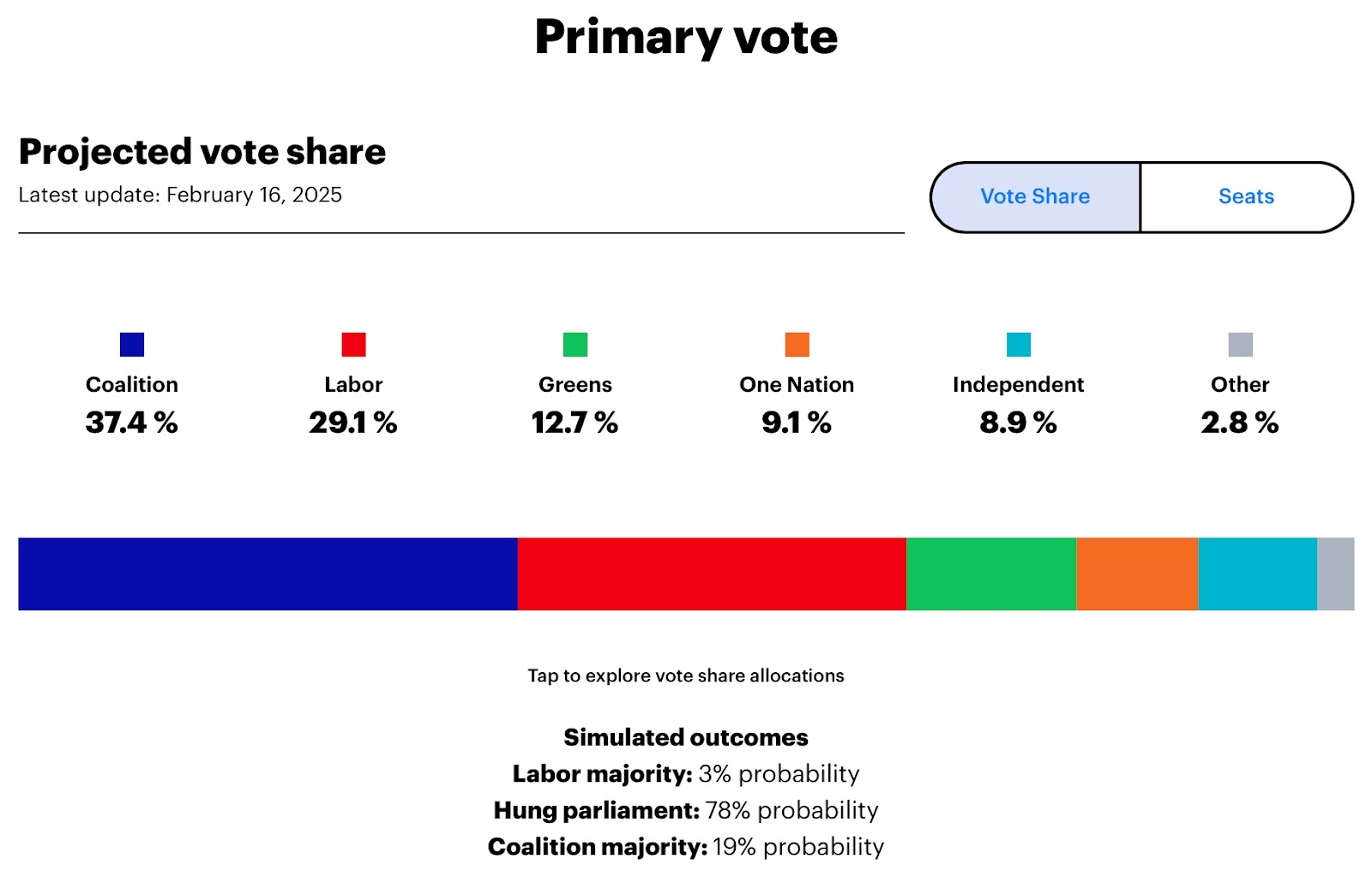

The 2025 Australian election is tipped to be a tight one, with some analysts even forecasting a hung parliament as the most likely outcome.

With razor-thin margins for either party, like Donald Trump in the United States, it seems politicians may be turning to crypto investors as a key demographic battleground.

According to market research and data firm YouGov, while the Coalition party is currently ‘leading’ on a two-party preferred basis, they may not win enough seats to form a parliament.

And that’s where crypto voters could come into play.

Swyftx, in collaboration with YouGov, recently conducted a survey asking Australians who owned cryptocurrency whether digital asset policies were close to the top of their political agenda.

Of the 2,031 people surveyed, only one-third claimed it didn’t matter whether their preferred political candidate was pro-crypto or not.

On the other hand, the research showed 59% of respondents would prefer to vote for a pro-crypto candidate.

Considering the success of Donald Trump’s blockchain campaign in the United States, and that nearly 4 million Australians currently own a digital asset, the sector could have a big impact on the election’s result.

The Liberal National Party has already publicly come out in support of digital currency reform if they are to gain Parliament this year.

‘Australians are increasingly investing in crypto and deserve the protections afforded by fit-for-purpose regulation…Operations are likely to move offshore if ASIC starts regulation by enforcement and litigation under existing laws which don’t fit neatly’. – Luke Howarth, Shadow Financial Services Minister and Shadow Assistant Treasurer

Meanwhile, the Labor Party, currently in power, has been exploring the potential of updated legislation alongside ASIC and industry experts.

Ben Knight