- > Labor Joins Promise of Digital Asset Reform

- > XRP breaks out of shackles as CEO announces an end to legal action

- > Crypto.com spikes following Trump partnership

- > BlackRock’s tokenised fund BUIDL surges past $1.7b assets under management

Labor Joins Promise of Digital Asset Reform

The 2025 Australian election is starting to heat up, and crypto investors could play a major role in its outcome.

Following the significant influence of blockchain discourse in the United States’ most recent political stoush, that trend appears to be heading Down Under too.

The opposition Liberal National Party has been on record stating that ‘supporting the crypto and blockchain industry is a longstanding priority for the Coalition’.

Now, the current Labor Government has thrown their hat in the ring with the Treasury document Statement on Developing an Innovative Australian Digital Asset Industry.

The primary goals are two-fold: protect Aussie investors while promoting national Web3 innovation.

The document outlines potential changes coming for Digital Asset Platforms (DAPs), which includes crypto exchanges and ‘custody products’. Largely, the Government (if re-elected) intends to introduce tailored regulations fit for the blockchain industry. DAPs will need to abide by both these and existing Australian Financial Services Licence (AFSL) requirements.

The Treasury initiative doesn’t delve into the specifics of the frameworks. Rather, it’s stressing that they will exist at some point in the future.

However, there were a few tidbits worth noting that give a bit more insight into what the Australian crypto sector could look like under a Labor regime.

The document excludes several major arms of the national Web3 industry from the new regulations, including ventures that create ‘non-financial product digital assets’ and those who ‘develop…software used by others to engage with digital assets’.

Further developing their interest in real-world assets, the Treasury report notes the Government is continuing to research the viability of an AUD central bank digital currency.

No matter the outcome of the fast-approaching 2025 Federal election, it seems crypto regulation in Australia is set for some tweaks.

XRP breaks out of shackles as CEO announces an end to legal action

1,547 days.

That is how long the XRP vs Securities and Exchange Commission court battle raged on, after the US financial regulators first tabled the case on December 22, 2020.

Following years of partial victories, appeals atop appeals and hundreds of millions of dollars, it’s over.

According to Ripple Labs CEO Brad Garlinghouse, the SEC officially decided to drop its case accusing Ripple of selling XRP as an unregistered security.

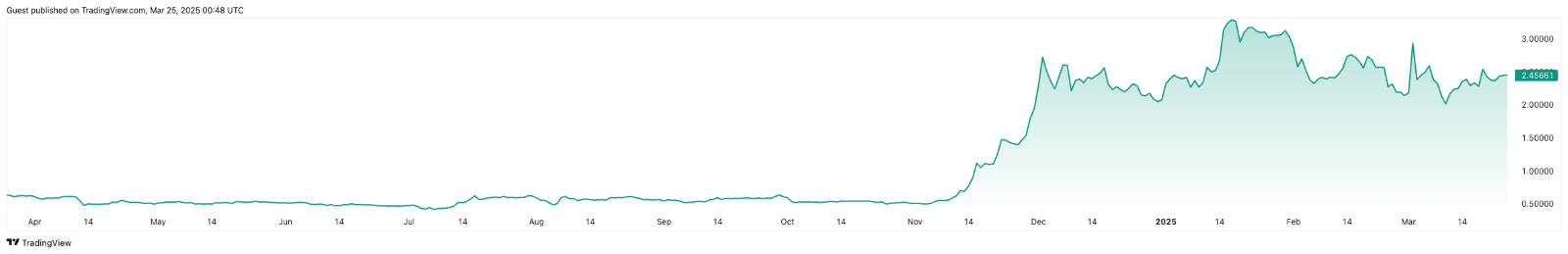

It was a colossal day for the XRP bandwagon, which had been building momentum following a strong end to 2024. The token exploded 12% within 24 hours of Garlinghouse’s announcement, bringing its 12-month gains to nearly 300%.

Despite the relief, there is still a lot of anger and mistrust throughout the digital assets industry toward financial regulators. Speaking at a Digital Assets Summit in New York, the Ripple Labs CEO criticised the mechanisms that allowed the lawsuit to happen in the first place.

‘The system just feels broken. That we had to fight this fight for the industry and you had an SEC attacking the industry, particularly the Ripple case. There were no victims, there was no investor loss. They were just not acting in good faith.’

Ripple will now decide whether they pursue legal action of their own against the SEC – an appeal of an appeal, if you will – or if they will follow in the regulator’s footsteps.

The news comes as part of a broader industry sigh-of-relief, as XRP is just one of several heavily-publicised lawsuits being dropped by the SEC. There is now a cautious optimism that a collaborative relationship between regulator and innovator can be fostered moving forward.

Crypto.com spikes following Trump partnership

US President Donald Trump has taken yet another step deeper into the crypto pond, with his company Trump Media announcing a team-up with global exchange Crypto.com.

The purpose of the collab is to offer a series of exchange-traded funds managed by Crypto.com, while being presented under Trump’s Truth.fi branding.

At this stage, the exact components of the funds are unclear. According to the press release, it will likely include a mix of ‘digital assets as well as securities with a Made in America focus’.

So far, the only cryptocurrencies confirmed to be in the proposed ETFs are Bitcoin and Crypto.com’s native token, Cronos (CRO).

The news gave Cronos’ price a significant boost, with the coin now trading +26% over the past seven days – with most of the gains coming immediately after the announcement.

However, the last fortnight has not been all sailing for the Crypto.com team. The Singapore-based trading platform copped significant backlash following a vote that reversed a four-year-old token burn.

Specifically, Crypto.com is forming a Cronos Strategic Reserve, which would include 70 billion CRO that were supposedly burned back in 2021. According to social media personality ZachXBT, this centralises the CRO supply and positions Crypto.com as ‘no different from a scam’.

BlackRock’s tokenised fund BUIDL surges past $1.7b assets under management

The tokenisation wave is continuing to wash over institutional investors despite the broader market’s relative indifference.

BlackRock has made a major splash in the blockchain industry over the past few years. On top of owning – by far – the biggest spot BTC ETF in terms of assets managed, they also handle the tokenised T-Bill fund BUIDL.

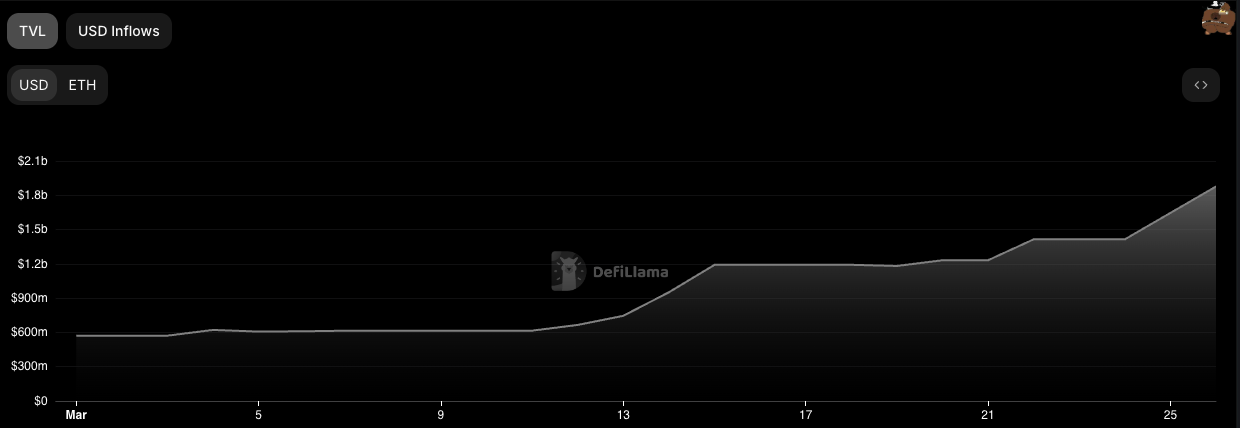

BUIDL, which allows 24/7 on-chain clearance of its Treasury-backed assets, has experienced an influx of interest over the past 11 days, with its AUM growing by $700 million USD in that time.

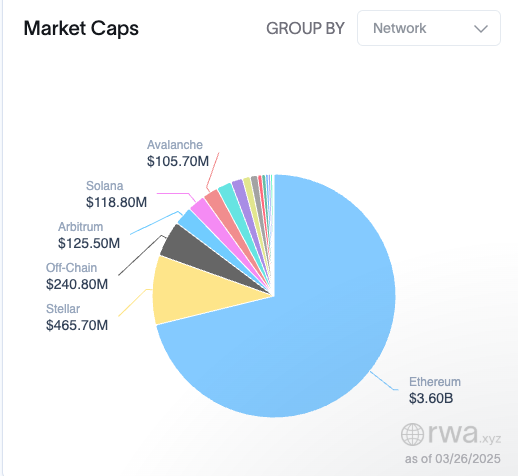

The surge has helped BUIDL capture 34% of tokenised fund market share while ballooning its total AUM to $1.87b USD.

To cap it all off, Securitize and BlackRock announced earlier this week they are integrating the Solana protocol with BUIDL. While most institutional RWAs still exist on Ethereum, the expansion may see Solana’s tokenised Treasury market cap creep upward.

Solana is now the seventh blockchain aligned with BUIDL, joining the likes of Aptos, Arbitrum, Avalanche, Optimism and Polygon.

Ben Knight