In conjunction with YouGov, Swyftx commissioned a sweeping survey, looking into how Australians engage with cryptocurrencies.

Overall, 2,609 Australian adults were surveyed with the intent of gathering some insights into cryptocurrency and how it’s being used, how much people know about it, and how they feel about it generally. The results are finally in, some of them very positive, some pleasantly surprising, and all give us invaluable insights into where crypto sentiment in the country is currently.

You can view the full results of the crypto survey here.

Crypto ownership in Australia

The past year has been a defining period for cryptocurrency, as roughly US$2 trillion was wiped from the digital assets market following a tremendous year in 2021. This may have felt like a make-or-break moment for many investors, but our findings show that, in spite of the current bear market, Australians are interested in the future of cryptocurrency, and their ownership is increasing.

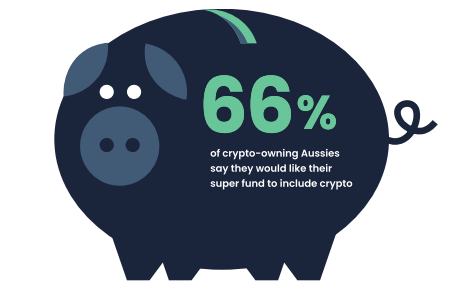

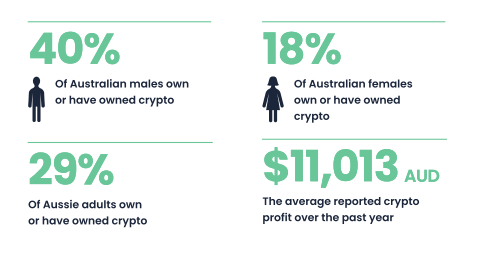

Cryptocurrency ownership in Australia grew year-on-year by 4%, from 17% in 2021 to 21% in 2022. Among the 29% of Australians surveyed who own, or have owned, cryptocurrency, 38% hold it in superannuation. That said, the survey also found the percentage of Australians who believe cryptocurrency is the future of online financial transactions has dropped 5% from the previous year. A common theme in the results was that lack of regulation of the crypto market was the top concern of those surveyed who have never owned crypto.

However, the report notes, for crypto adoption rates to increase beyond current rates, further global and domestic legislative and regulatory measures to protect consumers are required. There is also certainly a degree to which this confidence—or lack thereof—is generational. Only 5% of Australians surveyed born between 1946 and 1964 indicated their wish to include crypto in their super funds, and Australians, on the whole, continue to see traditional stocks as attractive investment options.

On the other hand, early crypto adopters were most likely to be those Australians born between 1981 and 1996, although that is now diversifying. The report indicated there was a disparity between those who currently own, or have owned, cryptocurrency, and those who do not, with crypto owners holding higher confidence in crypto than those non-owners, who may be hesitant to invest.

The majority of Aussie crypto holders reported a high level of financial literacy

Of the Australians who currently own crypto, 61% reported a high or very high level of financial literacy, and 84% reported having either some or a strong understanding of the digital assets market. Compared to non-crypto owners, this gap in knowledge or confidence may persist for some time, but it is certainly narrowing. It must also be noted that crypto adoption depends also on developments in national and international regulatory standards, as well as the health of digital asset markets globally.

Most Aussies made a profit on their crypto in 2022

At present, based on the report, 4.2 million Australians own cryptocurrency, and, in spite of the volatile markets we have seen this past year, 72% of them reported an average profit of AU$11,013 on their crypto investments. The percentage of crypto-owning respondents who reported losses has remained consistent with that of the previous year, at around 5%.

26% of Aussie adults are planning on buying crypto in the next 12 months

The survey results suggest that roughly one quarter of Australian adults are planning to buy crypto at some point in the coming year. This suggests that despite disparities in confidence, there is still adoption. Further, approximately one million non-crypto owners are likely to purchase crypto in the next 12 months.

Of course, for adoption rates to continue to rise, consumer confidence will need to increase through further regulation. The report states that adoption rates within retail and business continue to grow steadily, with the prospect of increased functionality for investors. As it stands, the crypto industry continues to expand, as it attracts top talent and has record levels of venture capital funding.

View the full results of the crypto survey here.

Ted