Aussie gen Zers have been the nation’s biggest crypto investors over the past 12 months, according to Swyftx’s fourth annual crypto survey.

The demographic shift between crypto owners in Australia has been sharp since last year’s survey. In 2023, following the collapse of the FTX exchange and price struggles, Gen Z adults pulled out of the industry, with ownership rates dropping 7%.

That trend has well and truly flipped, as adoption among Gen Z adults sky-rocketed 11% over the past 12 months. This represents the largest increase in ownership by a generation across any Swyftx survey.

32% of all Gen Zers surveyed owned cryptocurrency, making the demographic sit just behind Millenials (35%) as Australia’s most crypto-friendly generation.

Meanwhile, Australia continued to embed itself as a leader in the crypto world, with Swyftx’s survey placing Aussies as the fifth-highest adopter of digital assets.

The past year was marked by positivity in the industry, with the landmark approval of spot Bitcoin ETFs in the United States pushing BTC to a new all-time high.

The annual survey is run by respected international polling organisation YouGov. It is one of the largest annual tracking surveys on cryptocurrency usage in the country. You can view the full results of the crypto survey here.

You can view our previous three Australian crypto surveys here:

Crypto adoption slows among record-high profits

The past year has been all about Bitcoin, with Satoshi Nakamoto’s invention reaching new heights in March 2024, eclipsing USD $73k. Throughout the 12-month survey period, BTC doubled in value, up from USD $29k to $58k.

The impressive performance of BTC was impossible for owners to ignore, leading to record-high profits across Aussie crypto investors.

82% of Australians surveyed claimed they pocketed a profit, with the average yield being $9,627. For context, the average profit in 2023 was AUD $8,218, marking a 17% rise throughout the survey period.

Only 2% of all participants surveyed recorded a loss over the last 12 months.

The irresistible profits presented by Bitcoin may have played a part in slowing adoption rates among Australians, as investors cashed out of their portfolios during BTC’s early 2024 bull run.

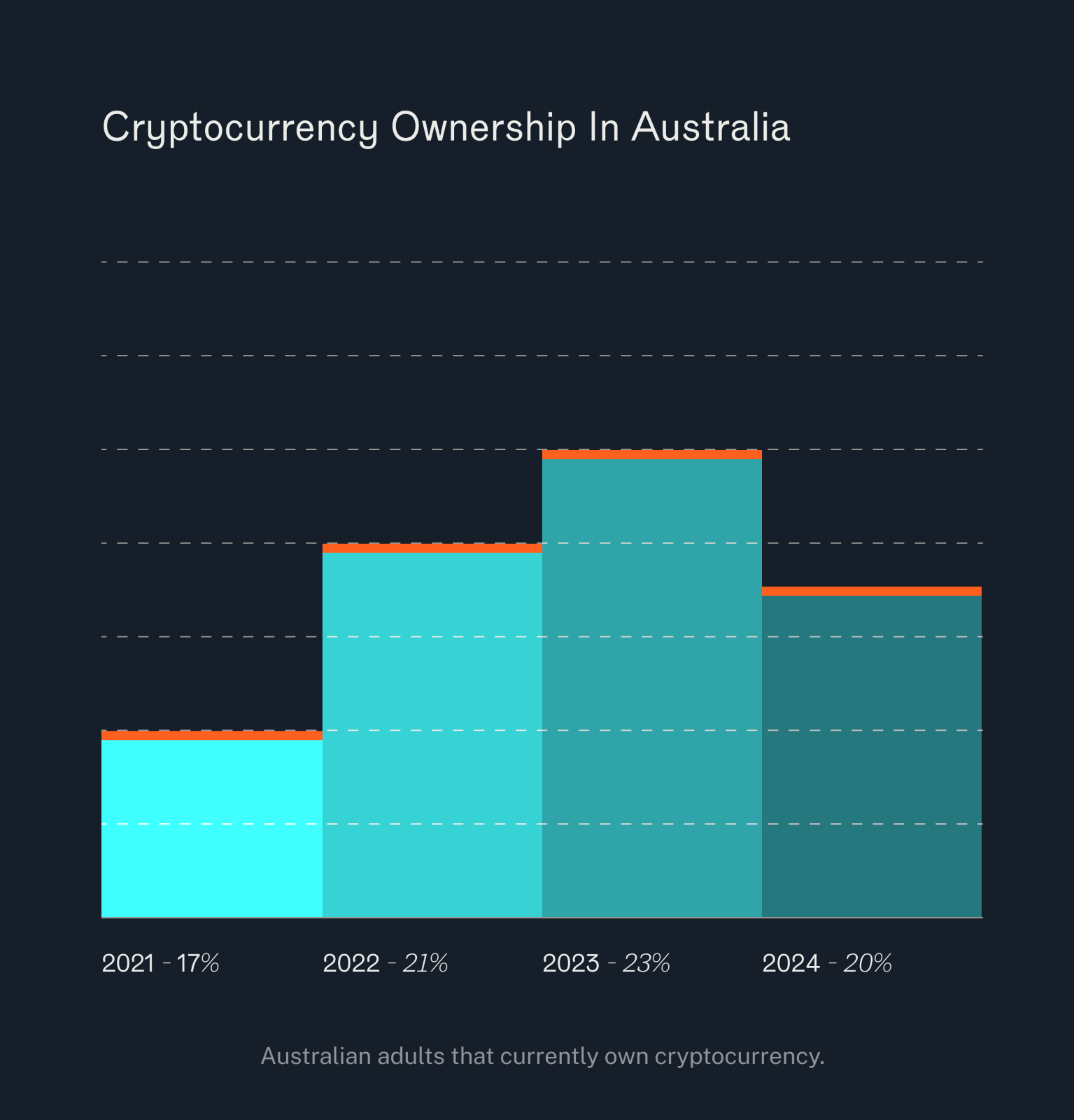

Overall crypto ownership in Australia fell 3% since the 2023 survey, down to one in five Aussies (or 20%). This is an estimated total of 3.9m individuals who currently hold crypto, dropping from 4.5m in 2023.

Despite Gen Z zooming to the top, Millennials are still the most likely generation in Australia to hold crypto. Over one-third (35%) of survey respondents claimed ownership of a digital asset portfolio.

Meanwhile, concerns around crypto regulation (41%) or a lack of industry knowledge (43% were the biggest barriers to owning digital currencies. Cost of living constraints (29%) also played a role.

Australia boasts world-leading crypto literacy

Australian crypto investors are some of the most financially savvy in the world, with 60% of owners claiming a “high or very high level of financial knowledge.” This compares to just 20% of the non-crypto-holding public.

The survey also recorded a 5% increase in respondents identifying “strong or some comprehension of digital assets”, making up 86% of all answers. Only 1% of digital currency holders reported no understanding of the market, down 1.5% since this time last year.

Improved crypto literacy comes on the back of growing media exposure from the US election and the emphasis of platforms like Swyftx Learn on educating customers.

Retirement savings see crypto boost

2022-3 saw an influx of SMSF investors moving away from crypto – but Swyftx’s most recent survey shows people are including crypto as part of their retirement portfolio.

31% of respondents have owned digital assets in their retirement savings at some point in their lifetime, a 2% increase from the same time last year. This does not specifically refer to holding crypto in a Self-Managed Super Fund but includes any crypto investments or savings intended for retirement.

Gen Z once again led the way, with 37% of Zoomer crypto owners holding digital currencies for retirement. This is a stunning 16% improvement from the previous survey.

Overall, 27% of Aussies would like their retirement portfolios to have cryptocurrency exposure (an increase of 2% from last year).

The increase in long-term crypto ownership likely boils down to the introduction of spot Bitcoin ETFs – especially given they are managed by reputable institutions such as BlackRock.

Looking to the future: Crypto regulation to shape the industry

Exchange-traded crypto funds dominated the past year’s news cycle, but the next 12 months are set to be all about regulation.

The US election has made digital asset regulation a priority, a trend likely to spill over international waters.

One in three Aussies (32%) claimed a higher likelihood of owning crypto if the government increased regulatory oversight.

Interestingly, younger generations in particular emphasised the “safety blanket” of regulation. Approximately half of Millenials (47%) and Gen Z (42%) respondents claimed greater chances of buying crypto if regulations were stricter.

Overall, regulation appears key to adoption in Australia. According to Swyftx CEO Jason Titman, greater clarity around crypto policy could see “around two million Australians…enter the market when it is regulated.”

Ben Knight