Leverage Trading

CFD Derivatives trading is now available for eligible approved wholesale customers.

This product is only available to Australian Swyftx customers.

CFD Derivatives trading is now available for eligible approved wholesale customers.

This product is only available to Australian Swyftx customers.

Get market exposure without handling storage or custody associated with owning crypto assets.

Increase your market exposure relative to your initial collateral.

Gain access to trading opportunities in rising or falling markets.

Speculate on price movements or hedge your spot position.

To trade CFDs with our Leverage Derivatives product, you must be an Australian resident with a Swyftx account and be approved as a Wholesale Investor, meaning you need to meet one of the following requirements:

Additionally, you will also be required to complete an Asset Declaration Form, which must be signed by an authorised accountant, belonging to one of the prescribed Australian professional accounting bodies.

If you meet the above criteria and are interested in applying, please book fill out the application:

The fees described on this page apply to the use of the Leverage Derivatives product on the Swyftx Platform.

0.30% of the Transaction Value

A fee charged for the execution of a transaction of the Derivatives Product.

The Spread is a dynamic value that fluctuates based on market conditions, including but not limited to, trading volume, volatility, and order book depth.

A dynamic fee charged for holding a Derivative product position open for a period greater than twenty-one (21) days.

An Overnight Credit/Fee is calculated using wholesale reference rates provided by liquidity providers. A fee or mark-up may be added to these wholesale reference rates.

Spot trading means buying and selling actual crypto assets – you own them and can hold, swap, or withdraw them.

Leverage Derivatives trading, however, lets you speculate on price movements without owning the underlying asset. CFDs, a type of leveraged OTC derivative, allow you to control a larger position with less capital, but this also increases risk.

CFDs, or Contracts for Difference, are leveraged financial instruments that allow you to speculate on price movements without actually owning the underlying asset. You can go long (buy) if you expect the price to rise or short (sell) if you expect it to fall.

For example, if you trade a Bitcoin CFD, you’re not actually buying Bitcoin itself. Instead, you’re entering into a contract where you profit if the price moves in your favour or incur a loss if it moves against you. When CFDS are leveraged, they allow you to control a larger position with less capital, but this also increases risk.

Trading fees or commission is 0.30% of the Transaction value. However, the spread, Overnight Credit/Fee and long hold fees are dynamic amounts that can fluctuate. For more information regarding fees please check out our Swyftx Support Centre here.

Our Leverage Derivatives trading platform will offer 5 order types across our CFD product for approved wholesale customers:

Market

Limit

Stop

Take Profit

Stop Loss

Market, Limit, Stop, Take Profit, and Stop loss orders, are not guarantees.

For the first phase of our Leverage Derivatives offering on Swyftx, we will offer a leverage of 1:5 for 100+ different assets for wholesale investors, with the objective of offering more leverage options in the future.

If you are transferring funds in to use our CFD product, first ensure the required balance is available in Australian dollars in your Swyftx SPOT trading account.

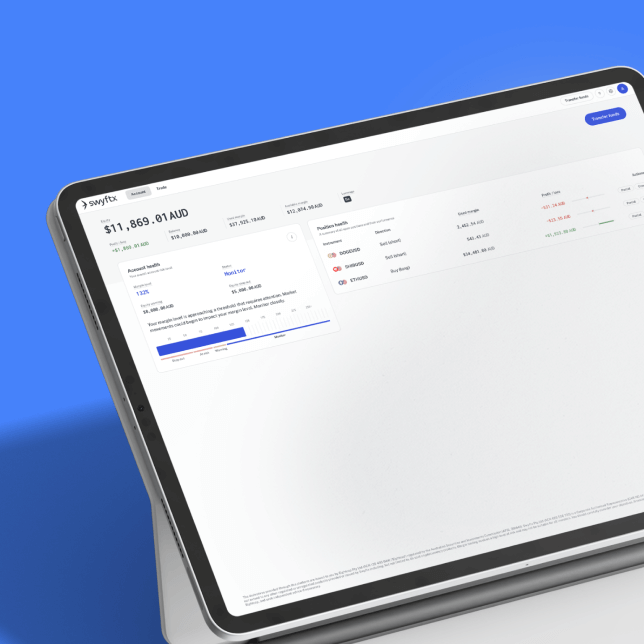

1) Switch to the Leverage trading platform.

2) From the Account page, select ‘Transfer funds.’

3) Click on ‘Transfer funds,’ ensure the ‘Transfer From’ field says ‘SPOT AUD Wallet’ and the ‘Transfer to’ field says ‘Leverage AUD Wallet.’

4) Enter the amount you wish to transfer, then select ‘Transfer to Leverage wallet’

DISCLAIMER: Swyftx Pty Ltd (ACN 623 556 730) is a Corporate Authorised Representative (Representative number 001315018) of Eightcap Pty Ltd (ACN 139 495 944) (AFSL Number 391441). Access to any offerings is conditional upon your acceptance of additional terms issued by Swyftx, and those issued by Eightcap, which you should review carefully. Under this authorisation, Swyftx is authorised to provide general financial product advice in respect of derivative products to wholesale clients, which involve a higher degree of risk and complexity. Any financial product advice provided is general advice only and does not take into account your objectives, financial situation and needs. Services offered by Swyftx on its platform relating to spot (non-leveraged) cryptocurrency trading are not provided or authorised under Eightcap’s Australian Financial Services Licence. Eightcap is not responsible for Swyftx’s conduct when engaging in these activities.