AUSTRAC

Registered Australian crypto exchange

Australian

Owned and operated

440+

Assets for trading

4.5 / 5

Rating on TrustPilot

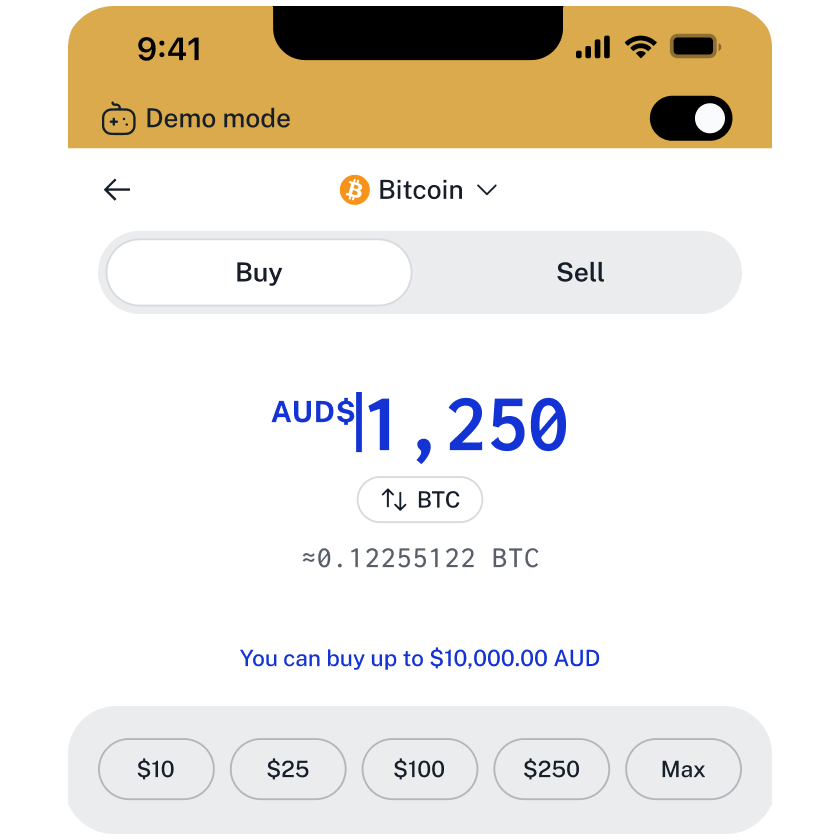

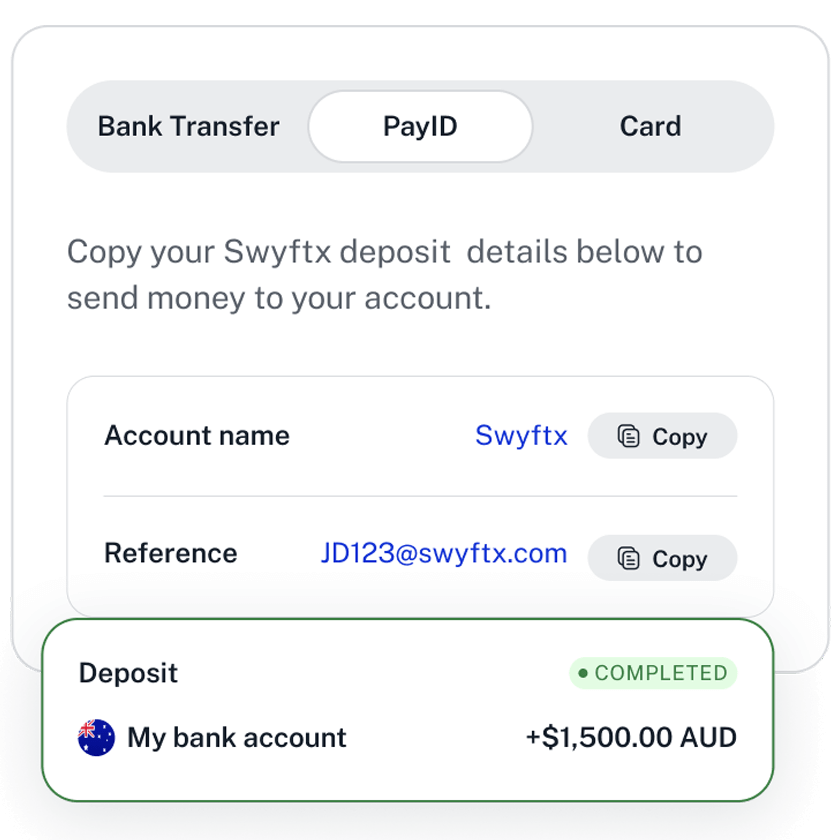

Buy crypto in minutes

Buy crypto in minutes

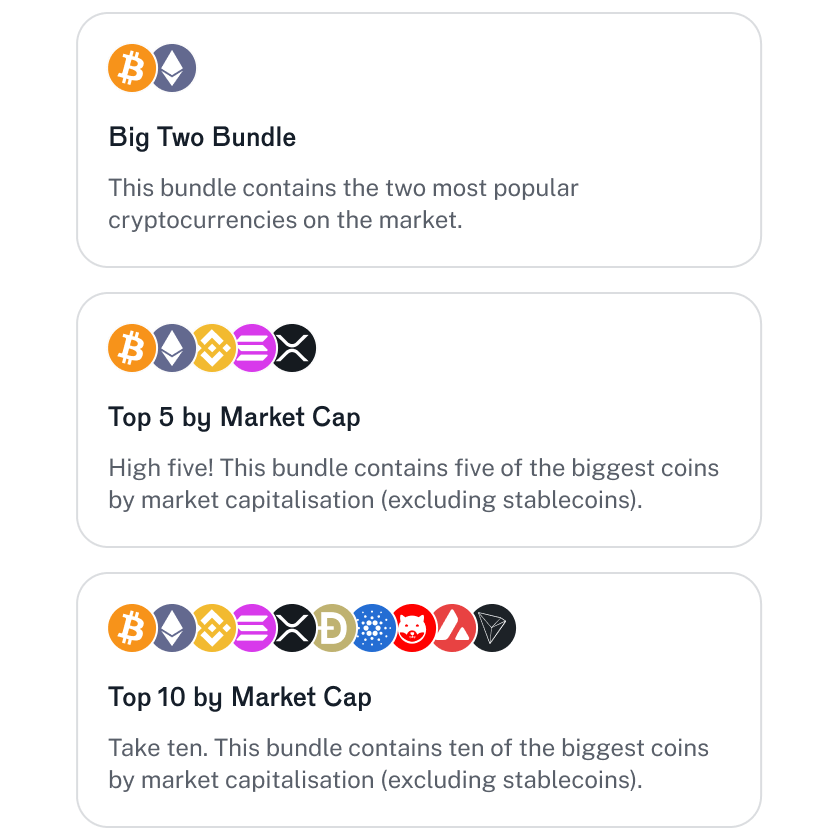

Trade 440+ cryptocurrencies

Buy, sell, swap, track and analyse hundreds of cryptocurrencies on the most trusted crypto exchange in Australia. Swyftx is constantly adding new digital assets to give our users a wide range of trading options with competitive trading fees.

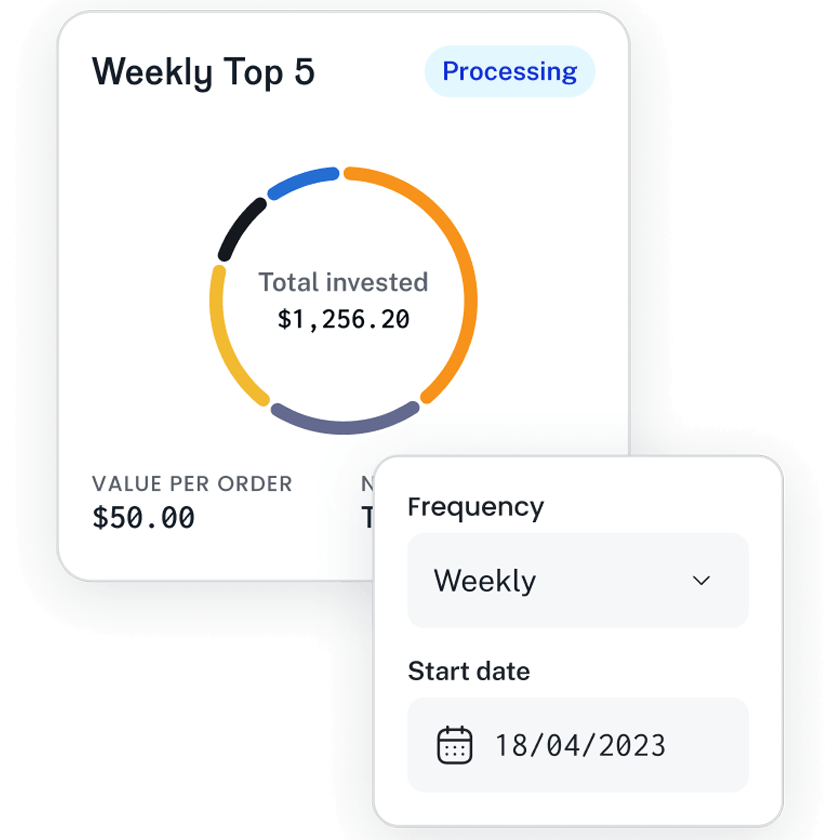

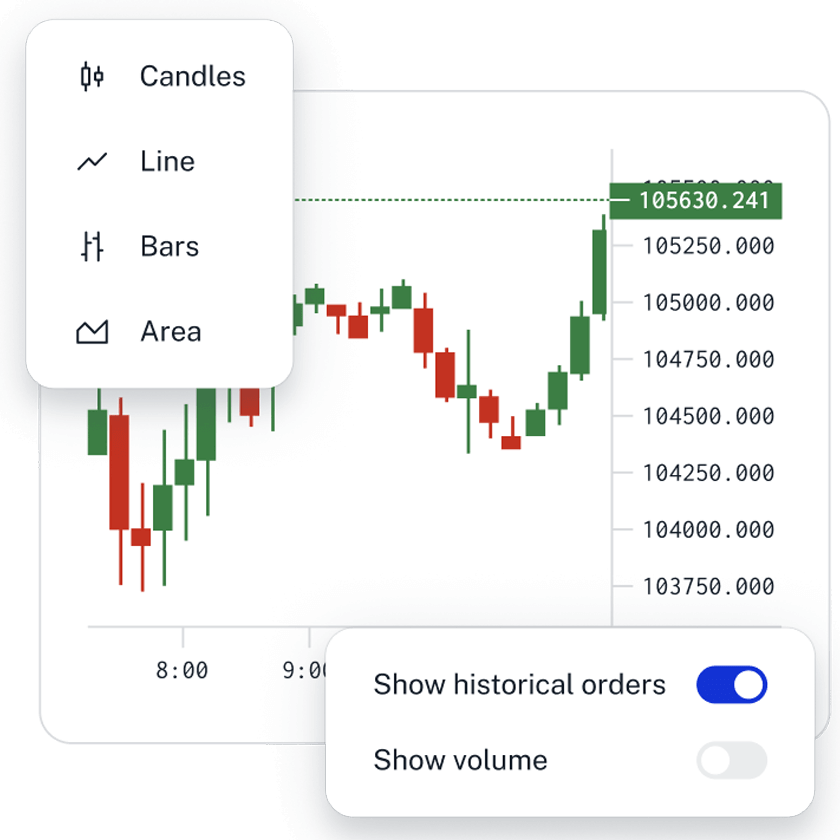

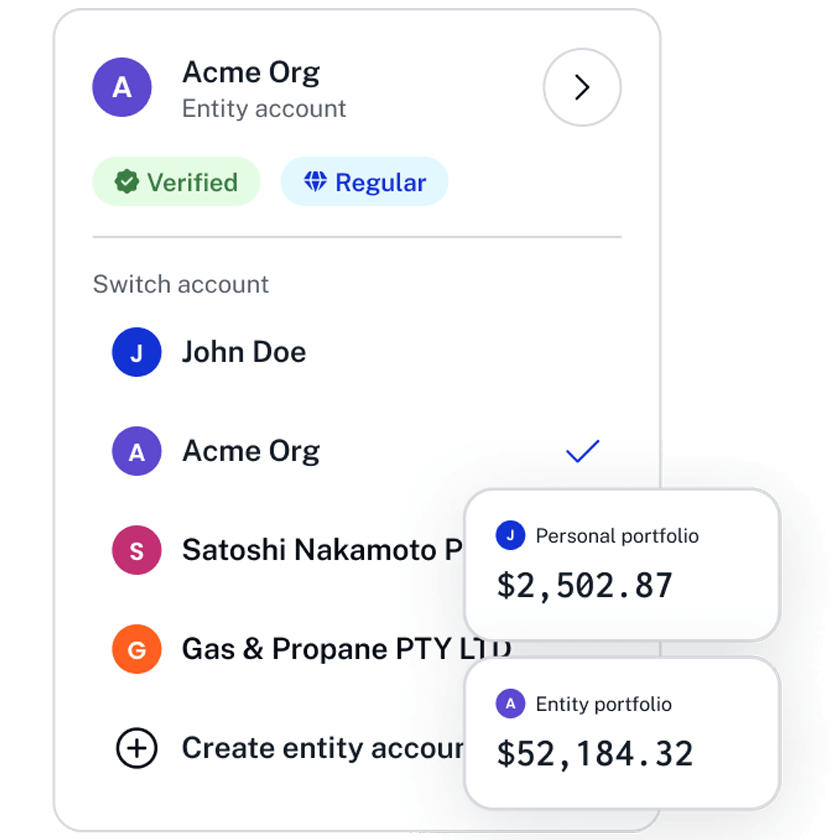

Invest like a pro

Navigate the crypto markets effortlessly with our app, crafted with an array of features that cater to both novice and experienced traders alike.