- > Judge rejects the SEC’s Motion to Appeal on the Ripple ruling

- > Google Cloud partners with Polygon

- > Leaked documents reveal Xbox planning to launch crypto wallet

- > ANZ bank particularly pleased with Chainlink stablecoin study

Judge rejects the SEC’s Motion to Appeal on the Ripple ruling

District Judge Analisa Torres denied the SEC’s appeal as “moot”, while XRP enjoyed 5% gains in light of the ruling.

In another massive win for cryptocurrency – and another loss for the Securities and Exchange Commission (SEC) – District Judge Analisa Torres threw out the SEC’s request for an appeal into July’s ruling that XRP did not violate securities laws. In direct response to the SEC’s “motion for certification of interlocutory appeal”, Judge Torres stated: “The SEC’s request for a stay is DENIED as moot. The Clerk of Court is directed to terminate the motion”. As a result, the price of XRP jumped 5% overnight.

XRP, the popular global payments project, was one of the SEC’s first targets among a long list of businesses and coins that supposedly shirked their regulatory requirements. Specifically, the SEC accused XRP of offering institutional and retail investors access to unregistered securities without meeting the specific requirements of selling such an asset.

But the SEC’s warpath was stopped in its tracks during the July court case, where the judge ruled that Ripple Labs hadn’t broken federal law by offering XRP to retail investors via crypto exchanges and that the token is not a security. This decision was a big deal for the community, as it casts criticism on just how tough the SEC and other government agencies can be on the crypto industry. The most recent win for XRP comes as the financial regulatory body unsuccessfully attempted to reverse the result of July’s decision.

However, it’s not all smooth sailing for XRP and Ripple Labs yet. The legal case is far from over – and the case will resume in April next year to determine if Ripple Labs broke any other laws during their token distribution. Even if the judge rules in XRP’s favor, there’s still a chance that the SEC can appeal that decision too. But even though there’s a long way to go, the short-term news is undoubtedly positive for XRP and the crypto world as a whole.

Google Cloud partners with Polygon

The network’s native token, MATIC, has soared 12% over the past week.

Google Cloud, the third-largest cloud computing provider in the world, has joined the Polygon community as an official validator. The move came as Google Cloud added 11 new blockchains to its data warehouse known as “BigQuery”. Google joins a list of over 100 validators on the Polygon protocol, with its validator and delegators stake totalling 33,391 MATIC tokens, equivalent to approximately AUD $29,710.

Polygon uses a scalable proof-of-stake (PoS) consensus mechanism to secure its network and verify new transactions. This means the more validators active on the network, the more decentralized and reliable it becomes. Google Cloud joining the protocol’s community not only adds a reputable name to the validator list but demonstrates a show of faith in the Layer 2 scaling solution.

Although it’s worth noting that Google Cloud’s contribution to the Polygon staking pool is relatively tiny, the news was still received with great enthusiasm. The price of MATIC, Polygon’s native token, climbed 12% over the past seven days, marking the coin’s best week in several months.

Google Cloud isn’t the only company to take note of Polygon in recent times. USDC, the market’s most-traded stablecoin, is being launched on the Polygon network in the next few weeks, while several NFT-based games are moving towards their release date. The heightened activity saw Polygon’s total value locked (TVL) numbers move into second place for all L2 networks, behind only Arbitrum.

You can buy Polygon (MATIC) on Swyftx.

Leaked documents reveal Xbox planning to launch crypto wallet

The wallet will supposedly be used to engage the gaming community in realistic in-game economies

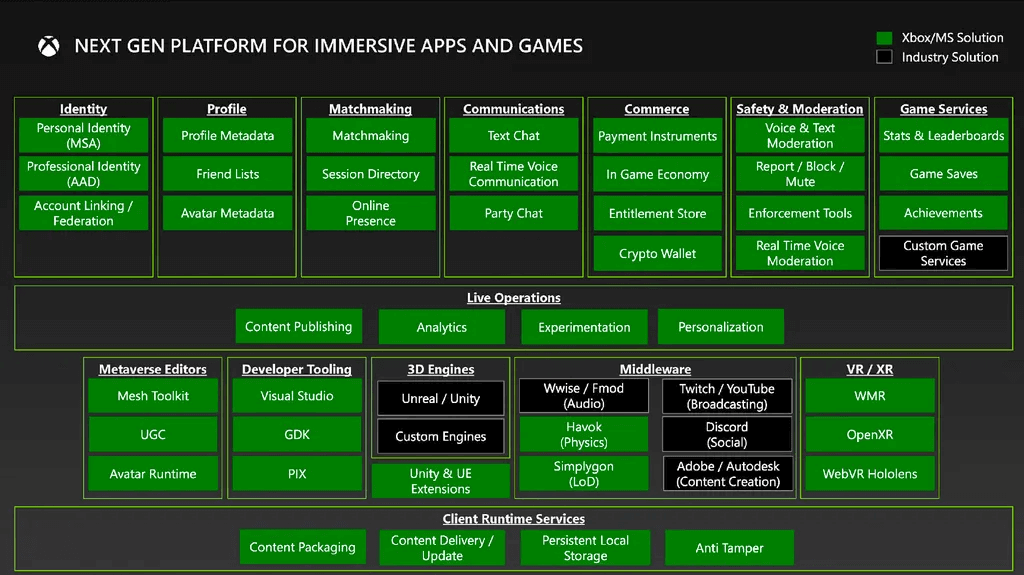

The next-generation Xbox console, set to be released by Microsoft this decade, may potentially contain a crypto wallet for participating in in-game economies. The speculation comes from court documents leaked from the Federal Trade Commission vs. Microsoft case. The unredacted PowerPoint slide, dated May 2022, has a box titled “crypto wallet” under the header “commerce”. The details of how such a mechanism would work are ambiguous, with no further context provided within the image.

The crypto wallet would likely be used for online-based games, particularly RPGs or metaverses, where an in-game economy performs an important role in building the world. It appears the wallet would be developed by and for Microsoft, meaning that competitors like Sony and Nintendo would need to create their own solutions if they wanted to follow suit.

However, whether this feature was just an idea or is actually in development is still being determined. The slide is over a year old, and no further news regarding crypto integration into a next-gen console has been leaked. Additionally, Microsoft’s next-gen Xbox console is unlikely to be released until approximately 2028 – so a lot can happen between now and then. But even in its formative stages, it’s exciting to see crypto considered as a way to unlock the economic and immersive potential of modern gaming.

ANZ bank particularly pleased with Chainlink stablecoin study

The research successfully demonstrated the ability to swap two different stablecoins 1:1 via separate blockchain networks.

Big Four bank, Australian and New Zealand Banking Group (ANZ), completed their pilot study with blockchain project Chainlink last week, with positive results. The research, titled Cross-Chain Settlement of Tokenized Assets Using Chainlink CCIP, was a deep dive into using tokenised assets (notably an AUD-based stablecoin) to settle large, fiat currency transactions. The study aimed to determine if using blockchain technology could improve the efficacy of processing international transfers.

ANZ already knows they can issue and manage stablecoins, having minted their first AUD-based cryptocurrency last year. Rather, this study focused on a key roadblock to the blockchain industry’s widespread adoption – interoperability. By leveraging Chainlink’s Cross-Chain Interoperability Protocol, the partnership tested whether they could seamlessly send and receive different stablecoins across different blockchains.

The test involved a client buying a fiat-based stablecoin (A$DC) using a trial version of the ANZ mobile app. The subject was then tasked with swapping the coin for a different stablecoin – an NZD-based asset, NZ$DC. To make everything more complicated, the Australian coin was hosted by the Ethereum Sepolia network, while the NZD currency used Avalanche’s Fuji protocol. Despite the differences in blockchain, the transaction was successfully completed thanks to the interoperability solution provided by Chainlink’s CCIP.

The news comes as ANZ edges closer to implementing an institutional digital currency to reduce fees and settlement times on large transactions. The move could be a game-changer for big businesses and corporate investors, who will be able to access several different stablecoins streamlined through a single user interface. While there are a few issues for the ANZ/Chainlink partnership to iron out before the technology goes live, it may only be a year or two away.

Ben Knight