Bitcoin’s reputation over the years has copped an unfortunate beating from some parts of the media and society. Despite more and more Australians getting on the crypto train, many are still unsure about the intricacies surrounding crypto and whether buying and selling it is even legal.

The short answer is yes. Bitcoin and other cryptocurrencies were declared legal in 2017 by Australia’s central bank, the Reserve Bank of Australia. However, like most things, there are regulations and obligations when it comes to trading cryptocurrency in Australia. In this article, we’ll discuss the legalities of Bitcoin and cryptocurrency in Australia as well as potential tax obligations.

Bitcoin’s Legalisation

Perhaps some of the confusion about whether Bitcoin is legal or not comes from the fact that there was a time when it technically wasn’t.

It wasn’t until 2017 that cryptocurrencies were officially declared legal in Australia.

That declaration also made cryptocurrency and other blockchain projects subject to anti-money laundering laws under the Counter-Terrorism Financing Act 2006. Additionally, like other capital gains assets like stocks and real estate, cryptocurrency became subject to tax in 2017.

Bitcoin has also been scrutinised from a legal point of view because, in 2019, more than $515 million was spent on illegal activities with Bitcoin, including money laundering. The use of Bitcoin itself wasn’t the illegal factor, but being entangled in such activities can shape the public perception of Bitcoin and other crypto assets.

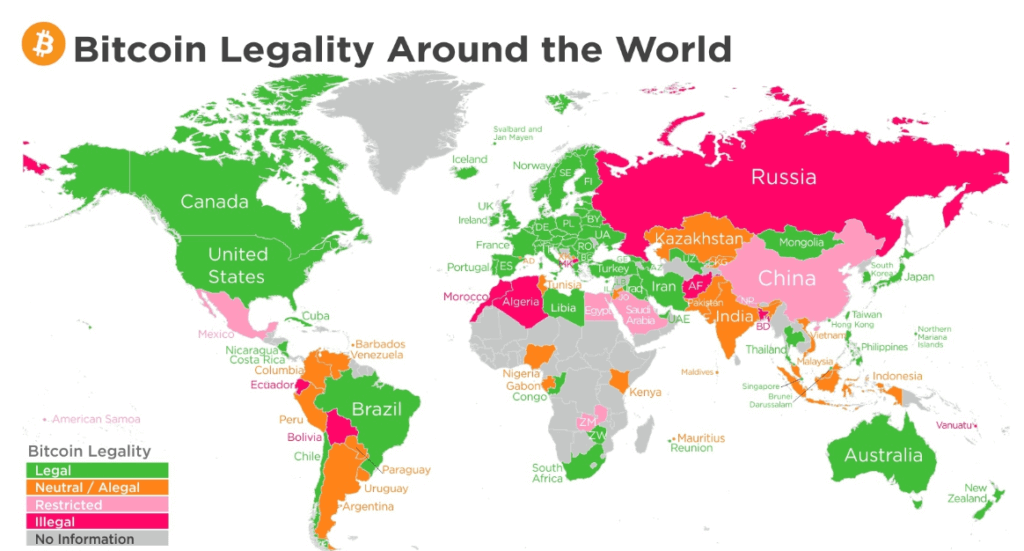

This is why crypto remains illegal in some countries. Yes, the anonymity and decentralisation of its transactions provides many benefits. Still, it also means that it’s relatively straightforward moving crypto assets from one country to another with no government control.

A practice many have utilised for less than legal purposes.

Are digital currencies regulated in Australia?

Rarely, if ever, does the Australian government legalise a service without regulations in place, and cryptocurrency is no exception.

Like most things in the digital world, the regulations around cryptocurrency have evolved and will likely continue to do so.

Following the legalisation of Bitcoin and other cryptocurrencies, the Australian Transaction Reports and Analysis Centre (AUSTRAC) announced the planned implementation of more significant regulations around cryptocurrency and cryptocurrency exchanges.

One primary regulation is that any cryptocurrency exchange that operates within Australia must be registered with AUSTRAC.

If an entity acts as an exchange or provides similar services, they must:

- Maintain records

- Verify and identify all of their users

- Comply with government AML/CTF reporting requirements (specifically Part 6A – the Digital Currency Exchange Register)

It is the responsibility of AUSTRAC’s CEO to update and maintain the Digital Currency Exchange Register. Any exchanges that are unregistered may be subject to both financial and criminal penalties.

Throughout the 2020s, the Australian Government has investigated updating the initial cryptocurrency regulations, particularly regarding stablecoins, to better reflect the evolving market.

Crypto and Bitcoin tax obligations

Cryptocurrency can be subject to both capital gains tax (CGT) and income tax.

Below we touch on the key differences, but we recommend looking at our Australian Crypto Tax Guide for a more detailed overview.

Income tax is typically reserved for ‘traders’. Cryptocurrency traders are sole traders or independent businesses where the primary source of their business income is, or is directly related to, cryptocurrency.

This could be exchanges, professional cryptocurrency traders, or any business that undertakes crypto-based activity for commercial purposes.

Paying CGT on crypto profits

The majority of cryptocurrency investors in Australia will be subject to capital gains tax, or CGT.

You incur CGT when you engage in any of the following:

- Selling or gifting cryptocurrency

- Converting cryptocurrency to a fiat currency, such as AUD

- Trading or exchanging cryptocurrencies

- Using Bitcoin or other cryptocurrencies to purchase goods and services

In the case of CGT on crypto investments – which are becoming an increasingly popular way to diversify portfolios – tax is only applied when you dispose of the asset.

One other area that is often overlooked or unknown to many Australians is using crypto exchanges.

While you can use exchanges such as Swyftx to transact one type of cryptocurrency for another you are still effectively disposing of an asset in the process. Thus, CGT applies.

Of course, there are a few caveats to the above.

CGT doesn’t apply in the case of personal use assets. For instance, when you aren’t using cryptocurrency in the course of business or as an investment.

If you’re a little confused by the above, you’re not alone. This is why it’s important to talk to tax professionals and use reputable exchanges that can assist with providing information to meet your tax obligations.

Cryptocurrency SMSF and tax

Australia offers a very generous tax structure for Self Managed Super Funds (SMSFs). More and more Australians are looking for alternative investments like cryptocurrencies to invest their retirement savings in. SMSFs have a concessional tax rate of 15%, a figure that can fall as low as 10% thanks to CGT discounts. Both of these rates are much lower than standard marginal tax rates for individuals.

Swyftx offers a cryptocurrency Self-Managed Super Fund service, allowing eligible investors to invest their SMSF into cryptocurrencies like Bitcoin, Ethereum, XRP, Cardano and hundreds more.

Is Bitcoin Safe to Buy?

The majority of the time, that answer is yes.

When selecting a crypto trading platform, keep an eye out for some form of KYC (Know Your Customer) or identity verification process before you are allowed to begin buying Bitcoin. When in doubt, do your research.

But if you ensure you’re using legitimate exchanges to purchase your Bitcoin or other cryptocurrencies, the biggest risk is the price of your digital assets falling.

Investing in cryptocurrencies is like purchasing any other speculative asset: its value will fluctuate. Crypto markets are highly volatile so it’s important to conduct thorough research to avoid badly timed purchases (buying before a crash). One way of mitigating this risk is to dollar cost average. This is a trading strategy that involves investing small amounts into Bitcoin over regular intervals (i.e. every week).

Another thing to consider is cyber theft. If a bank were to get robbed, there’s government backing in place to cover the theft of any of their customers’ money. This isn’t the case with cryptocurrency digital wallets (for now).

Make sure that you’re properly storing your coins in a reputable cryptocurrency wallet. Swyftx has implemented an advanced security framework to ensure the safety and security of our customer’s funds. We also allow our customers to withdraw their funds and transfer them to an external wallet like a hardware wallet or mobile wallet.

Read: Best crypto wallets in Australia guide.

Practice crypto trading

Cryptocurrency trading and investing can be difficult and confusing for beginners. A lot of traders invest before conducting any research and can subsequently lose their money in the process. For beginners looking to get into the crypto market, it’s generally recommended to start by practicing trading on a demo account. The Swyftx demo trading account allows users to trade crypto using real-life volumes and prices. This means you can test your strategies and practice trading without any financial risk.

Read: Beginner’s guide for investing in cryptocurrency

Final Thoughts

All bias aside, Bitcoin and other cryptos are legal, and there is a general consensus they are safe.

With that said, the best way to play it safe is to educate yourself. Be aware that crypto is subject to many of the regulations and laws of fiat currency.

It’s also important to be aware of exactly what tax obligations apply to you. You’d certainly not be alone in finding tax laws confusing, and this may be even more so for crypto.

Regardless of whether you exchange your crypto assets for fiat currency or another digital currency, CGT can still apply. Many accountants do specialise in taxation around digital assets so, when in doubt, utilise a professional. It’s a small price to pay to avoid any legal strife a lack of knowledge may land you in.

Do your research before you purchase Bitcoin or any other cryptocurrency. This includes everything from research into the currency itself (its historic market value, perceived volatility etc.) to how you intend to purchase or exchange the cryptocurrency. If you’re using an exchange, are they reputable? What safety measures do they have in place? Ensure you’re also using a reputable digital wallet.

Ted