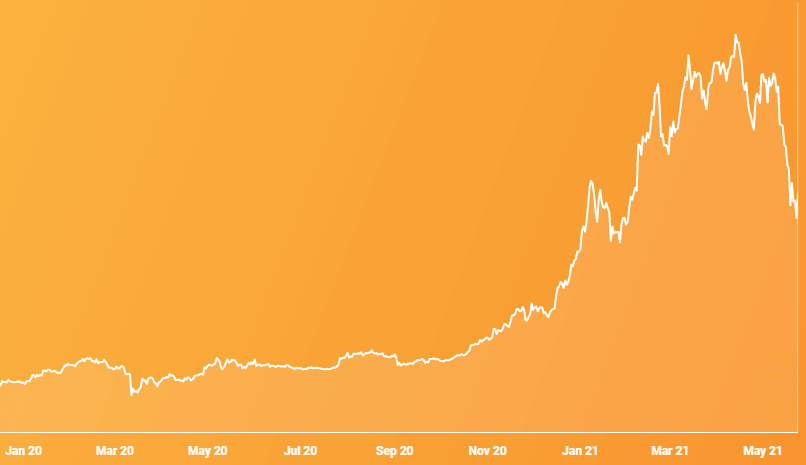

On Wednesday, the 19th of May, the cryptocurrency market crashed, wiping out over $1 Trillion in market value. This came shortly after news broke of China deciding to further restrict cryptocurrency transactions by banning financial institutions from providing crypto-related services. Bitcoin was the first to go, nosediving as much as 30%, with alt coins closely followed behind.

Although we can’t say that the market crash was a direct correlation of any single occurrence, a combination of events leading up to the 19th of May are likely to have triggered mass FUD (fear, uncertainty, doubt) in crypto investors. This article will discuss each of these events and how they could have affected the market.

Possible reasons for crypto market crash

Elon Musk and Tesla dilemma

On May 12, Bitcoin’s price fell by roughly 12%. This came after Elon Musk tweeted that Tesla will no longer accept Bitcoin as payment for its cars due to the environmental impact of mining. Bitcoin mining requires a lot of electricity which is majorly generated using fossil fuels and therefore the process of creating new Bitcoin has a fairly large carbon footprint. This is an issue for Tesla, who are dedicated to producing environmentally-friendly, zero-emission electric cars.

Musk then followed up with two seemingly contradictory Twitter posts, indicating that Tesla had sold all of its Bitcoin holdings, before clarifying that it in fact had not sold any. Much like the current state of the crypto market, the relationship between musk and crypto investors around the world remains volatile, with some alluding to the fact that Musk has too much influence on the market.

Chinese crypto ban tightened

For years now, China has had limits to prevent cryptocurrency trading within its borders. In 2013, financial and payment institutions were banned from providing bitcoin-related services as it was declared that Bitcoin was not a real currency. On Tuesday May 18, three major industry bodies released a statement reiterating their stance on cryptocurrency. This news appeared to spark a mass sell-off the following day, resulting in the total crypto market cap to almost halve.

Rumours of IRS investigation into Binance

On May 13, Bloomberg reported that the largest cryptocurrency exchange in the world, Binance, was being investigated by the IRS (Internal Revenue Service) and US Justice Department. As part of the investigation, officials who primarily deal with tax and money laundering offenses have sought information from key individuals with insight into Binance’s business operations. Although Federal agencies have not accused Binance of any wrongdoing, it’s possible that, given the timing, this announcement could have been one of the factors contributing towards the market crash.

Huobi Exchange suspends some of its services following China crackdown

One of the biggest cryptocurrency exchanges in the world, Huobi, stated that it scaled back some of its services due to the recent China crackdown according to Coindesk. The pullback includes suspension of some of its futures contract trading services, exchange-traded products and leveraged investment products just to name a few. Additionally, miner hosting services have been stopped for the time being in Mainland China. Huobi is a large exchange offering crypto trading services to Chinese investors. With millions of users, it’s highly likely that this news had an effect on the recent market crash.

What will happen next?

Last week’s volatile swings really shook up the crypto market. However, some experts think this pullback is simply a healthy correction. Chief of Strategy at CoinShares, Meltem Demirors, thinks that this crash is healthy and completely normal for the market and remains a long term bull.

Co-creator of Ethereum Vitalik Buterin stated that he wasn’t surprised by the crash and that he has seen it all before.

Where Bitcoin and the crypto market will go in the near future is relatively unknown despite many experts remaining positive. However, in huge news this week, Bitcoin is now considered an investable asset class by American multinational investment bank, Goldman Sachs. This is undoubtedly going to have a beneficial impact on the market in the long term.

Ted