Across Australia, and especially among millennials, there has been a huge spike in interest in cryptocurrencies.

The statistics are so staggering in fact, that now 4 in 10 Aussies are planning to use cryptocurrencies within the next year, according to Mastercard’s New Payment Index survey.

So why is cryptocurrency interest booming, and what does this mean for the Australian market?

The Stats Now

Earlier this year, Bitcoin surpassed its previous all-time high.

While cryptocurrencies have long been approached with a degree of scepticism, a boom in performance is seeing these attitudes change.

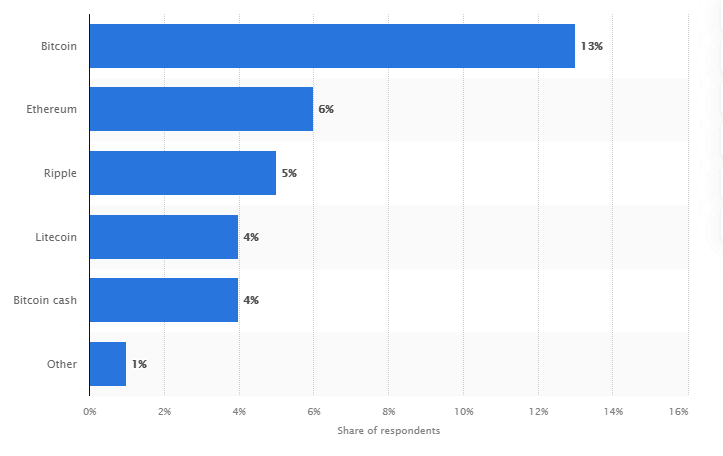

In the Australian market, a majority of cryptocurrency investors held Bitcoin at ~13%. The second most popular was Ethereum at 6% followed by XRP at 5% and then closely followed by Litecoin and Bitcoin Cash.

Of all age brackets, millennials show the most interest in investing in and learning more about cryptocurrencies.

As it stands, nearly one in five Australians or 13% of the population now own cryptocurrency. This is only expected to grow, and their reasons for investing are varied.

The Upward Trajectory Of Cryptocurrency

Shortly after its creation in 2009, Bitcoin was valued at a mere $0.01. As of April 14th 2021, Bitcoin was valued at an all-time high of $83,104 AUD and surpassed a market cap of $1 trillion AUD in February. While volatility is always a factor with digital currencies, to say Bitcoin has experienced exponential growth in its 12-years of existence is an understatement.

Speaking of growth, 2020 alone recorded impressive statistics across Australia’s cryptocurrency market. Australian national survey, the Independent Reserve Cryptocurrency Index (IRCI) seeks to benchmark confidence and awareness around digital currencies. Their survey revealed that 78.2% of crypto owners had either broken even or made a profit in 2020.

If we were to look back a decade, the early adopters of digital currencies saw returns of more than 5,000% on certain coins. While once a blip on the international media radar, cryptocurrencies now garner major attention and ongoing speculation about “the next bitcoin.”

Like any investment, there are no guarantees with coins and all come with varying degrees of risk. For major digital currencies though, it has certainly been a very bullish trend.

So Why Are More Australians Investing In Cryptocurrency?

Its growth has certainly spurred an attitude change towards the profitability of crypto, but reasons are a little more diverse than that.

A survey revealed 45% of cryptocurrency investors had purchased crypto due to its appreciating value.

Another common motivation was to diversify portfolios. For years it has been speculated cryptocurrency could be the future and a replacement of fiat currency. Whether this is true or not, a more diverse range of assets has generally been viewed as a safer investment.

Finally, as we see inflation rise across the globe with fiat currencies, many investors see crypto as a means to hedge against inflation.

Major Market Leaders Are Now Adopting Cryptocurrencies

If its skyrocketing value alone wasn’t attributed to a perception change around crypto, adoption by major market leaders certainly helped.

Both major and even smaller companies in the US now accept Bitcoin as a form of payment. In the US, even Paypal users can now buy, sell and checkout using cryptocurrencies through their account.

One notable, and highly publicised example, was Elon Musk and Tesla’s $1.5 billion dollar investment in Bitcoin. Alongside this, Musk also announced the company would start accepting Bitcoin as payment for its products.

This resulted in a market upturn for crypto, dubbed the ‘Musk Boom’.

Yet, Musk has since backflipped on his original statement, announcing on Twitter that Tesla has suspended ‘vehicle purchases with Bitcoin.’

Closer to home, more and more Australian businesses and retailers are beginning to accept Bitcoin as well, including the likes of Subway.

Investors Are Buying (but not spending) Bitcoin

Despite Bitcoin trading and cryptocurrency growing, we aren’t necessarily seeing a dramatic increase in the spending of cryptocurrency.

Perhaps the best example to explain why this may be is the case of Laszlo Hanyacz.

In 2010, Laszlo became the first man ever to use cryptocurrency as a payment.

He ordered himself two pizzas, which at the time cost him 10,000 Bitcoins. Today, that amount of Bitcoin would be worth over $700 million Australian dollars.

An extremely unfortunate turn of events for Laszlo, but one that shows the potential for crypto’s dramatic growth.

It’s by no means uncommon for Bitcoin value to jump (or drop) by thousands within a 24-hour period, but overall it typically behaves in a bull-like manner.

Due to the massive returns many coins have seen over the years, investors seem unwilling to part with their cryptocurrencies just yet.

Cryptocurrency In Australia

Despite its rising popularity, Australia’s financial market is still a bit behind the eight ball when it comes to cryptocurrency.

A lot of this comes down to regulations and policymakers unwillingness to adopt the currency.

ASIC and the RBA, according to Independent Reserve CEO Adrian Przelozny, aren’t being particularly proactive or open when it comes to policies around cryptocurrency.

While Australians can still well and truly participate in the crypto market through exchanges like Swyftx, many institutions are yet to catch up.

Additionally, no Australian super fund to date offers the option to invest in cryptocurrency. This is despite the fact that over a third of Australians have expressed interest in investing retirement savings into it.

Many policymakers still state risk as the biggest reason for their lack of confidence in the currency. While it’s true 43% of Australians do admit volatility as one of their biggest deterrents, all statistics and global trends point to cryptocurrency only continuing to grow.

SMSFs and cryptocurrency

In recent years, more and more Australians are looking for alternative ways to invest their retirement savings. Bitcoin and other cryptocurrencies are one of these investments that are quickly growing in popularity. This can largely be attributed to the exponential growth of the crypto market in 2020-21.

Swyftx offers a Bitcoin and cryptocurrency SMSF product that allows eligible investors to invest their retirement savings in blockchain-based projects listed on our exchange. Visit the link for more information.

What are the next steps and what does this mean for Australia?

The Australian Financial Review asks two questions around cryptocurrencies: Do we have the right protections in place for consumers, and can we – as a country – keep pace with global developments?

They don’t ask if cryptocurrency adoption will become more prominent, but when.

There are a lot of speculative talks about crypto being the future of currency. The ABC has even gone as far as to speculate it could be the new gold.

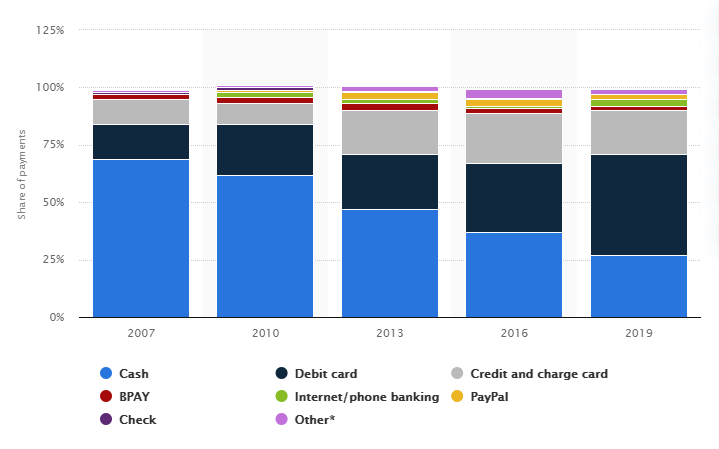

In 2007, cash made up three quarters of all payments in Australia. Compare this to just over one-quarter of payments in 2019 and it’s easy to see how these predictions have come about.

There’s no doubting the digital world moves fast and cryptocurrency is no exception. Already, we’re seeing crypto increasingly used as an investment or store of value.

The AFR has gone on to say Australia could potentially become a new global leader in a new financial system hub, bringing in significant investment and the creation of countless jobs.

Yet, Australia’s big four banks have run in a minimally competitive market for decades. As international players that offer cryptocurrency look to set up shop in Australia, a hesitance to adopt digital currencies could lead to them falling behind.

As financial authorities both abroad and in Australia start looking at digital currencies more seriously, the end result will likely be a better regulated, safer and more popular cryptocurrency system.

Ultimately, there are no guarantees in the world of investments. Digital currencies can be volatile, and it’s always best to seek professional advice.

Yet with more Australians adopting cryptocurrencies, it’s clear that the value of and role crypto plays in our country will only continue to grow.

Ted