The global economy is not in good shape. To be sure, things might pick up—but it can be difficult to say how and when. The crypto market is suffering, as are just about all financial markets. Here, we aim to shine a light on the effect the downturn in the global economy is having on crypto markets: what monetary policies and global events could have contributed to this, and what the future may hold in this regard.

To begin with, a decline across various crypto exchanges caused some panic among investors. Things seem to have gotten worse, and for a variety of reasons. While 2022 began strongly enough, by April, things began to take a serious dive.

Recall that in 2020, in the context of COVID-19 there was a precipitous drop in cryptocurrencies across the board. This was then followed by a terrific year in 2021 for crypto investors. At one point, Bitcoin was projected by some to be valued at over $100,000 USD. In June and July 2022, Bitcoin is back hovering around the $20,000 USD mark.

Many pundits, veteran investors, and experts blame global inflation for the current crypto situation, as central bank around the world—in particular the US Federal Reserve—attempt to combat recession by increasing interest rates. Furthermore, the correlation between stock prices and crypto prices remained generally strong, with losses in both asset classes. Adding to this, the Ukraine war seems to have caused even more uncertainty in global markets.

Inflation and interest rates

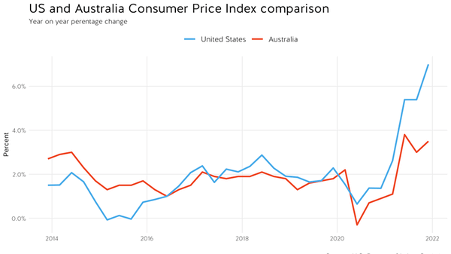

The Reserve Bank of Australia is currently facing a looming crisis, some have compared this to the Asian crisis of 1997, the GFC of 2008, and the fallout of the pandemic in 2020. Inflation is at its highest in over 25 years, and similarities have been drawn between where we are now, and where we were in the 70s—a long period of low inflation combined with an energy crisis and high public expenditure.

The 1980s saw a huge rise in inflation as our economy boomed, and the Reserve Bank hiked interest rates in an attempt to control this before the markets crashed in 1987. A response to this came in the 1990s, with the Reserve Bank attempting to maintain inflation within a range of two to three per cent over the economic cycle, especially as the excessive consumption of the previous decades had indicated the importance of containing inflation.

The global financial crisis of 2008 saw Australia emerge as one of the only developed economies not to fall into recession, owing in large part to quick action taken by the government and the Reserve Bank.

While many worry that we currently face a return to the same circumstances we found ourselves in during the 1970s, much has changed regarding policy. If we can tackle inflation, and if consumers, investors, business owners and the like can regain confidence, we may be able to negate some of the worst this coming downturn has to throw at us.

With regards to crypto, many have called Bitcoin and other cryptocurrencies inflation hedges, but at least to date, when major central banks raise interest rates to tackle inflation, it seems that the crypto market suffers. Higher interest rates may also mean lower appetites for high-risk/high-return asset investments, such as crypto.

Does the stock market affect the crypto market?

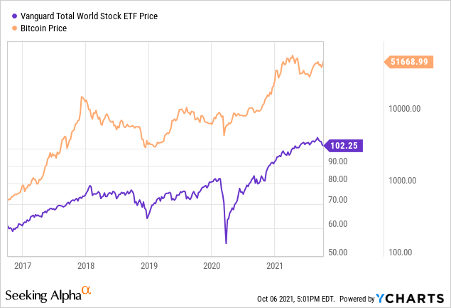

Many have suggested a correlation between stock prices and crypto prices. This could be due to multiple factors, such as supply and demand, regulatory changes, monetary policy, and economic conditions. It may also result from the same investor sentiments and geopolitical events that impact all trading on a global scale.

The correlation could also arise from traders and investors dealing with cryptocurrencies in the same way they deal with conventional classes of assets – on the other hand, it may well be a coincidence. It could be the case that investors are temporarily treating crypto the way they treat equities, as crypto is still an experiment for some investors; one of the reasons the prices fluctuate so greatly.

Swyftx Learn: Why is crypto so volatile

The geopolitical effect of the Russo-Ukrainian conflict

The Russo-Ukrainian conflict—causing mass destabilisation throughout Europe, worldwide oil shortages, and having contributed to the current energy crisis—has triggered turmoil in global financial markets. This may have served to accelerate a rise in inflation, particularly in Europe where rates have soared to 8.6 per cent as of June. An example of the concerns felt by investors and market participants is in the April 2022 edition of the International Monetary Fund’s World Economic Outlook, where the word ‘war’ was found more than 200 times.

Commodity markets are struggling to meet massively affected demands, and financial markets have been volatile since the onset of the conflict, as the ripple effect has spread throughout the global economy. This seems to have had an impact on cryptocurrencies, especially since they are new, considered fickle, and are generally more prone to changes in market confidence than other, conventional assets.

Summary

We all know crypto can be a volatile asset class, and confidence in such assets tends to decline with the confidence in our situation generally. Crypto slumps seem to line up, at least in time, with COVID in early 2020 and the war in Ukraine—and this could point to the significant degree to which investor backing of crypto relies upon a mass perception of global stability.

Bitcoin arose shortly after the 2008 global financial crisis, and some speculate that this was a contributing motivation for its creation. When assessing the market, an interesting note is that in the existence of Bitcoin, it has never undergone such a bad economic climate, except perhaps during the outbreak of the pandemic.

With any luck, crypto markets will be sure to stabilise, as will other markets.

Ted