- > Bitcoin slumps with halving days away

- > Hong Kong approves spot BTC and ETH ETFs

- > Prominent Bitcoin analyst predicts potential $500K BTC by 2025

Bitcoin slumps with halving days away

A sea of red has overtaken the crypto market on the eve of Bitcoin’s halving, with double-digit weekly losses across the board.

Okay. Take a deep breath. It’s been a pretty rough week for Bitcoin and friends. The crypto giant is down 15% over the past seven days, and the mid-March ATH of $72k now seems very far away. But in context, Bitcoin’s escaped lightly, with several altcoins making for some dire reading. Prominent projects like Aave, Fantom and Filecoin are all in the red 30%+. So, what’s behind the form slump, and is it time to hit the panic button?

Unfortunately, Bitcoin is at the mercy of geopolitical events, and with tensions rising in the Middle East following Iran’s retaliation to Isreal, things are looking dicey. Investors are getting cold feet across all financial markets – not just crypto – with the S&P 500 and Nasdaq also bleeding.

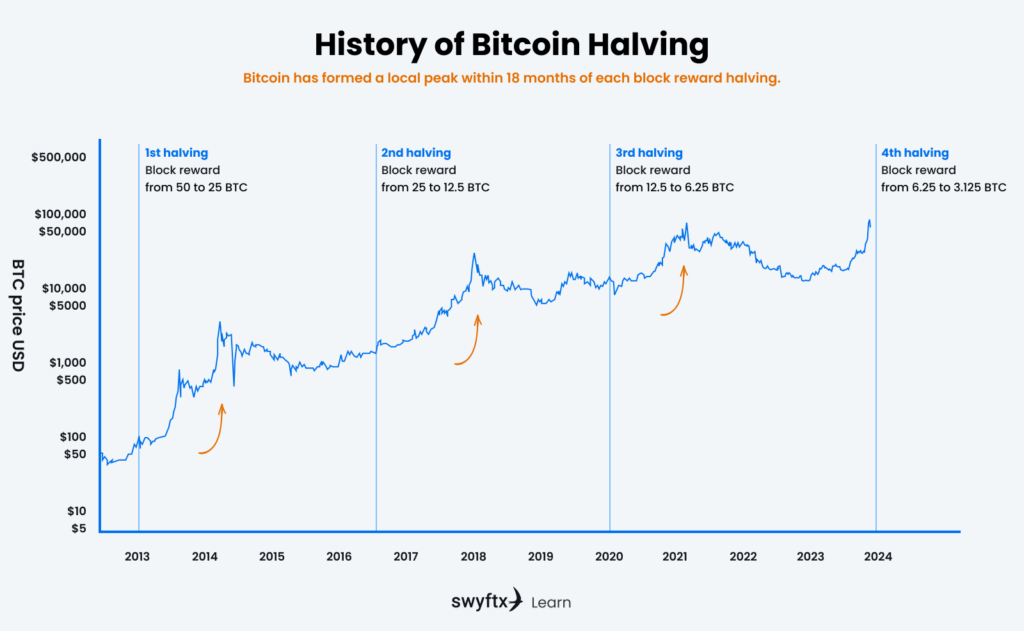

To complicate matters, the Bitcoin halving is so close we can almost touch it. With the significant event set to take place this weekend, analysts are split on how the market will react. Historically, restricting the issuance of BTC has resulted in long-term gains as demand outpaces supply – but the leadup to these events has traditionally been rather rocky.

Caption: Zooming in on each halving line we can see Bitcoin has experienced short downturns each time – and it looks like 2024 will be no different.

However, the doom and gloom may be a little over-the-top. In a broader sense, things are still looking pretty good for the blockchain sphere. According to a report from KuCoin, investors are continuing to accumulate stablecoins in the build-up to the halving. So, while whales may be moving out of BTC for now, they aren’t taking their assets to other markets and are perhaps preparing to accumulate cryptocurrency once the dust settles.

X (formerly Twitter) is often a divisive platform at the best of times, and it’s easy to find analysts that sit on both sides of the post-halving spectrum. Some are claiming there’s serious cause for concern, while others are suggesting the current downturn is par for the course.

No matter the outcome, Bitcoin is set up for a riveting few days.

Hong Kong approves spot BTC and ETH ETFs

Hong Kong has become the latest government to greenlight crypto ETFs – but with a twist – becoming one of the first to approve spot Ethereum funds.

The crypto news cycle for the first quarter of this year was dominated by one thing – spot Bitcoin ETFs. The build-up to the Securities and Exchange Commission (SEC) finally approving BTC funds in the United States was feverish, and after a slow start, the impact was as profound as many expected. The exciting intersection of traditional and digital finance pushed BTC’s price to new heights, with major institutions like BlackRock now handling hundreds of thousands of Bitcoin for its clients. After the raging success of the spot Bitcoin ETFs in the US, it was only a matter of time before other nations followed suit.

Hong Kong is one of Asia’s largest digital currency markets, however, in part due to a testy relationship with China, had adopted a largely anti-crypto stance for several years. This is all set to change in 2024, with Hong Kong’s key regulators approving spot Bitcoin and Ether ETFs for trading. This move comes in a broader play from the nation to position itself as a leader in global crypto innovation, attempting to dethrone other major markets like Singapore and Dubai.

To date, there are still no products available on Hong Kong’s trading hubs, however ChinaAMC, Harvest Global and Bosera International have all been approved to release funds when they see fit.

There is still one question on everyone’s lips though: What does this mean for Chinese investors? China as a whole has been wiped from the crypto market after the government’s hardline crackdown essentially banned all trading and ownership of digital currencies. The Chinese financial markets are some of the largest in the world, and their re-entry into the crypto scene would be a huge coup amid the current downturn. However, we will have to wait and see whether Chinese residents can capitalise on the new products.

Prominent Bitcoin analyst predicts potential $500K BTC by 2025

According to PlanB’s latest video, an extreme supply squeeze and unique market conditions has Bitcoin setup for an explosive 18 months.

What’s that? A positive Bitcoin prediction among the coin’s worst downtrend in several months? Amid all the uncertainty, we can take solace in the fact that some things remain constant: Bitcoin bulls gonna be bullish. And analyst PlanB is taking that optimism to the next level.

In his most recent video, PlanB takes a look at the current state of the Bitcoin market, honing in on several technical indicators to form his prediction. Historically, BTC has always set new all-time highs in the months following a halving event. But this time around, spurred by the success of spot ETFs in the US, Bitcoin got impatient and set record heights a month prior. PlanB suggests this could create the perfect storm for the digital currency to see significant returns as the post-halving bull market truly gets underway.

The most compelling evidence PlanB touches upon may even be the simplest – Bitcoin’s stock-to-flow model. Basically, this metric compares the amount of circulating supply (stock) to new coins being minted (flow). Spot Bitcoin ETFs have already placed a stranglehold on BTC supply, with institutions like BlackRock racking up hundreds of thousands of coins. And the weekend’s halving event reducing BTC’s block reward will only restrict supply further.

Put it all together, and you have new supply dwindling with demand (in theory) staying stagnant or even increasing. The result of this, according to PlanB, is a Bitcoin price prediction of $500K USD.

At face value, this prediction may be a little over the top, but hey, given the market’s short-term struggles, Bitcoin holders will take any positive analysis they can get.

Ben Knight

Log in

Log in