Market capitalization is a huge indication of the success of a cryptocurrency. Coins with a large market cap are generally projects that have been widely adopted across the world. Getting familiar with this concept may help inform your decisions when it comes to buying different types of cryptocurrency. This article will explain what market cap is and how to calculate it. It will also discuss why market cap can be a vital element in researching new projects to invest in.

What is market capitalization?

Market capitalization is a term that has been used in the stock market for decades. In the stock world, market cap refers to the total dollar market value of outstanding shares of a company. It’s calculated by the total number of shares multiplied by the dollar value of each individual share.

What about crypto market cap?

For the most part, crypto market caps function the same way as in the stock market. Every cryptocurrency has a fiat market value, which fluctuates based on a variety of factors. The total market cap of a particular coin just means the price of the coin, multiplied by the total number of coins in circulation.

Depending on which methodology you use though – circulating supply, fully diluted supply, or max supply – you may interpret a cryptocurrency’s market capitalization slightly differently.

Key Takeaway

Market capitalization is the total market value of a cryptocurrency. This is how it is calculated: total number of coins × price of each coin.

Circulating supply

This is the most popular method. It looks at the coins that have already been mined and are in public circulation at the time.

Fully diluted supply

This metric extrapolates the value of the market by combining the coins that are already in circulation and those yet to be mined.

Max supply

Max supply takes into account the maximum amount of coins that could potentially be created in the lifetime of that cryptocurrency.

Tip

The majority of the time, a cryptocurrency’s market cap will be calculated based on that coin’s circulating supply, which is amount of coins that have already been mined (or issued) and are currently in circulation.

Are crypto market cap and fiat investment the same?

This is a common misconception in the world of cryptocurrency. Just because a particular crypto has a market cap of, say $2 billion USD, doesn’t mean $2 billion USD has actually been invested in that coin. This is due to a number of factors.

Rapid increases or decreases in demand

A sudden spike in the demand of a cryptocurrency and the aggressive bidding behind this may raise the price of a particular coin and, in turn, raise the market cap. However, if that demand suddenly decreases and people rapidly sell off their coins, despite the initial surge causing a market cap value of X amount, doesn’t mean X amount of fiat currency was actually invested or that sellers will then be able to withdraw this.

For example, imagine a coin with a circulating supply of 1,000,000 coins with each coin being valued at $1 USD. The market cap would be $1 million USD. Now imagine a large account expecting big things from the project market buys 50,000 coins up to a price of $5. Now the market cap is technically $5 million USD, but that is definitely not the amount of money that has been invested.

Coins not selling when they’re initially created

When a coin is mined and introduced to the market, it isn’t guaranteed it will sell. Say for example 10,000 coins are mined but only 100 are purchased at $1 each. Even though only $100 of fiat currency has actually been invested in that crypto the market capitalization is still $10,000.

Why crypto market cap is important for you to consider

Like the stock market, there’s no guarantee a particular cryptocurrency will behave the way anyone expects it to. However, market capitalization can be used as a rough gauge to estimate how stable a particular crypto is likely to be.

The bigger the market cap of a coin is, the less likely it is to be subject to dramatic changes in market sentiment. A larger market cap can indicate a coin’s popularity and market dominance which may also indicate it has experienced relatively stable growth over the years.

What is the global crypto market cap?

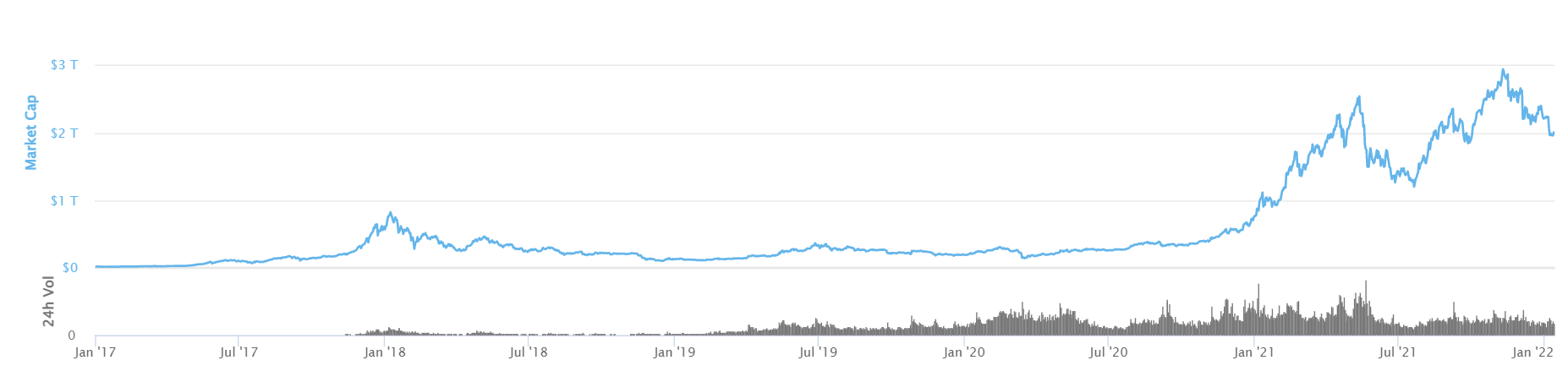

The global (or total) cryptocurrency market cap is the total value of all the coin market caps combined. At the height of the 2018 cycle, the global market cap reached $833 million USD. In January 2021 it broke $1 trillion dollars for the first time. Three months later, in April, it broke $2 trillion. As it stands, the global crypto market cap all-time high is $2.97 trillion, which was set in November 2021.

Figure 1 – Global cryptocurrency market capitalization January 2017 – January 2022.

Should you take a cryptocurrency market capitalization into account

Understanding how a coin’s market capitalization may affect its volatility is important. The size of the market cap, and by extension the level of volatility often falls into four categories: large-cap, mid-cap, small-cap, and micro-cap.

Large-cap

Large-cap coins are those with a market capitalization of over $10 billion. Bitcoin and Ethereum are two examples of large-caps, with market capitalizations of over $800 billion and nearly $400 billion respectively. As such they are viewed as ‘safer’ or more conservative choices. Other large-cap coins include Tether (USDT), Binance Coin (BNB), and Cardano (ADA), which are all in excess of $40 billion.

Mid-cap

Mid-cap cryptocurrencies are those with market caps between $2 billion and $10 billion, these are often viewed as higher risk, but they also often have much more potential for growth (the positive side of volatility).

Small-cap

Small-cap coins are valued between $300 million and $2 billion. They are even riskier than mid-cap investments, but they have an even higher potential for growth.

Micro-cap

Micro-cap coins have a valuation of between $50 million and $300 million. These are the riskiest coins to invest in, however, they also have the most extreme growth potential.

Important To Remember

Market capitalization is only one factor to take into account when investing in any cryptocurrency. Factors like market sentiment, trading volume, adoption, and more all come into play, so it’s important to do your research. Regardless, upskilling yourself around the behaviour of the cryptocurrency market will always be beneficial.

Summary

Market cap is the total dollar market value of a cryptocurrency. It can be a reliable indicator of the success of an established crypto or the potential of a newly established project. This article looked at what market cap is and why it can be a useful part of researching new projects to invest in. Swyftx Learn has plenty of great resources for teaching yourself technical analysis or how to perform rigorous research on potential investments.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.