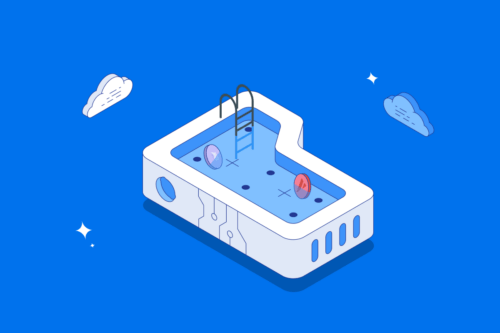

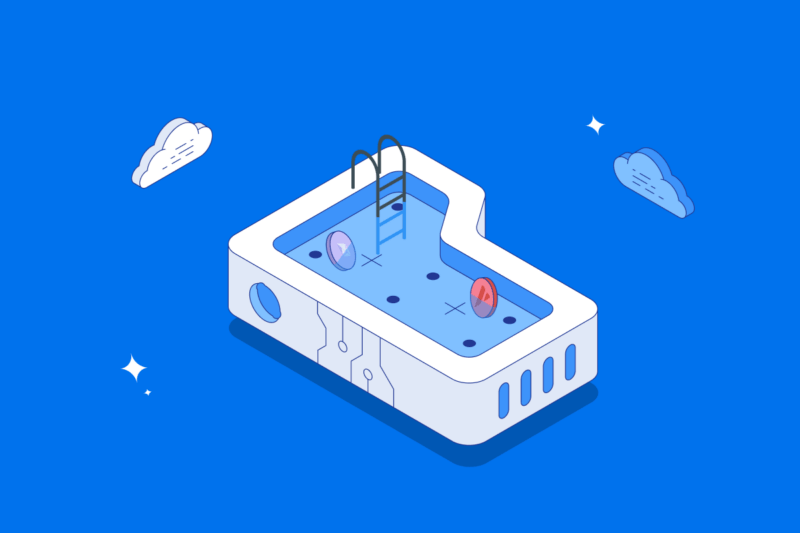

Liquidity pools allow users to trade digital assets on decentralized exchanges within the decentralized finance (DeFi) ecosystem without relying on a traditional market maker or centralized financial market model. This piece will explore what liquidity pools are and how they work. It will also cover the potential risks of this investment strategy.

What is a liquidity pool?

Liquidity pools are one of the most important innovations of the DeFi ecosystem and are critical in the operation of automated market makers (AMMs), yield farming, synthetic assets, lending protocols, and more. Liquidity pools are a fundamental feature of decentralized exchanges such as Uniswap. The assets held in a liquidity pool are locked in place by a smart contract and are added to the pool by liquidity providers. In most cases, providers add an equal value of two tokens to a pool to create a market, which is similar to trading pairs on traditional exchanges.

Market participants that provide liquidity (contribute crypto assets) to a liquidity pool will earn trading fees as a reward for the trades executed within the pool. Liquidity pools allow AMMs to facilitate instant, permissionless, and automatic trades between buyers and sellers without the need for counterparties. Liquidity pools are a critical element of this system, and function as the “pool” of assets from which AMMs draw in order to execute trades.

Key Takeaway

Liquidity pools are decentralized, crowdsourced pools of digital assets that are locked within a smart contract. They are used to trade digital assets without the need for a centralized exchange, which eliminates the need for counterparties or order books from the exchange model.

What’s the difference between a liquidity pool and an order book?

The importance of liquidity pools within the DeFi ecosystem can be highlighted by comparing liquidity pools to order books within traditional exchange models.

On centralized exchanges, market participants submit buy or sell orders to an order book. The system that matches these orders is called a matching engine. This model facilitates the creation of complex markets and allows for the efficient exchange of assets, but is inherently centralized.

DeFi markets, however, are inherently decentralized and are therefore incompatible with traditional exchange models. Trades executed within the DeFi ecosystem occur on-chain, or directly on the blockchain, without a third party acting as a custodian for traded assets.

A decentralized exchange operating an on-chain order book would cause users to incur a transaction fee for every interaction with the blockchain, as well as incur transaction fees during operation. Liquidity pools overcome this problem by eliminating the need for an order book, allowing users to trade directly with a smart contract.

How do liquidity pools work?

Liquidity pools make it possible for traders to rapidly buy or sell crypto through a trading pair that would typically have low liquidity on a traditional exchange. This is done through automated market makers that allow for crypto trading without the need for an order book.

In simple terms, exchanges that operate with order book models can be considered as “peer-to-peer” exchanges in which market participants trade with each other. AMMs that leverage liquidity pools, however, can be considered as “peer-to-contract” exchanges. This means market participants trade with a contract rather than another trader.

Automated market makers rely on liquidity pools to execute trades. The design of a liquidity pool, therefore, must incentivise liquidity providers to contribute or “stake” their assets within the pool. To achieve this, most liquidity pools give participants a reward for providing liquidity. This usually comes in the form of trading fees for their contribution.

In many cases, liquidity providers are rewarded with liquidity provider tokens (LP tokens), which can be used within the DeFi ecosystem in a variety of applications. A liquidity provider that contributes to a liquidity pool receives a proportional amount of LP tokens for their contribution to a pool. These are then used to determine the percentage of transaction fees a liquidity provider receives when trades are executed within the pool.

Interesting Fact

There is currently almost $100 billion USD locked in liquidity pools worldwide!

Liquidity pools and yield farming

Different DeFi protocols offer a variety of incentives to liquidity providers. In some cases, protocols may offer tokens for “incentivised” pools. The practice of participating in these pools as a liquidity provider in order to maximize LP token gains is called liquidity mining.

Determining which pool to commit assets to, however, can be a complex process for liquidity providers. Staking digital assets within a blockchain protocol with the goal of generating tokenized rewards is referred to as “yield farming“.

Liquidity providers that practice yield farming will stake assets across a wide range of different DeFi protocols and applications in order to maximise earnings. Yield farming typically targets protocols and trading platforms that offer the highest trading fees and LP token rewards to liquidity provides, and often automatically places user assets into the highest-yield asset pairs.

What are the risks of liquidity pools?

While contributing assets to a liquidity pool can generate value, there are a number of risks associated with liquidity pools that include:

- Smart contract reliance. Liquidity pools AMMs rely heavily on smart contracts in their operation. Errors, bugs, or exploits present within the smart contracts upon which a liquidity pool relies can expose liquidity providers to significant risk.

- Impermanent loss. Holding an asset in a liquidity pool in which the value of assets is determined by an equation can create scenarios in which imbalances occur in the pool. This can result in a unique risk to investors known as impermanent loss.

Important to Remember

Liquidity pools offer large incentives because there is always a risk of impermanent loss, which results when your assets are locked in a contract and the price of your assets changes in comparison to when you deposited them into the pool. The bigger the change in price, the bigger the loss. It’s very important to understand impermanent loss before you start providing liquidity.

Examples of liquidity pools

Uniswap is currently the largest and most widely-used decentralized exchanged and DeFi platform and operates some of the largest liquidity pools within the DeFi sector. Some of the largest liquidity pools on Uniswap include USDC-ETH, WBTC-ETH, ETH-USDT, and DAI-ETH.

Other DeFi platforms offer different approaches to the way liquidity pools are managed. Curve, for example, focuses on pairing similar assets in multi-token pools, while Balancer offers greater diversity in pool composition and ratios.

Wrap up

Liquidity pools overcome the problem of limited liquidity presented by decentralized exchange models. Liquidity providers lock assets in liquidity pools in return for transaction fees and LP token rewards. The assets held within liquidity pools are used to execute decentralized trades within the DeFi ecosystem. You can continue exploring Swyftx Learn to read more about decentralized finance, smart contracts, automated market makers, and a range of other cryptocurrency-related topics!

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read